|

|

28 February 2023 Back to watching traditional markets |

| LMAX Digital performance |

|

LMAX Digital volumes were off marginally on Monday. Total notional volume for Monday came in at $371 million, 4% below 30-day average volume. Bitcoin volume printed $198 million on Monday, 3% below 30-day average volume. Ether volume came in at $103 million, 5% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $5,557 and average position size for ether at 3,0009. Volatility has cooled from recent peaks, but overall, has turned up a good deal from multi-month lows we were seeing in 2022. We’re looking at average daily ranges in bitcoin and ether of $875 and $66 respectively. |

| Latest industry news |

|

The other week, we got a glimpse of crypto wanting to trade on its own fundamentals, despite what was going on in US and global equity markets. While stocks were under pressure, crypto was trading higher, feeling good about the outlook for the space and ongoing institutional adoption. But we also said we would only be getting glimpses of this right now, with crypto assets still sensitive to developments in traditional markets. And so, that’s more or less where we’re back to right now. Price action in recent sessions has been more about what’s been going on in global markets. Stocks were supported on Monday, perhaps on the back of a weaker US durable goods orders print that may have got investors thinking this would be enough to get the Fed to ease up on its hawkishness. But we think this is far too much of a stretch and the reality of higher for longer policy is a reality that could continue to weigh on both stocks and crypto by extension, at least over the coming weeks. Technically speaking, as highlighted in our technical overview, bitcoin has been rolling over and could be looking to gravitate back towards a test of the February low at $21,365. We’ll need to see a sustained push back above $25,000 to suggest we could be seeing a more significant bullish structural shift. |

| LMAX Digital metrics | ||||

|

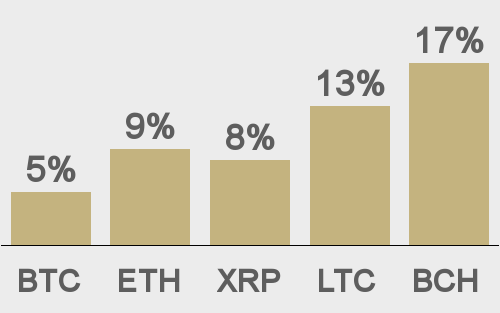

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

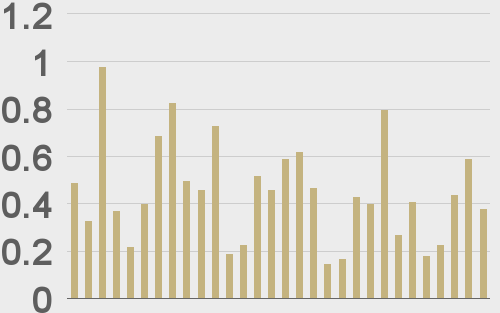

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

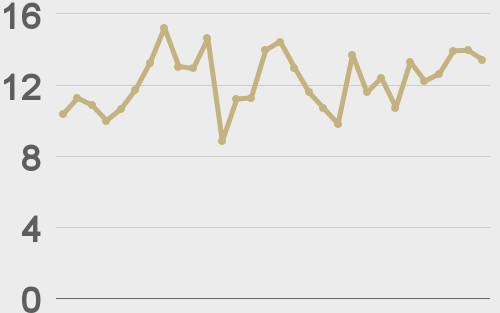

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

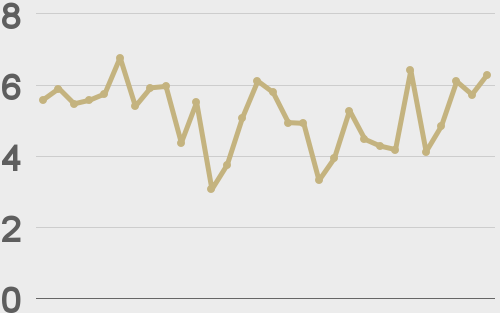

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||