|

|

19 February 2025 A maturing asset class |

| LMAX Digital performance |

|

LMAX Digital volumes improved from Monday levels but were still lighter overall on Tuesday. Total notional volume for Tuesday came in at $427 million, 26% below 30-day average volume. Bitcoin volume printed $162 million on Tuesday, 44% below 30-day average volume. Ether volume came in at $77 million, 18% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $10,600 and average position size for ether at $2,048. Market volatility continues to cool off since peaking out earlier this month. We’re looking at average daily ranges in bitcoin and ether of $3,237 and $176 respectively. |

| Latest industry news |

|

February has historically been a strong performance month for crypto assets. Yet, to this point, we haven’t seen any evidence of the positive seasonality. That being said, there is still plenty of time for the market to push higher between now and month end. Technically speaking, when looking at the price of bitcoin and ETH, there hasn’t been much going on at all, with both markets confined to consolidation. We think the most interesting development is away from the comparatives with the US Dollar. The ETHBTC ratio is showing signs of life and should we see a more meaningful recovery here, it will send an encouraging message of broader adoption. Recent flows have been supportive, with ETH spot ETFs doing a relatively better job of capturing interest in February as reflected through net inflows. The market has also done a good job taking negative headlines around trade tariffs and memecoin fallout in stride, reflecting a healthy maturity in the asset class. Looking ahead, it will be important to keep an eye on the Fed Minutes released late Wednesday. Investors will be curious to see if there are any hints at dovish leanings within the Minutes – something that would support crypto assets by way of a reaction to sell the US Dollar and buy stocks. |

| LMAX Digital metrics | ||||

|

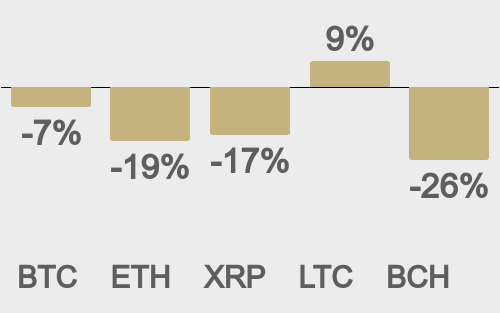

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

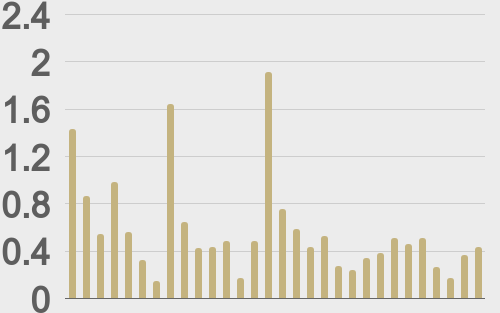

Total volumes last 30 days ($bn) |

||||

|

||||

|

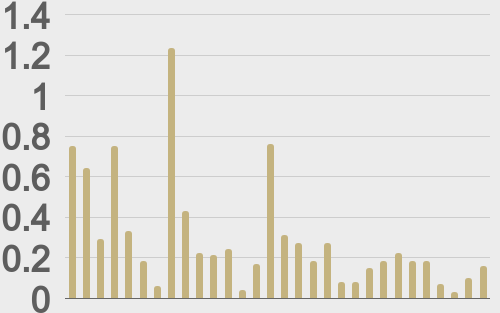

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

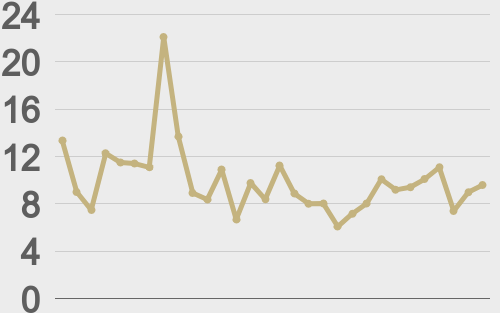

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||