|

|

30 October 2023 Another week of robust volume |

| LMAX Digital performance |

|

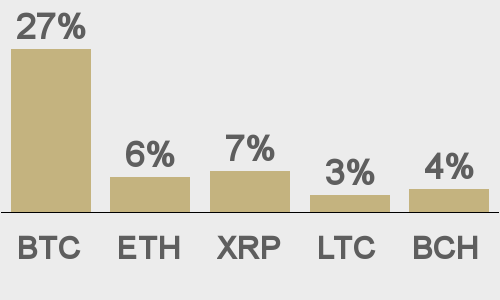

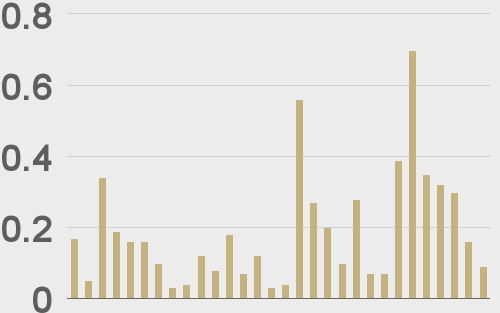

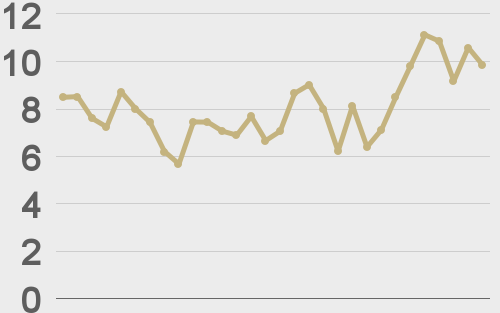

Total notional volume at LMAX Digital was impressive in the previous week. Total notional volume from last Monday through Friday came in at $3 billion, 52% higher than the week earlier. Breaking it down per coin, bitcoin volume came in at $2.1 billion in the previous week, 47% higher than the week earlier. Ether volume came in at $667 million, 69% higher than the week earlier. Total notional volume over the past 30 days comes in at $8.7 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,500 and average position size for ether at $2,727. Volatility has settled down in recent sessions after breaking out to the topside. We’re looking at average daily ranges in bitcoin and ether of $1,071 and $55 respectively. |

| Latest industry news |

|

We’re into Fed week, with market participants around the globe starting to prepare for and position into Wednesday’s central bank event risk. Bitcoin has been exceptionally resilient in the lead-up to the decision, outperforming across the board over the past 30 days (up around 30%). The only other major traditional market asset to show outperformance against the US Dollar over the past 30 days is gold (up about 7%), all while US equities have been hit hard, sitting in the red at the other end of the spectrum. This highlights the fact that the market might want to be thinking about bitcoin’s draw as a store of value asset when considering the direction it could take in reaction the the Fed decision. Having said that, there have been other drivers influencing bitcoin’s outperformance in October, the most obvious of which – a growing expectation the SEC will go ahead and approve bitcoin spot ETFs. We have seen a growing interest from the institutional side of the market because of this, and recent data out of the CME back up this theory with open interest on bitcoin futures surging to a record high. Technically speaking, we’ve highlighted the fact that the latest breakout to a fresh yearly high in the price of bitcoin has opened the next major upside extension, now underway and targeting a push to $40,000. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||