|

|

20 March 2023 Another big week of volume |

| LMAX Digital performance |

|

Total notional volume at LMAX Digital was quite robust in the previous week. Total notional volume from last Monday through Friday came in at $3.9 billion, 78% higher than the week earlier. Breaking it down per coin, Bitcoin volume came in at $2.5 billion in the previous week, 81% higher than the week earlier. Ether’s volume jump was even more impressive, coming in at $872 million, 101% higher than the week earlier. Total notional volume over the past 30 days comes in at $14.4 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,154 and average position size for ether at $3,355. Volatility has also turned up nicely in recent sessions, trading back at yearly highs. We’re looking at average daily ranges in bitcoin and ether of $1,249 and $84 respectively. |

| Latest industry news |

|

It’s turning out to be a special year for crypto assets. Year-to-date, nothing even comes close. Bitcoin is up 71%, while ether is up 50%. Perhaps more impressively, bitcoin has traded to its highest level since June 2022, suggesting the market has fully priced in and recovered from fallout associated with all of the turmoil of 2022. Interestingly enough, what initially surfaced as what could have looked like the next big knock on crypto, has actually turned out to be a pivotal moment. The implosions of three of the biggest banks partnering with crypto had triggered an initial wave of panic, before everything turned around rather quickly. All of this disruption in the traditional banking sector has exposed serious vulnerabilities within the legacy system, and this has in turn, put a positive spotlight on an extremely limited supply currency, where there is an option to self-custody, be your own bank, and eliminate counterparty risk. We wouldn’t rule out the possibility for more turbulence in 2023, which could invite renewed downside pressure on crypto assets. But at the same time, we are getting more and more signs of the broader market waking up to the draw of bitcoin and other crypto assets. Technically speaking, bitcoin’s ability to hold up above $25k offers further encouraging signs that we could very well be in the process of starting to see the next big run back towards and eventually through the record high from November 2021. |

| LMAX Digital metrics | ||||

|

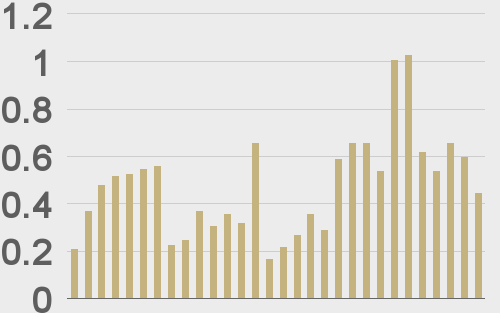

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

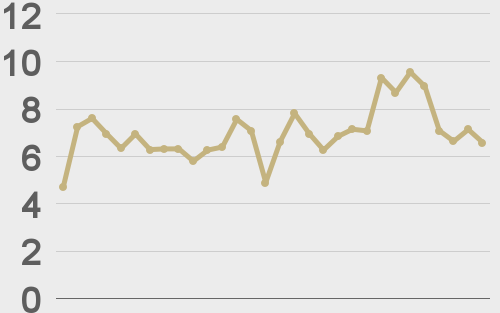

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

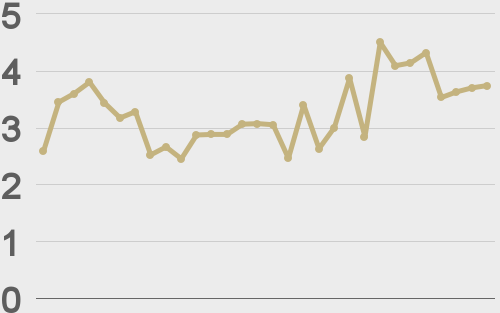

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@MartyBent |

||||

|

@matt_levine |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||