|

|

19 December 2022 A welcome pickup in volume |

| LMAX Digital performance |

|

Total notional volume at LMAX Digital took a welcome turn to the topside in the previous week. Total notional volume from last Monday through Friday came in at $1.54 billion, 79% higher than the week earlier. Breaking it down per coin, Bitcoin volume came in at $1.1 billion in the previous week, up 122% from a week earlier. Ether volume came in at $259 million, 51% higher from the week earlier. Total notional volume over the past 30 days comes in at $5.59 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $3,712 and average position size for ether at $1,676. Volatility has been anemic in 2022, and after seeing a little pick-up in recent weeks, we’re right back down to yearly low levels. We’re looking at average daily ranges in bitcoin and ether of $485 and $55 respectively. |

| Latest industry news |

|

Trading conditions are set to thin out quite a bit between now and the second week of January on account of the holiday season. As things stand, overall sentiment in global markets has been in deterioration mode, which has added to the latest downside pressure on crypto assets. Of course, there’s also ongoing worry within the crypto space around fallout from FTX. What the ripple effects look like and what type of regulatory response we get going forward are all variables that need to be considered when assessing the outlook in the weeks and months ahead. Some of the ripple effects being considered right now are things like the future of Binance and if the massive exchange will be exposed, and swirling risk around DCG and Genesis. Nevertheless, given the extent of the pullback of crypto assets in 2022, it’s now a lot more sensible for investors to be taking on a trade where the asymmetries skew to the upside. We believe the outlook for both the global economy and crypto could be shaky in H1 2023, but at the same time, we are closer to a bottom and we don’t anticipate setbacks in bitcoin extending below $10k for more than a moment. |

| LMAX Digital metrics | ||||

|

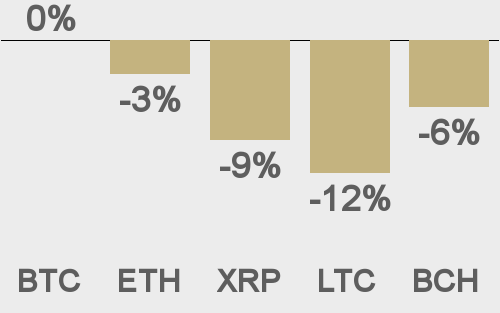

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

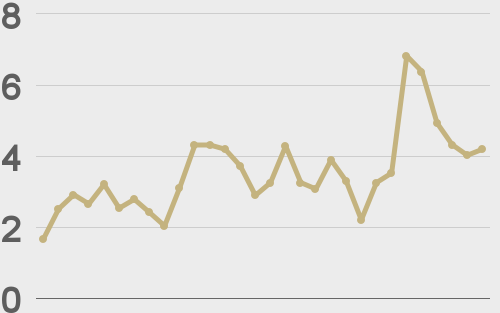

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||