|

|

5 November 2024 All eyes on US election |

| LMAX Digital performance |

|

LMAX Digital volumes got off to a good start this week. Total notional volume for Monday came in at $431 million, 54% above 30-day average volume. Bitcoin volume printed $316 million on Monday, 77% above 30-day average volume. Ether volume came in at $60 million, 10% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,756 and average position size for ether at $2,718. Market volatility is showing signs of wanting to bottom out after trending lower since March. We’re looking at average daily ranges in bitcoin and ether of $2,102 and $103 respectively. |

| Latest industry news |

|

All of the attention will be on the US election over the coming sessions. This is going to be a tight one and it’s worth considering the market may not have an answer until later in the week. As far as market reaction and expectations go, there is no denying the fact that Trump has been decidedly more crypto friendly when it comes to crypto policies. At the same time, we’ve also seen warmer gestures out from the Harris campaign. If we’re considering the immediate aftermath, a Trump victory would therefore likely translate to an acceleration in demand for bitcoin and other crypto assets. A Harris victory would certainly be less bullish, though we wouldn’t expect any fallout to be intense. The reasons for this are the fact that as already mentioned, Harris has warmed up to crypto in recent months. We’d also highlight that we have already seen some weakness in recent sessions that could be accounting for a Harris victory, which means a lot of this weakness could already be priced in. More importantly, if we look beyond the short-term, the outcome to the election should have not major impact on crypto assets. The outlook remains exceptionally bright and macro conditions are also inviting of additional demand for the alternative asset class. Of course, as we’ve already highlighted many times in recent weeks, Q4 performance metrics are strong and suggest we still could see a healthy amount of demand between now and year end. |

| LMAX Digital metrics | ||||

|

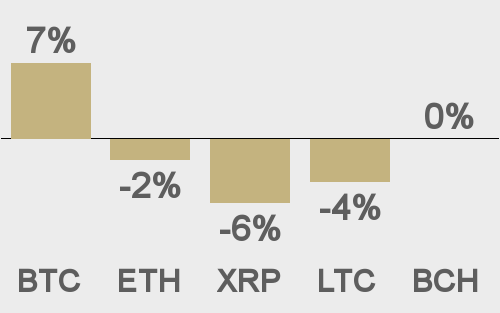

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

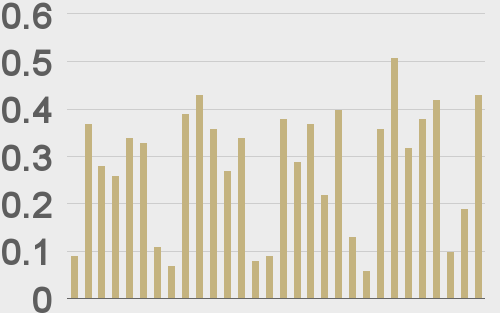

Total volumes last 30 days ($bn) |

||||

|

||||

|

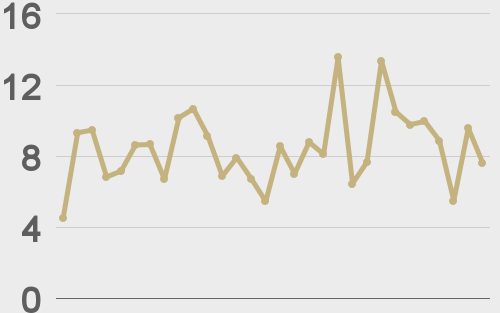

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

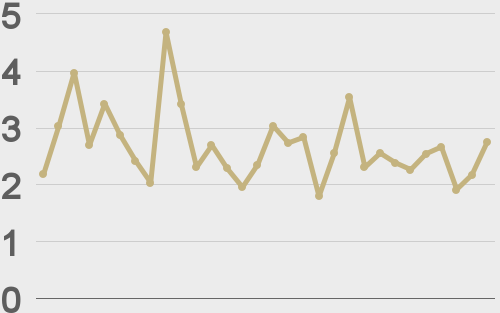

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||