|

|

12 October 2023 About crypto and recent correlations |

| LMAX Digital performance |

|

LMAX Digital volumes recovered on Wednesday after a lower volume Tuesday session. Total notional volume for Wednesday came in at $243 million, 14% above 30-day average volume. Bitcoin volume printed $175 million on Wednesday, 27% above 30-day average volume. Ether volume came in at $49 million, 16% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,664 and average position size for ether at $2,400. Volatility continues to consolidate just off the August low levels. We’re looking at average daily ranges in bitcoin and ether of $634 and $43 respectively. |

| Latest industry news |

|

In recent months, it’s been far more difficult to anticipate the direction in crypto based on developments in global markets. Correlations with risk sentiment have certainly been called into question. This week, we’ve seen a stock market that has been wanting to trade higher. And yet, crypto assets have been heading in the opposite direction. If we break it down, it’s a lot easier to attempt to reconcile the price action with respect to bitcoin. We’ve long since argued about the appeal of bitcoin as a flight to safety, store of value play. And so, if stocks are rallying, there is an argument that could be made for some selling in the price of bitcoin. As far as ether goes, it’s a little harder to make this argument, given how much more risk sensitive ether is as an asset. Still, we believe, it’s hard for ether to be wanting to rally if bitcoin is heading south. Our view here actually holds up when taking a closer look at the ETHBTC rate. Though ether was down against the US Dollar on Wednesday, there was some notable outperformance relative to bitcoin. Ultimately, we believe the outlook for both bitcoin and ether is exceptionally bright as the space continues to mature. This also puts bitcoin in the unusually attractive position to be trading higher both as an emerging market asset, and as a flight to safety, store of value asset. As far as industry specific updates go, JP Morgan has gone live with its Tokenized Collateral Network, offering an endorsement for the potential of blockchain based applications. Meanwhile, Circle has announced a strategic partnership in the Philippines to drive awareness around the use of USDC as an optimal solution for low cost, instant international money transfers. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

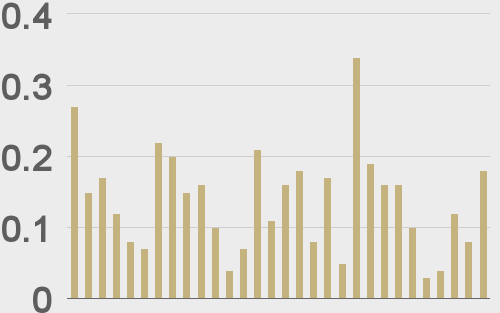

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||