|

|

5 December 2022 A little brighter out there….but not out of the woods yet |

| LMAX Digital performance |

|

Total notional volume at LMAX Digital was off in the previous week, mostly on account of the thinner holiday trade. Total notional volume from last Monday through Friday came in at $1.26 billion, 6% lower than the week earlier. Breaking it down per coin, Bitcoin volume came in at $669 million in the previous week, off 20% from a week earlier. Ether volume came in at $275 million, 15% lower from the week earlier. Total notional volume over the past 30 days comes in at $11.7 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $4,795 and average position size for ether at $2,500. Volatility has been anemic in 2022, and after seeing a little pick-up in recent weeks, we’re right back down to yearly low levels. We’re looking at average daily ranges in bitcoin and ether of $545 and $65 respectively. |

| Latest industry news |

|

It’s feeling like the market has done a good job getting away from worry around tail risk associated with the FTX implosion. Demand has clearly picked back up in recent sessions – a lot of that having to do with no fresh stories around fallout in the crypto space, and a lot of that having to do with last week’s comments from the Fed Chair about slowing the pace of rate hikes. Nevertheless, we think it’s too early to be thinking we’re out of the woods just yet. Markets have a way of pushing in the direction of the trend into year end, and that trend has been one in which risk assets and cryptocurrencies have been exposed in 2022. There could very well still be more fallout from FTX in the pipeline, and the Fed may once again be forced into talking tougher on monetary policy – especially if inflation data starts to shoot back up again. Looking at this past Friday’s jobs report out of the US, evidence would certainly suggest the Fed would be needing to lean back more towards the hawkish side. The jobs numbers were strong, and perhaps more importantly, hourly earnings ticked back up, suggesting inflation is still very much a problem. We’ve spent a lot of time talking about how we expect to see a breakdown in the correlation between risk-off and crypto performance. But we still believe this correlation can exist for a short while longer, with another round capable of dragging bitcoin down towards a test of $10k. At that point, we believe demand will offset any risk off flow in traditional markets, with investors looking to take advantage of the tremendous discount in an asset that offers a tremendous longer-term value proposition. |

| LMAX Digital metrics | ||||

|

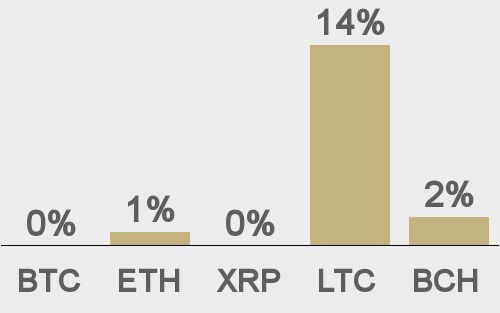

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

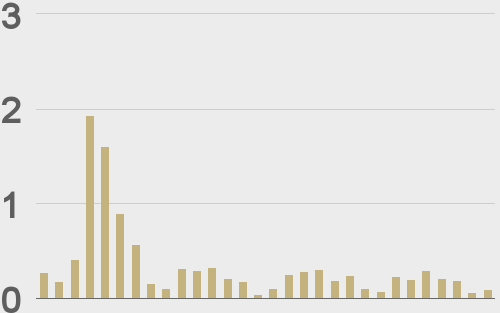

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

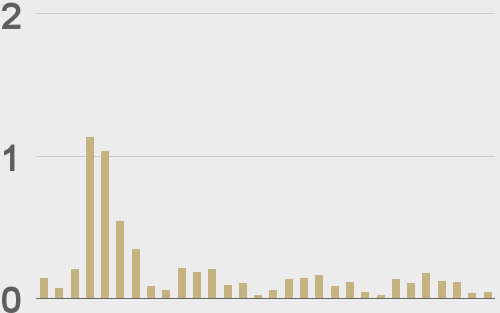

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

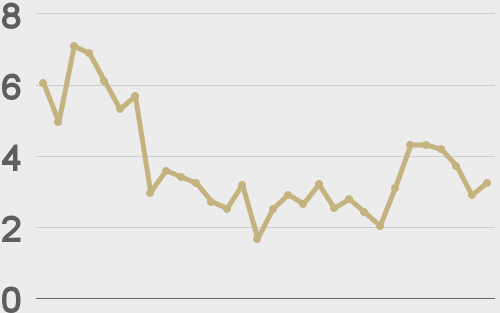

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@woonomic |

||||

|

@fintechintern |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||