|

|

10 April 2024 About bitcoin and today’s US CPI data |

| LMAX Digital performance |

|

LMAX Digital volumes saw a nice jump from Monday’s already healthy prints, coming in even more impressive on Tuesday. Total notional volume for Tuesday came in at $999 million, 41% above 30-day average volume. Bitcoin volume printed $685 million on Tuesday, 82% above 30-day average volume. Ether volume came in at $203 million, just 2% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,907 and average position size for ether at $4,701. Market volatility has been in cool down mode since peaking in Mid-March. We’re looking at average daily ranges in bitcoin and ether of $3,109 and $194 respectively. |

| Latest industry news |

|

Tuesday’s round of setbacks in crypto assets shouldn’t be alarming by any stretch, with price action confined to some tight consolidation since bitcoin put in a fresh record high in March. Overall, the outlook remains highly constructive, with bitcoin in the process of looking for that next higher low ahead of a bullish continuation to fresh record highs. There has been a lot of talk around the expectation for bitcoin to be well supported in April on account of the halving event. And while we wouldn’t argue against this expectation, we have also stated we believe the event has been mostly priced in. As far as the short-term outlook goes, we believe a lot more of the direction could be predicated on developments in traditional markets, namely how the market prices the Fed rate trajectory in 2024. Later today, we’ll get a better indication, with US CPI data due for release. If the data comes in at or below expectation, risk assets will find comfort in the release and look to rally, while yield differentials will move out of the US Dollar’s favor, which could be a benefit to crypto assets. If on the other hand the CPI data comes in above forecast, it will likely trigger a wave of risk off flow, while pushing yield differentials back towards the Buck, which could spill over into crypto and open the door for setbacks in the coming sessions. |

| LMAX Digital metrics | ||||

|

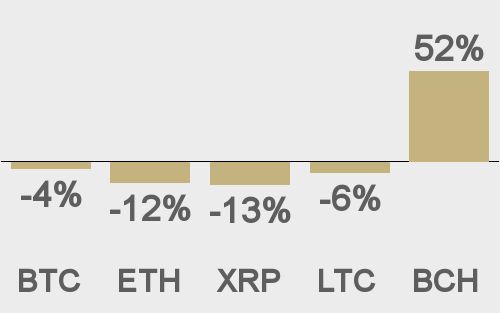

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

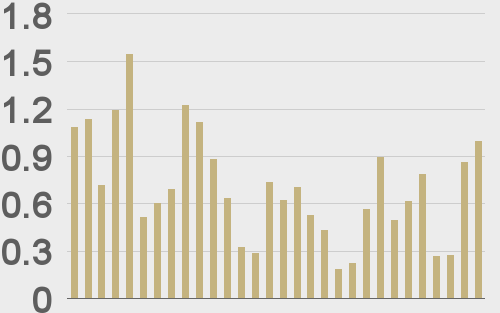

Total volumes last 30 days ($bn) |

||||

|

||||

|

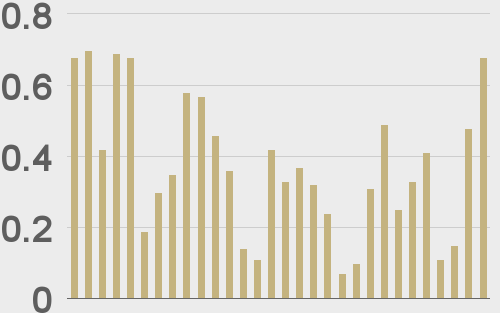

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

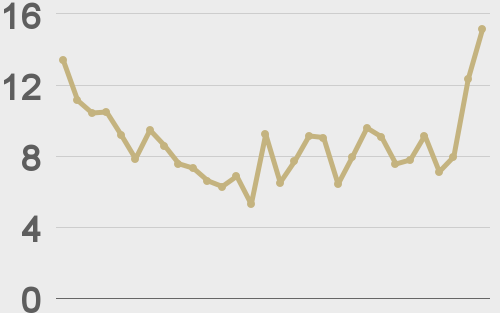

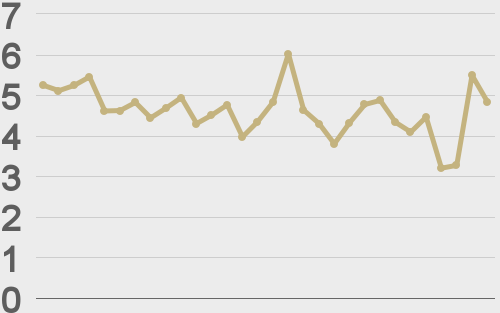

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||