|

|

4 April 2024 About perspective and managing expectations |

| LMAX Digital performance |

|

LMAX Digital volumes were on the lighter side in Wednesday trade. Total notional volume for Wednesday came in at $500 million, 38% below 30-day average volume. Bitcoin volume printed $248 million on Wednesday, 45% below 30-day average volume. Ether volume came in at $160 million, 30% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,604 and average position size for ether at $4,657. Market volatility has been in cool down mode since peaking in Mid-March. We’re looking at average daily ranges in bitcoin and ether of $3,257 and $199 respectively. |

| Latest industry news |

|

As we look at the bitcoin chart, we see a market that is very much trading within an uptrend, but also a market that shows the potential for more pullback before pushing to another record high. And so, for now, the best way to manage expectations is to recommend being prepared for the possibility of a deeper retreat in the days ahead, while knowing that this retreat is nothing more than the market looking for the next higher low within a strong uptrend. As far as defining the extent of the pullback, we believe the correction could extend back down to the $50k area without this doing anything to compromise the bullish structure. Indeed, bitcoin volatility runs higher than traditional assets. But it’s also important to understand this and take it with a grain of salt. A pullback to $50k would still have bitcoin trading up some 18% on the year, still outperforming all other major assets. As per our Wednesday update, there is plenty of reason to be expecting bitcoin to be supported in the days ahead, with some of those reasons being excitement around the upcoming halving event and seasonality trends which show April as the second best performing month for bitcoin. As far as downside risk goes, we believe there could be some hiccups around the outlook for Fed policy and the potential for this to drive yield differentials back in the US Dollar’s favor. We also believe there could be turbulence around updates involving the SEC approval of ETH spot ETFs, which will likely have an impact on bitcoin as it relates to the outlook for the broader crypto asset class. Ultimately however, any risk off flow should be a major positive for bitcoin, given the asset’s attractive qualities as a store of value play. We have yet to really see bitcoin rallying in periods of intense risk off (on account of a US equity market that has been in an uptrend since bitcoin’s inception). But we believe there will be a time in the not so distant future where bitcoin will have an opportunity to shine in such a market environment, which will only help to lend further credibility to the case for bitcoin. |

| LMAX Digital metrics | ||||

|

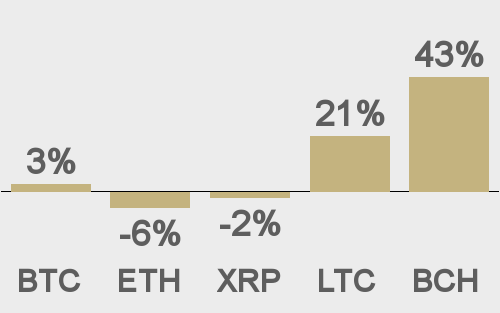

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

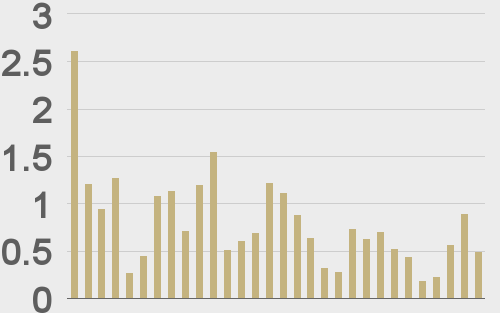

Total volumes last 30 days ($bn) |

||||

|

||||

|

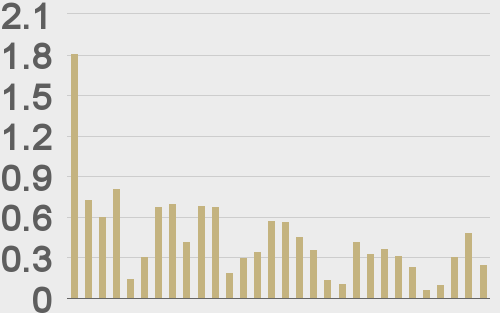

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

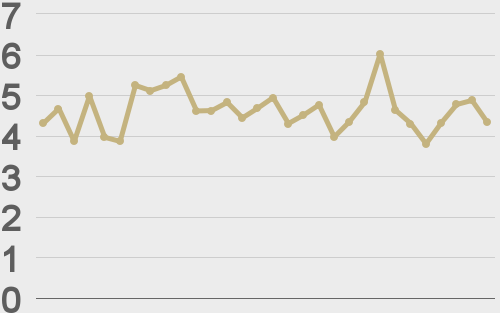

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@CoinDesk |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||