|

|

| Attention turns to inflation |

| LMAX Digital performance |

|

LMAX Digital volume held up well on Wednesday after making a strong recovery from earlier in the week. Total notional volume for Wednesday came in at $1.9 billion, 12% below 30-day average volume. Bitcoin volume held steady at $963 million, but still down 10% from 30-day average volume. Ether volume continues to be a great story in 2021. On Wednesday, Ether volume came in at 658 million, up 1% from 30-day average volume. Total notional volume at LMAX Digital over the past 30 days came in at $65.9 billion. Average trading size for Bitcoin came in at $9,018. Average trading size for Ether came in at $6,291. The average daily trading range for BTCUSD is $3,637. The average daily trading range for ETHUSD is $333. |

| Latest industry news |

|

The crypto market got a nice boost on Wednesday from the news out of El Salvador of Bitcoin getting passed into law as legal tender. There was also talk on desks of a decent amount of short positions getting taken out on the jump higher. Meanwhile, institutional players have been looking to take advantage of the Bitcoin dip down into the $30,000 area and have been increasing exposure. The focus for today will be on the inflation narrative. We will be looking to see what the ECB has to say about inflation being transitory and what US inflation reads produce. While rising inflation should bode well for Bitcoin on its longer-term value proposition as a hedge against inflation, we don’t see this risk necessarily being a prop in the short-term. We believe the risk of rising inflation is a risk that will weigh on risk correlated assets, as it forces central banks into needing to be more considerate of tighter monetary policy conditions, something investors don’t want to see. And looking at shorter-term fundamentals, Bitcoin, and certainly other crypto assets, are still perceived as emerging markets that do share correlations with investor risk appetite. Ultimately, the key takeaway here is that any signs of higher inflation could ignite a wave of risk off flow, which could in turn open short-term downside pressure on crypto assets. Technically speaking, we still won’t rule out the possibility for a deeper drop in the sessions ahead. Looking at Bitcoin, a drop back below $30,000 will warn of deeper setbacks towards previous resistance turned support in the $20,000 area, in the form of the previous record high from 2017. It will now take a break back through $47,000 to take the pressure off the downside and suggest the market is getting ready to start making its way back to fresh record highs. |

|

LMAX Digital metrics |

||||

|

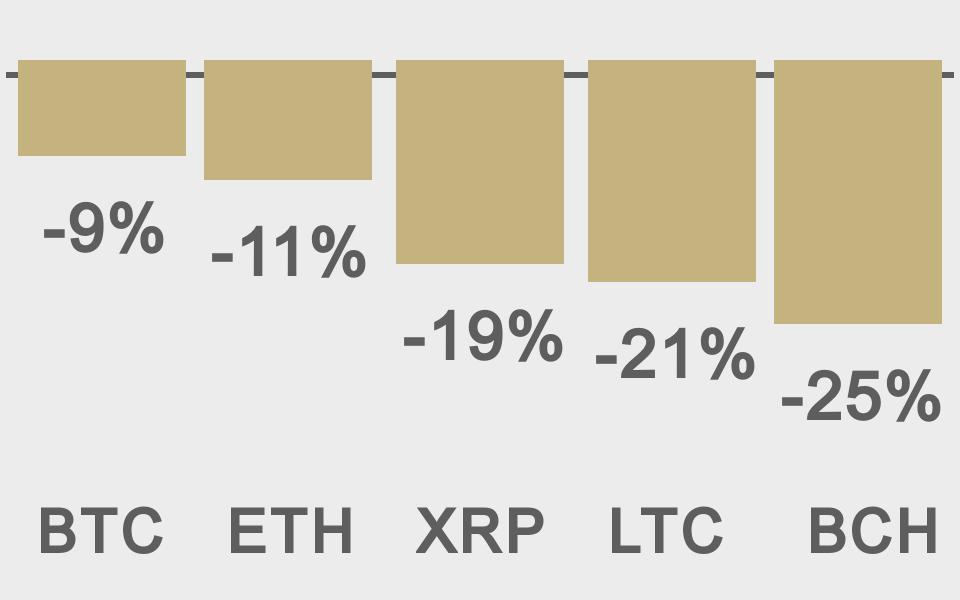

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

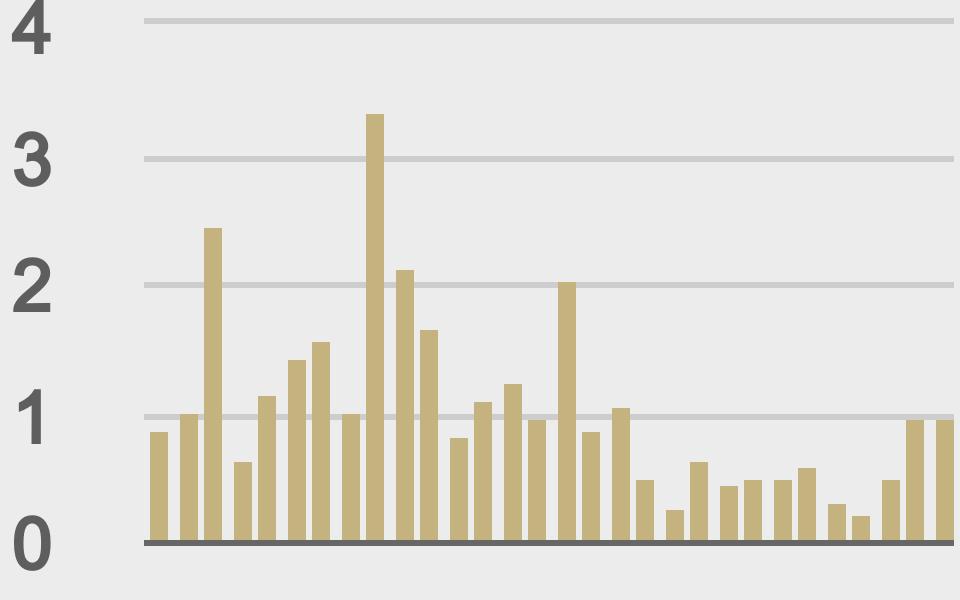

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

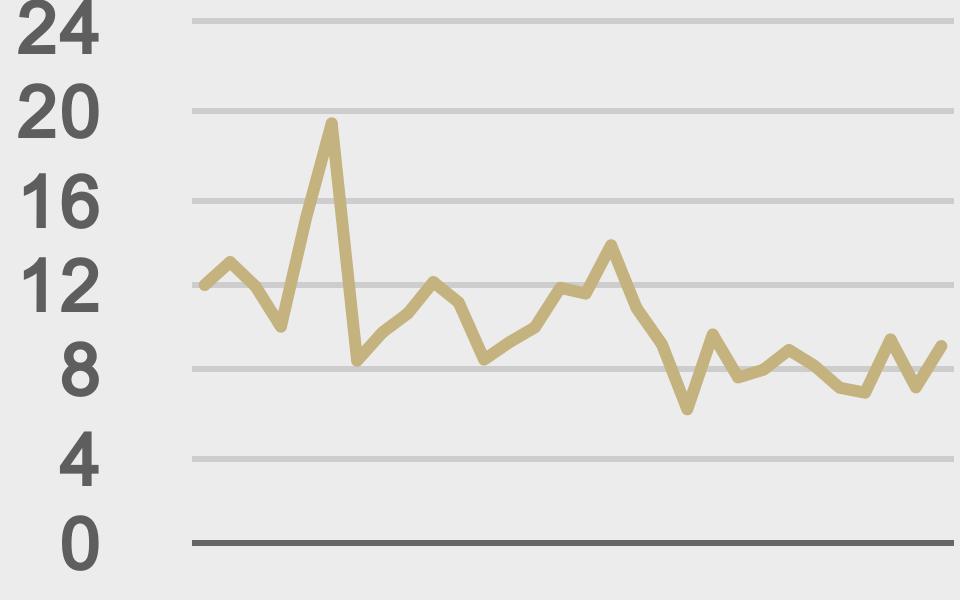

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@nayibbukele |

||||

|

@fintechfrank |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||