|

| 10 June 2025 A fresh wave of positive catalysts |

| LMAX Digital performance |

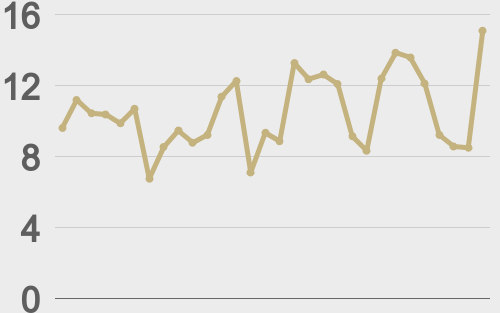

LMAX Digital volumes got off to a solid start this week. Total notional volume for Monday came in at $426 million, 6% below 30-day average volume. Bitcoin volume printed $211 million, 1% above 30-day average volume. Ether volume came in at $99 million, 12% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $10,664 and average position size for ether at $3,200. Bitcoin volatility is still tracking just off recent yearly lows, while ETH volatility has picked up since bottoming in May. We’re looking at average daily ranges in bitcoin and ether of $2,887 and $132 respectively. |

| Latest industry news |

Institutional demand remains a key driver of the latest wave of positive price action. Strategy’s purchase of 1,045 BTC for $110.2 million and The Blockchain Group’s $342 million share issuance plan to acquire more Bitcoin have signaled robust confidence. ETH’s price stability has been bolstered by ETF inflows and growing institutional interest in stablecoins and tokenization. Investors are getting increasingly turned on to Ethereum’s pivotal role in blockchain-driven financial innovation, projecting mainstream adoption beyond Bitcoin’s store-of-value narrative. Major firms like Visa and Mastercard are advancing stablecoin and real-world asset tokenization strategies, enhancing ETH’s value as a decentralized computing platform. In traditional markets, the U.S. dollar’s retreat following a mixed jobs report, has supported risk assets like cryptocurrencies, with rising two-year Treasury yields failing to curb market momentum. Meanwhile, ECB President Christine Lagarde’s push for a stronger euro and hints of de-dollarization, indirectly enhance crypto’s appeal as an alternative asset. Upcoming U.S. CPI and PPI data are critical, as cooler inflation could weaken the dollar further, boosting crypto prices, while stable U.S. stock futures and Apple’s WWDC sustain a risk-on environment. Optimism from US-China trade talks in London, described as “fruitful” by U.S. officials, has also lifted sentiment, though geopolitical tensions, including Russia-Ukraine and Israel-Iran conflicts, add caution. |

| LMAX Digital metrics | ||||

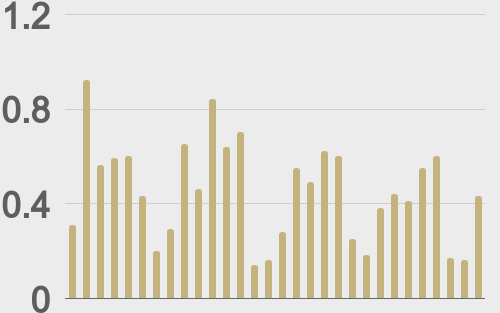

| Price performance last 30 days avg. vs USD (%) | ||||

| ||||

| Total volumes last 30 days ($bn) | ||||

| ||||

| BTCUSD volumes last 30 days ($bn) | ||||

| ||||

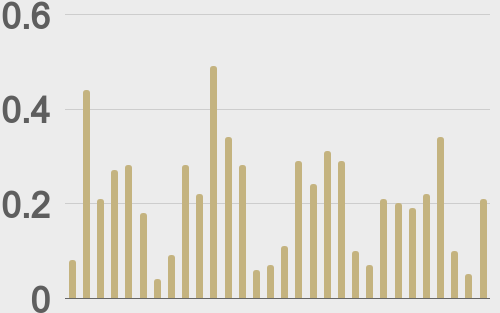

| BTCUSD avg. trade size last 30 days ($k) | ||||

| ||||

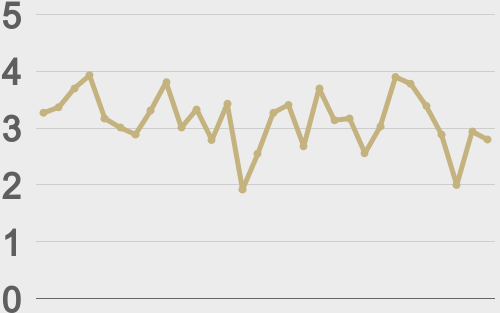

| ETHUSD avg. trade size last 30 days ($k) | ||||

| ||||

| Average daily range | ||||

| ||||

| ||||

@TheBlock__ | ||||

@TheBlock__ | ||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||