|

|

| Bitcoin back below 200-day moving average |

| LMAX Digital performance |

|

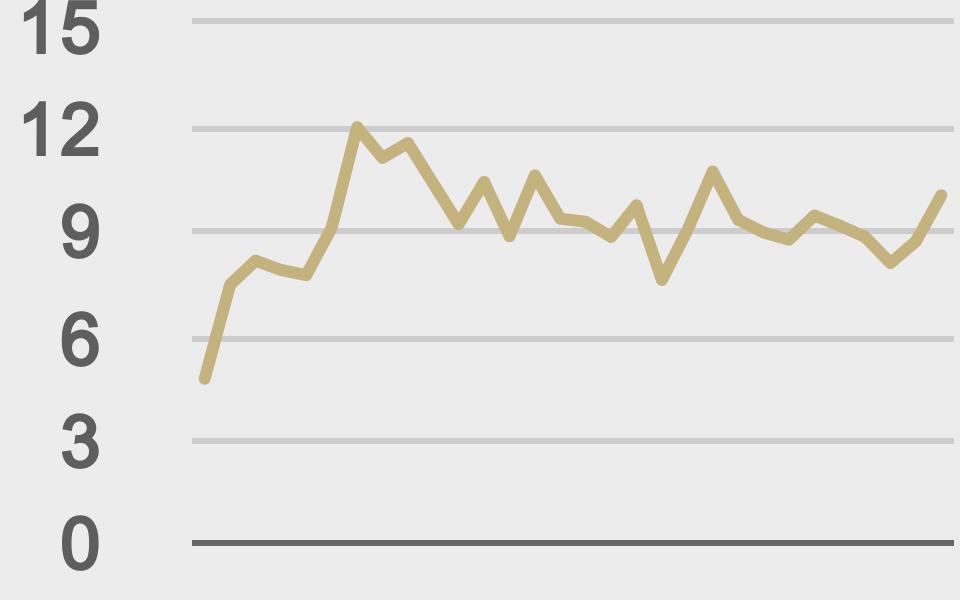

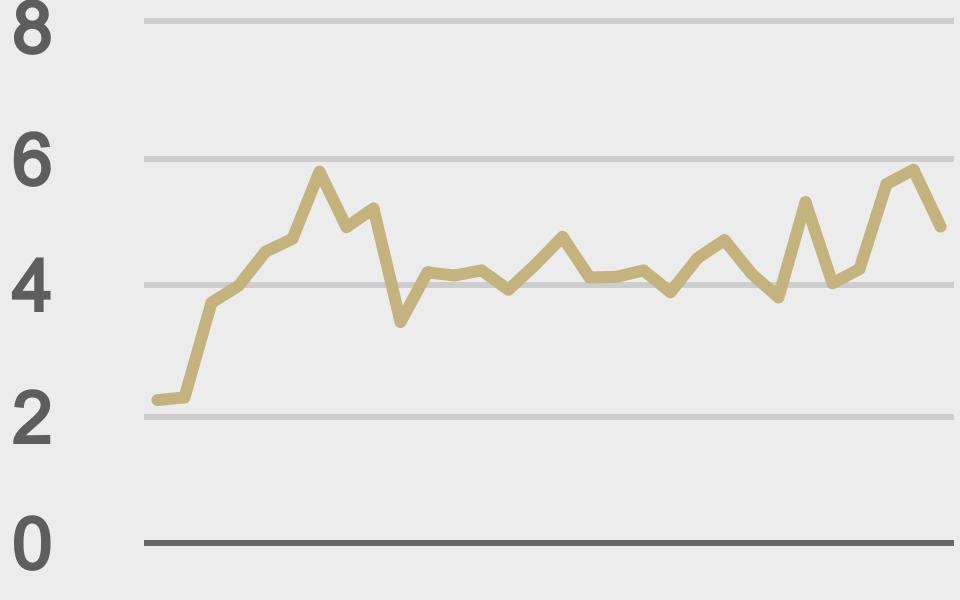

Total notional volume continues to shoot up in the month of August and we’re coming off yet another day of an easy clearance of the yard mark. On Wednesday, total notional volume came in at $1.28 billion, 11% above 30-day average volume. Volumes for bitcoin and ether were both up as well. Bitcoin volume came in at $709 million, 10% above 30-day average volume, and ether volume came in at $318 million, also 10% above 30-day average volume. Average trade sizes were trending well above 30-day averages as well on Wednesday. Bitcoin average trade size came in at $10,020, 10% above 30-day average trade size, while ether average trade size came in at $4,860, 14% above 30-day average trade size. |

| Latest industry news |

|

There has been some worry about recent price action, with bitcoin rolling over a bit and dipping back below the 200-day moving average. The price had pushed back above the indicator earlier this month, for the first time since mid-May, but has since dipped back below. Some of the headlines in the space over the past 24 hours are around shares of Robinhood tumbling after the company warned its Q2 revenue surge fueled by crypto may not last, a hack of a Japanese exchange, reports out of China around 11 companies operating illegal businesses, and Coinbase teaming up with MUFG to offer services in Japan. But the biggest story right now in our view, is the story around weakness in US equities. We could be reaching an inflection point where the Fed needs to be worrying more about inflation risk, which translates to moving away from a policy that is supportive of risk markets. And as things stand, at least over the shorter-term, bitcoin (and ether by extension) could be at risk of selling off in the event of a period of intensified risk liquidation in global markets. A lot of what has fueled demand for the asset class over the past several years has been an unprecedented risk on backdrop, and if this goes away, we should expect some selling. Of course, looking out medium and longer-term, bitcoin’s lure as a hedge against such downside risk, given its compelling economics, should shine through, ultimately resulting in a very well supported asset into any meaningful dips. |

|

LMAX Digital metrics |

||||

|

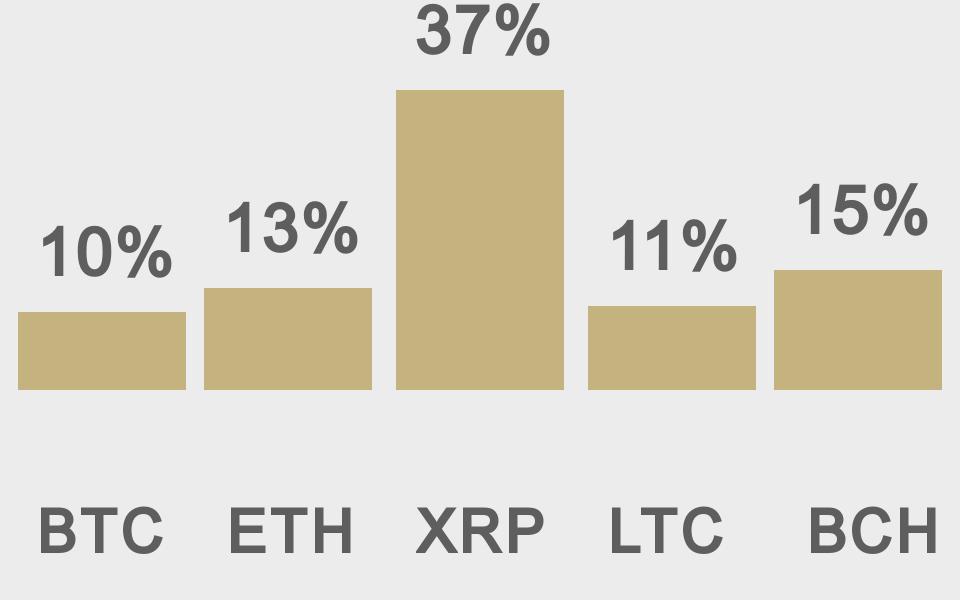

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

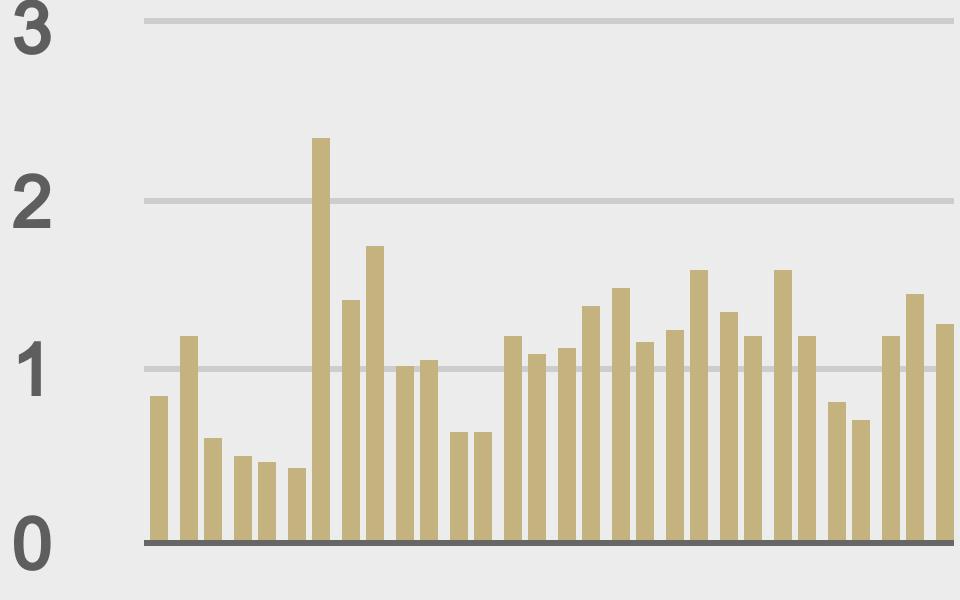

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

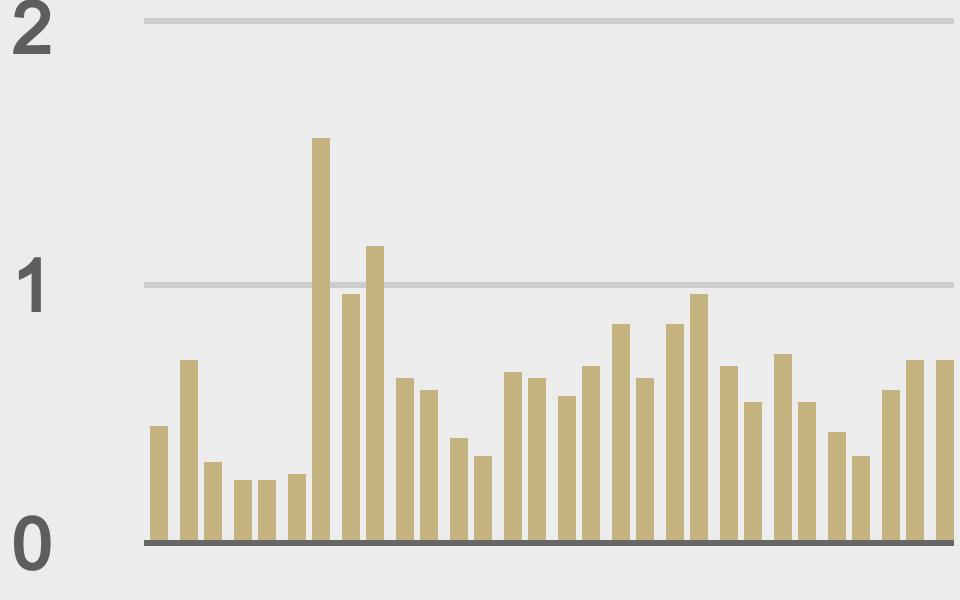

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@jack |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||