|

|

5 September 2023 August reflections |

| LMAX Digital performance |

|

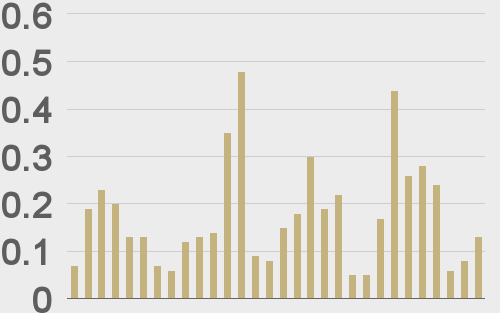

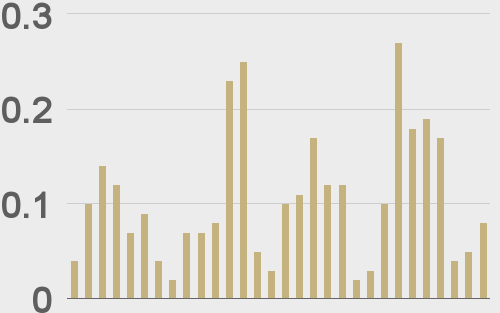

LMAX Digital volumes cooled off on Monday, though this was no surprise on account of the US long weekend holiday break. Total notional volume for Monday came in at $132 million, 25% below 30-day average volume. Bitcoin volume printed $81 million on Monday, 22% below 30-day average volume. Ether volume came in at $33 million, 30% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,527 and average position size for ether at $2,465. Volatility is holding up after recovering from cycle lows in August. We’re looking at average daily ranges in bitcoin and ether of $707 and $45 respectively. |

| Latest industry news |

|

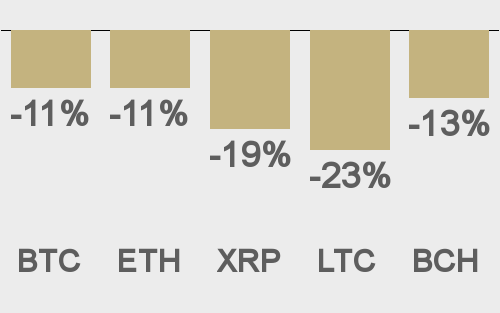

Crypto performance for the month of August was a whole lot more deceptive than what was presented in the numbers on the surface. For the most part, bitcoin and ether were confined to tight ranges, despite the net result of both assets closing down over 11% on the month. Fundamentally speaking, things weren’t all that bad. The initial wave of weakness in mid-August came from fallout in global markets on the back of concerns around the need for higher interest rates in a slowing economy. This resulted in broad based US Dollar demand on both yield differential and flight to safety flow, which translated to setbacks in crypto assets. Updates from the crypto front were actually a net positive. In the end, it came down to one negative reaction in late August which left the market under pressure and right where it was in the aftermath of the fallout from traditional markets earlier in the month. In the final week of August, the crypto market celebrated the news of the Grayscale court victory against the SEC in which the US Court of Appeals ruled in favor of Grayscale. The court said the SEC acted in an “arbitrary and capricious” manner when denying Grayscale’s proposal to convert its over-the-counter Grayscale Bitcoin Trust (GBTC) into a listed bitcoin ETF. This ruling set the stage for what the market expected would be a swift approval of a bitcoin ETF. However, in the day that followed, the SEC completely soured market sentiment after further delaying its ruling on existing bitcoin ETF applications from the likes of BlackRock and Fidelity. Ultimately, we weren’t surprised to see this type of resistance from the SEC and even warned of this risk in our daily report. But overall, we see the court decision as a big step forward for the space and expect that it will further contribute to a backdrop which is already moving significantly more in favor of embracing widespread crypto adoption. Looking ahead, we expect we should soon see an SEC approval of a bitcoin ETF. When this happens, it will usher in a much needed and overdue wave of institutional adoption which will significantly increase demand and interest while driving further innovation. We will also look for activity and volume to pick up nicely in September as many market participants return from summer holidays. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

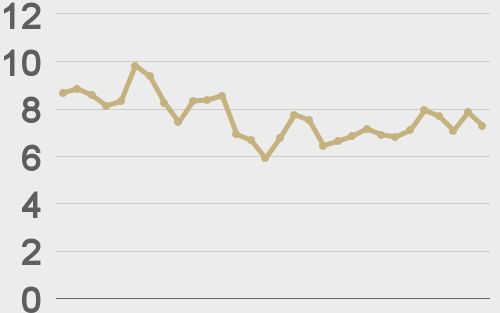

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

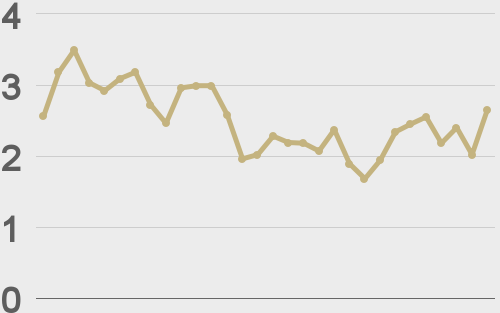

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||