|

|

28 May 2024 Activity expected to pick up into fuller trading conditions |

| LMAX Digital performance |

|

LMAX Digital volumes got off to a quiet start this week on account of holiday sessions in the UK and US. Total notional volume for Monday came in at $273 million, 38% below 30-day average volume. Bitcoin volume printed $112 million on Monday, 53% below 30-day average volume. Ether volume came in at $112 million, 17% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,857 and average position size for ether at $3,763. Bitcoin volatility continues to trend lower since peaking in March. Ether volatility has however shown signs of turning back up in recent sessions. We’re looking at average daily ranges in bitcoin and ether of $2,534 and $174 respectively. |

| Latest industry news |

|

Crypto market conditions have been relatively quiet as the new week gets going. This shouldn’t come as any surprise after both the UK and US markets were out on Monday holidays. We expect activity will start to pick up from today as trading conditions return to fuller form. Overall, bitcoin and ether have been very well supported into dips and remain confined within well defined uptrends. As far as market moving stories go, there are a few that are getting some attention in otherwise lackluster trade. One of these stories comes out of the UK, where there has been excitement around bitcoin and ether spot ETF products going live. The UK’s FCA has gotten on board with the US and other major financial centers when it comes to adoption of digital asset products that will be made available to traditional investors. Names like Wisdom Tree and Invesco Digital Markets are amongst those firms who have been FCA approved to list bitcoin and ether exchange traded products on the London Stock Exchange. Another story getting some attention on Tuesday that could be behind some of the mild selling pressure we’ve been seeing is the story of Mt. Gox transferring bitcoin for the first time in 5 years as the long awaited repayment process kicks off, which could fuel conversion of bitcoin into fiat. Finally, there has been chatter around what the SEC ETH ETF approval could mean for Grayscale over the coming weeks, with many speculating a similar outcome to what played out when the spot bitcoin ETFs were approved. Should the same events transpire, the market would expect to see significant Grayscale ETH outflows on a daily basis in the weeks that follow the launch of the new ETF products. But this should not be confused with what also should be overall net inflows into ETH as the other funds generate significant interest and volume. |

| LMAX Digital metrics | ||||

|

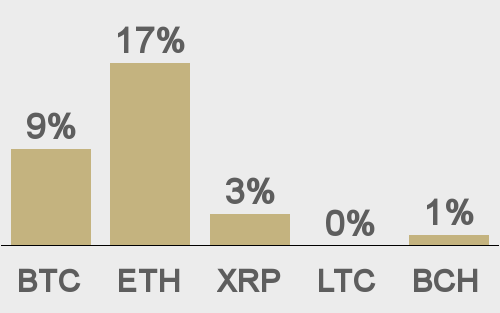

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

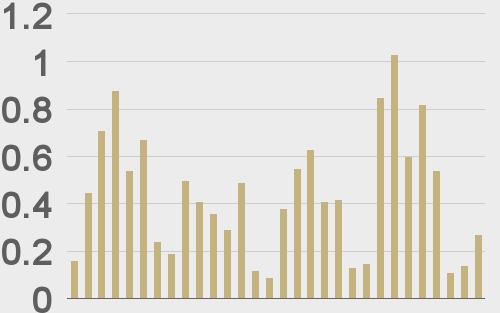

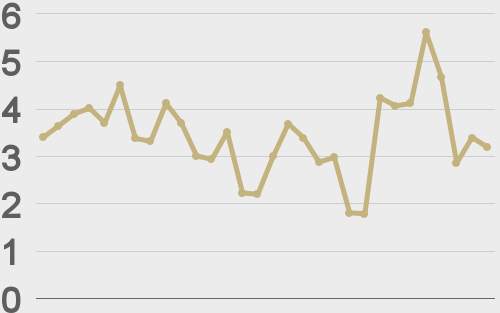

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

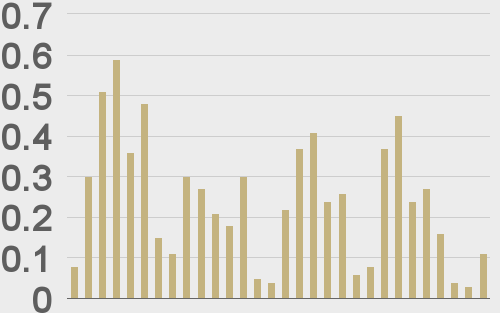

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

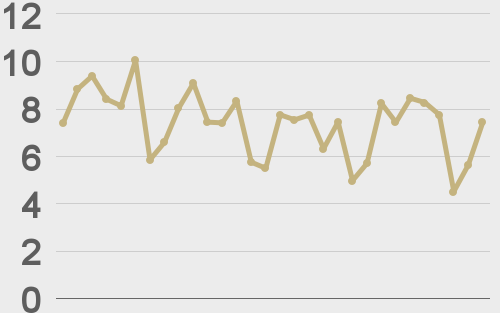

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||