|

| 2 September 2025 August reflections and looking ahead |

| LMAX Digital performance |

|

LMAX Digital volumes got off to a slow start this week on account of the long weekend in the US. Total notional volume for Monday came in at $429 million, 22% below 30-day average volume. Bitcoin volume printed $185 million, 17% below 30-day average volume. Ether volume came in at $135 million, 36% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,653 and average position size for ether at $3,323. Bitcoin volatility continues to consolidate off yearly low levels. Meanwhile, ETH volatility has been trending up, recently tracking at the highest levels since December 2021. We’re looking at average daily ranges in bitcoin and ether of $2,956 and $235 respectively. |

| Latest industry news |

|

Bitcoin spent August largely in consolidation. While it did manage to push to a fresh record high, the broader trend reflected cautious investor sentiment, supported by modest momentum and ongoing macro uncertainty. The narrative suggests price resilience, but without the forcefulness needed for the next wave of bullish momentum. In stark contrast, Ethereum continued with its run of outperformance—posting double-digit returns and surpassing its 2021 peak to hit fresh all-time highs. Its rally was powered by robust institutional demand, record ETF inflows, and active on-chain metrics like rising transaction volumes and reduced network fees. Favorable regulatory signals, particularly stablecoin-friendly legislation, further stoked confidence in ETH’s utility-driven narrative. This divergence has shifted the ETHBTC dynamic sharply in ETH’s favor. As Bitcoin grinded higher with subdued volatility, Ethereum’s performance underscored its emergence as the speculative bellwether, attracting capital rotating away from Bitcoin’s more mature positioning. Outside of core crypto dynamics, broader markets had their eyes on cues around Fed policy and just how accommodative the central bank would be going forward. Meanwhile, macro tailwinds and sovereign-level engagements, such as strategic digital asset reserve discussions, added a layer of structural legitimacy to crypto investing. Looking ahead, August’s momentum points to a market that should be well supported to close out Q3, setting up a compelling run into Q4, traditionally a strong period for crypto. With ETH already breaking new ground and Bitcoin stabilizing near key levels, both are well-positioned to challenge fresh record highs before year-end. |

| LMAX Digital metrics | ||||

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

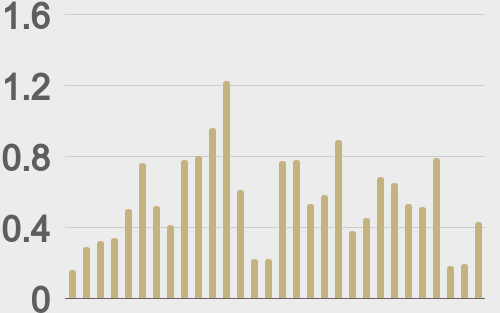

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

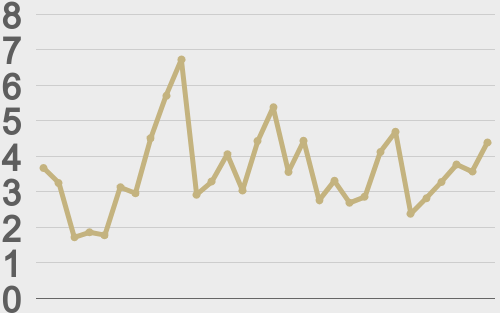

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||