|

|

1 May 2024 A perfect storm of short-term headwinds |

| LMAX Digital performance |

|

LMAX Digital volumes were up a nice amount from Monday levels. Total notional volume for Tuesday came in at $712 million, 8% above 30-day average volume. Bitcoin volume printed $509 million on Tuesday, 30% above 30-day average volume. Ether volume was still below trend on Tuesday, but much improved from Monday levels, coming in at $141 million, 21% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $10,177 and average position size for ether at $4,495. Market volatility has been in cool down mode since peaking in March. We’re looking at average daily ranges in bitcoin and ether of $3,031 and $180 respectively. |

| Latest industry news |

|

For quite some time now, we’ve warned a healthy correction could be forthcoming in the price of bitcoin. On Tuesday, bitcoin closed out the month of April down about 15%, while the price of ether was hit even harder for the month, down about 17%. The key takeaway here however is that this is simply a ‘correction’ within what continues to be a very aggressive uptrend. If we look at price action in bitcoin since January of 2023, it’s pretty much been a one way show to the topside, culminating in a fresh record high in March. And so, as per today’s technical insights, it’s important to be prepared for the possibility of additional declines in May after the first bearish monthly close in seven months. But it’s equally important to recognize the market is simply looking for that next major higher low. We’ve highlighted important short-term support at $59k. If this level gives way, it will open the door for a deeper correction back down into the $50k area. Ultimately, we expect there will be plenty of demand into the dip, and if we do see a drop towards and below $50k, it will be short-lived and exceptionally well supported. Fundamentally, the market is contending with the perfect storm of negative headwinds from natural profit taking post the record high run, selling of the fact on the bitcoin halving event, the normalization of flow post the euphoric bitcoin spot ETF launches, and an aggressive repricing of Fed expectations that has driven yield differentials back towards the US Dollar. But all of these headwinds are short-term headwinds only. And as far as Fed expectations go, it now feels like we are closer to seeing things shift back the other way after rate cut bets have gone from an expectation of over six rate cuts at the start of the year to basically just one rate cut. If this is the case, we could be closer to seeing the start to broad based demand for currencies against the Buck and a wave of risk on flow, all of which should be supportive of crypto assets. Later today, we get the latest Fed decision and considering the state of things heading in, we wouldn’t at all be surprised if that shift in yield differentials back the other way comes be way of today’s central bank communication. |

| LMAX Digital metrics | ||||

|

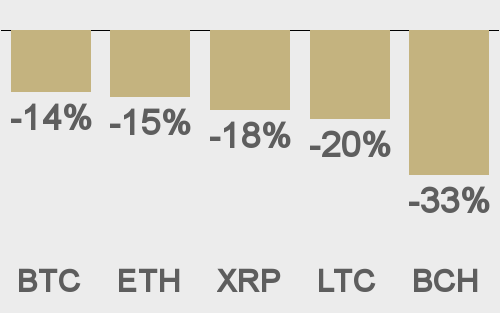

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

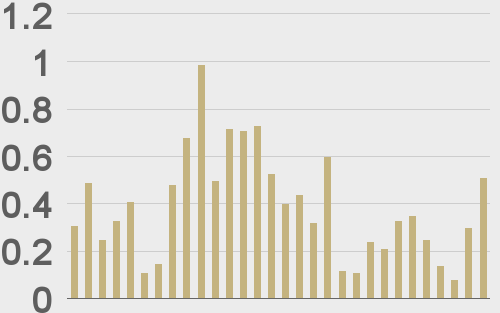

Total volumes last 30 days ($bn) |

||||

|

||||

|

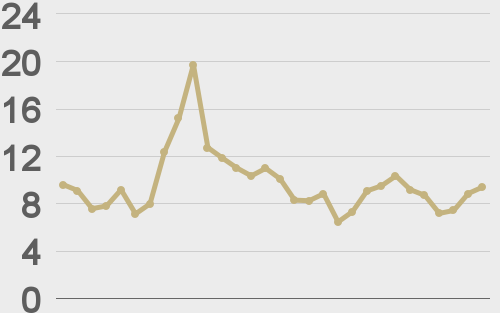

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

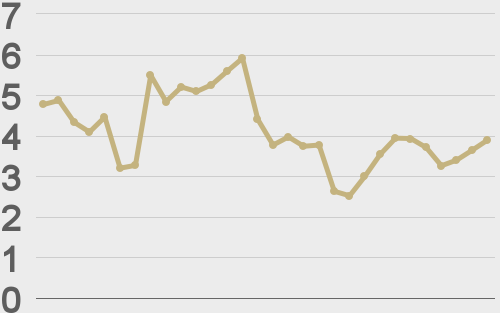

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||