|

|

23 March 2023 Bearish reversal day for bitcoin |

| LMAX Digital performance |

|

LMAX Digital volumes ran back up on Wednesday after a lighter Tuesday session. Total notional volume for Wednesday came in at $777 million, 53% above 30-day average volume. Bitcoin volume printed $492 million on Wednesday, 60% above 30-day average volume. Ether volume printed $166million, 39% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,121 and average position size for ether at 3,397. Volatility has been on the upswing of late, currently trading at year high levels. We’re looking at average daily ranges in bitcoin and ether of $1,317 and $85 respectively. |

| Latest industry news |

|

Crypto assets came under pressure on Wednesday, in the aftermath of the Fed policy decision. The fallout seemed to mostly come from the risk off flow in US equities resulting from a communication that may have let down investors looking for a more accommodative tone. While the Fed delivered a 25 basis point hike and talked about the need to address financial stability risk, it wasn’t ready to downplay risks associated with inflation and the need to continue to address this risk via higher rates. Interestingly enough, the currency market rallied across the board against the Buck following the decision, this despite risk off flow that might normally have resulted in flight to safety demand for the Buck. And yet, crypto was unable to rally. We believe a lot of this could be about a crypto market that was already looking a little stretched following this latest impressive run in 2023. Bitcoin’s surge back through $25k had the market in position to be seeking out some corrective action, and so, the pullback we’re seeing could be nothing more than technical. As per our technical insights in today’s report, we believe any setbacks we do see, should now be very well supported back into previous resistance in the 25k area. Ultimately, the break of $25k was a significant development suggesting we could just be getting started with respect to the next big up-move. |

| LMAX Digital metrics | ||||

|

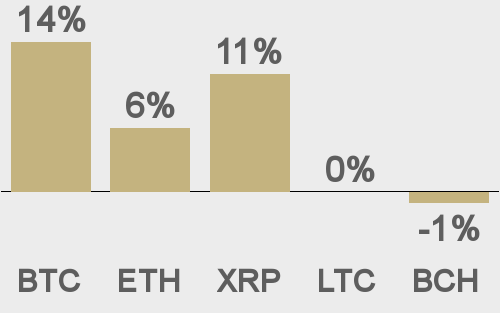

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

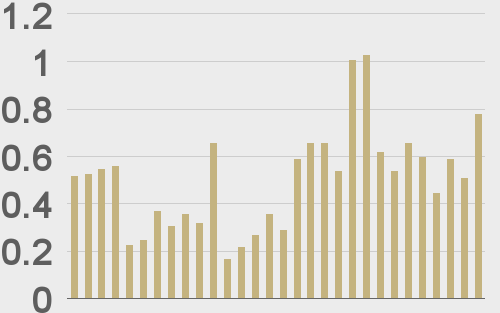

Total volumes last 30 days ($bn) |

||||

|

||||

|

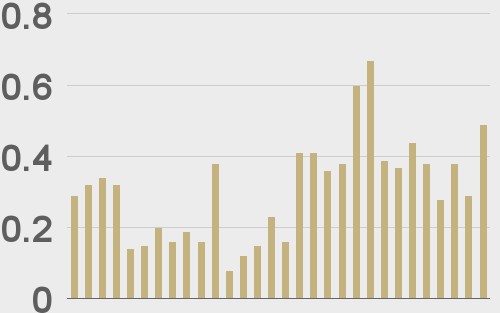

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

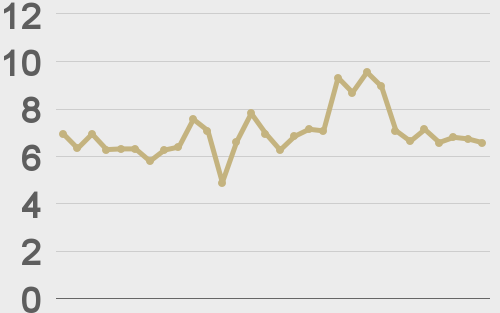

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||