|

|

18 October 2023 Bitcoin as a store of value |

| LMAX Digital performance |

|

LMAX Digital volumes were robust yet again on Tuesday. Total notional volume for Tuesday came in at $372 million, 65% above 30-day average volume. Bitcoin volume printed $268 million on Tuesday, 83% above 30-day average volume. Ether volume came in at $78 million, 29% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,827 and average position size for ether at $2,476. Volatility has picked up in recent sessions but overall, continues to consolidate off the August low levels. We’re looking at average daily ranges in bitcoin and ether of $703 and $42 respectively. |

| Latest industry news |

|

Bitcoin has been correlating closer with gold in recent sessions, a development clearly reflecting the asset’s lure as a store of value. The escalation in geopolitical tension, against an already existing stress around elevated inflation is expected to continue to generate demand for bitcoin. At the same time, the market is also waiting for an SEC approval of bitcoin spot ETFs, something that will usher in a long awaited and overdue wave of mass institutional adoption. Technically speaking, bitcoin has shown exceptionally strong support down into the $25k area, while gradually pushing back to the topside. We’ve seen a series of higher lows and higher highs on the daily chart, with the latest break above $28,615 confirming the next higher low at $26,520 and opening the door for the next measured move upside extension targeting a retest of the yearly high. |

| LMAX Digital metrics | ||||

|

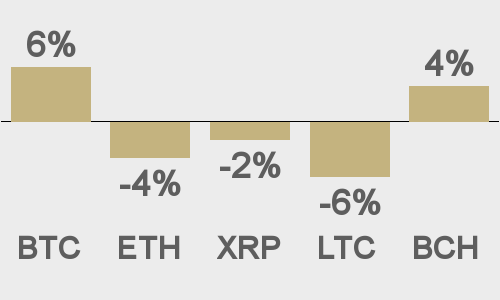

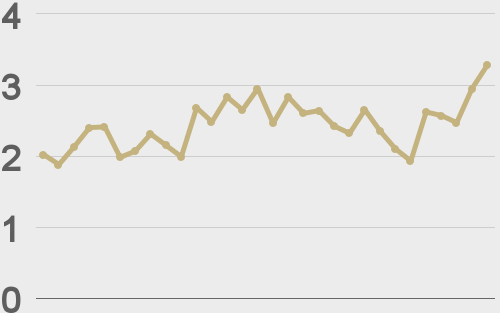

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

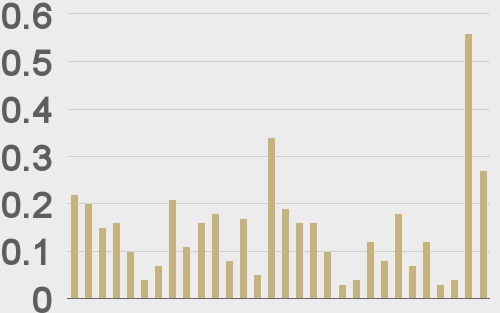

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

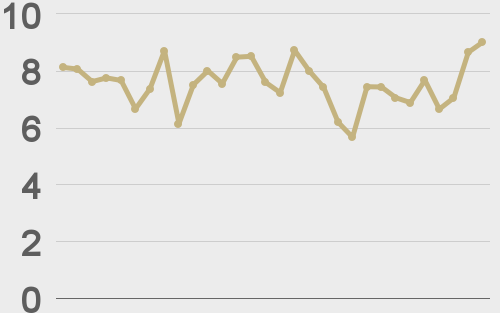

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

BTCTN |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||