|

|

15 October 2024 Appetite picking up in a big way |

| LMAX Digital performance |

|

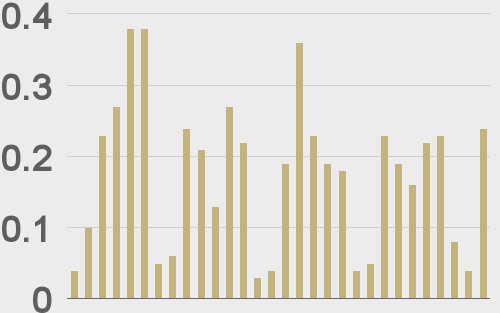

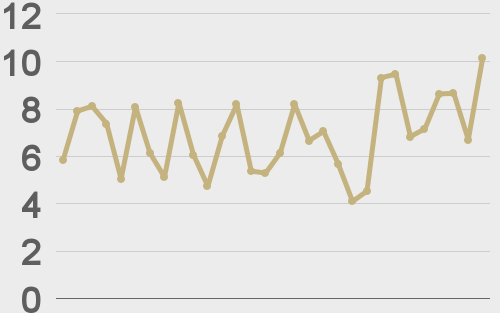

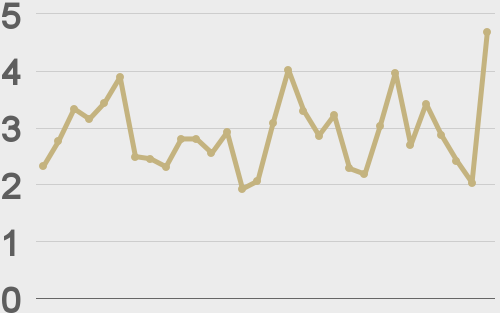

LMAX Digital volumes got off to another healthy start this week. Total notional volume for Monday came in at $389 million, 36% above 30-day average volume. Bitcoin volume printed $239 million on Monday, 36% above 30-day average volume. Ether volume came in at $96 million, 46% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,030 and average position size for ether at $3,044. Market volatility is showing signs of wanting to bottom out after trending lower since August. We’re looking at average daily ranges in bitcoin and ether of $2,061 and $101 respectively. |

| Latest industry news |

|

Things are looking up as this new week pushes forward. There have been a number of developments over the past 24 hours alone that could easily account for this latest wave of demand. Japanese investment firm Metaplanet is back at it and has announced that it has added just over 100 new bitcoin to the company’s balance sheet, bringing total exposure to around $56 million. The move highlights what has been an emerging trend of firms incorporating bitcoin into their business strategies. The most famous example of this thus far has been what we’ve seen via Michael Saylor’s MicroStrategy. MicroStrategy currently holds 252,220 bitcoin ($16.6 billion). On the political front, the Harris campaign has been out making efforts to boost its support for crypto assets. There hasn’t been much in the way of any substance around the pledge, but the gesture alone could be helping to prop crypto assets. Meanwhile, BlackRock CEO Larry Fink is getting the market excited after offering up another round of bullish talk about bitcoin and ETH. His comments around ETH are of particular importance after saying “the role of Ethereum as a blockchain can grow dramatically.” The market will also be pleased to see spot ETF money flowing back into both bitcoin and ETH. The ETH ETFs had been struggling a little more of late but there are signs of fresh demand. The big obstacle right now is some technical resistance in the form of the bitcoin September high at around $66,550. The market stalled out just ahead of this level on Monday and will be wanting to see if it can break through today. A push above $66,550 will open the door for the next major upside extension towards a retest and eventual break of the record high from earlier this year. As a reminder, seasonal trends are already on crypto’s side, with October and Q4 performance overall shining bright when looking at bitcoin performance from 2013 to present. |

| LMAX Digital metrics | ||||

|

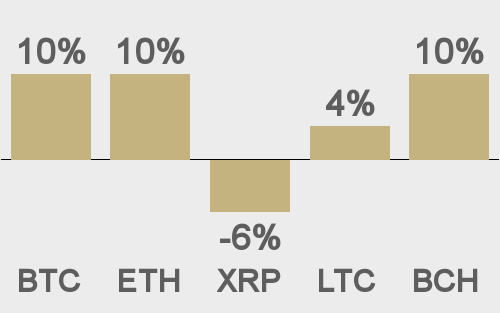

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@Cointelegraph |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||