|

|

6 July 2023 About bitcoin performance in July |

| LMAX Digital performance |

|

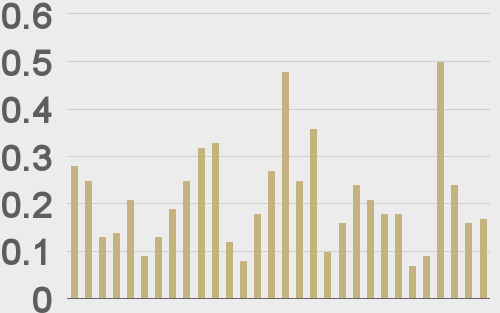

LMAX Digital volumes picked up from Tuesday but were still below 30-day average volume. Total notional volume for Wednesday came in at $327 million, 11% below 30-day average volume. Bitcoin volume printed $174 million on Wednesday, 18% below 30-day average volume. Ether volume printed $104 million, 2% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,078 and average position size for ether at 2,651. Volatility has been trending lower in recent days after an impressive run up in June. We’re looking at average daily ranges in bitcoin and ether of $916 and $62 respectively. |

| Latest industry news |

|

We saw a little weakness in the crypto market on Wednesday. We chalk up most of this to macro flows and a mild downturn in global sentiment. On Wednesday, currencies were in flight to safety mode into the Buck, while US equities had a hard time into rallies. Technically speaking, using bitcoin as our proxy for directional insight in the crypto space, everything is looking quite constructive despite the latest minor setback, with bitcoin seen in a bullish consolidation ahead of the next big push into the $35-40k area. As far as seasonality trends go, now that we’re into the second half of the year and July has just gotten going, it’s worth taking a look at historical bitcoin performance in the month of July. Breaking it down and looking at bitcoin performance over the past 10 years, we’re able to see that July is actually a solid month overall for bitcoin, with the crypto asset averaging 10% gains on the month. And over the past ten years, there have only been two down months in July, both less than 10%. Moreover, 2020, 2021, and 2022 were all super impressive July performances, all above 20%. On another positive note, digital asset products had another week of inflows, this most recent week amounting to $125 million of inflows. We believe this will continue to pickup in the weeks and months ahead as more products are approved and institutional adoption ramps up. |

| LMAX Digital metrics | ||||

|

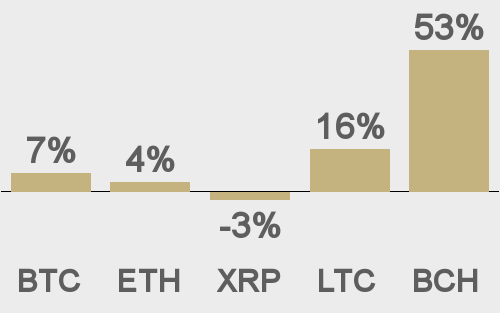

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

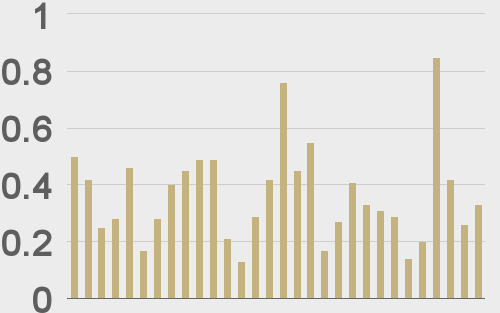

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

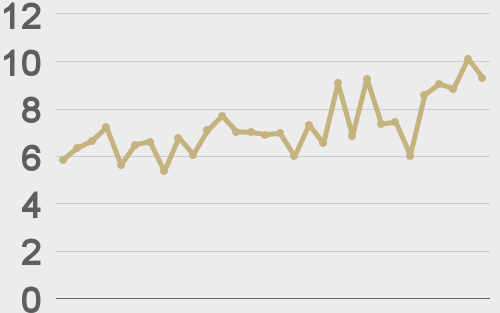

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

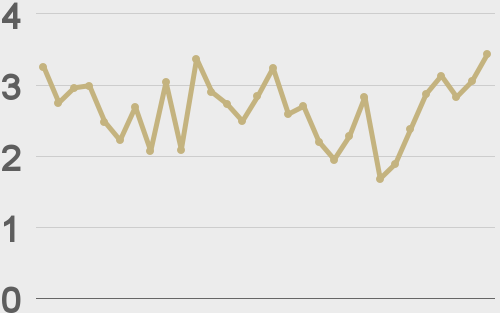

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||