|

|

29 April 2025 A good mix of demand and lower volatility |

| LMAX Digital performance |

|

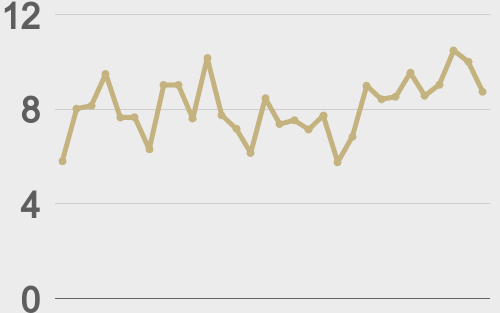

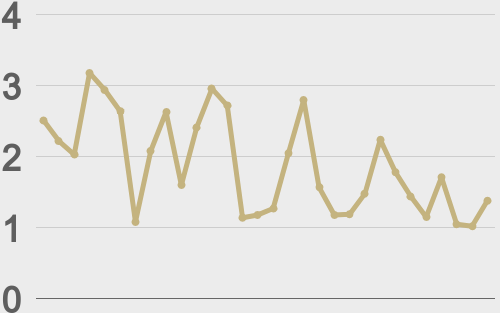

LMAX Digital volumes got off to a quiet start this week. Total notional volume for Monday came in at $403 million, 13% below 30-day average volume. Bitcoin volume printed $190 million, 21% below 30-day average volume. Ether volume came in at $96 million, 16% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,324 and average position size for ether at $1,765. Volatility has calmed down over the past several days and is now trading at the lowest levels of the year. We’re looking at average daily ranges in bitcoin and ether of $2,926 and $97 respectively. |

| Latest industry news |

|

Things have been rather quiet in the crypto market over the past 24 hours or so. In fact, interestingly enough, while the general direction of late has been higher, volatility has been moving in the opposite direction, tracking at the lowest levels of the year. Higher prices and lower volatility is a good thing as it reflects a maturing asset class in demand. And indeed, this has been backed up by an uptick in ETF inflows and substantial bitcoin purchases from the likes of Strategy and BlackRock. The fact that the positive price action has been accompanied by an uptick in demand for ETH, the world’s second largest crypto asset, is also encouraging as it sends a message of interest in the broader crypto asset class. In recent days, ETH has been trying to put in a bottom both against the US Dollar and bitcoin. The rise of decentralized AI projects, integrating blockchain for transparent AI solutions, is also shaping market dynamics, particularly in sectors like healthcare and finance, as investors seek innovative applications beyond speculative trading. And as far as the macroeconomic drivers are concerned, the pause in China’s tariffs and a favorable crypto climate under the Trump administration are further bolstering crypto sentiment. |

| LMAX Digital metrics | ||||

|

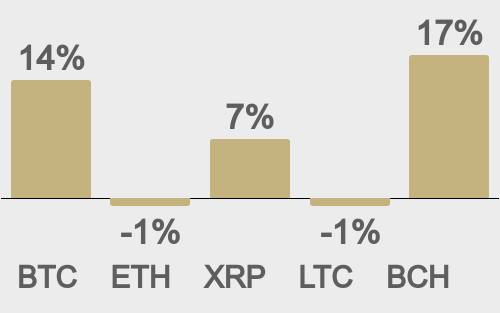

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

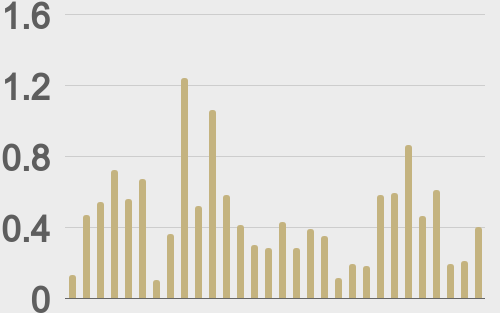

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

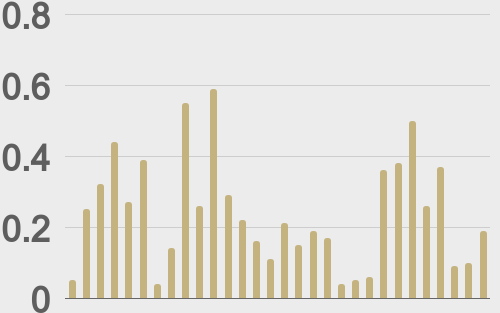

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||