|

|

18 July 2023 Bitcoin bending….but hoping not to break |

| LMAX Digital performance |

|

LMAX Digital volumes were lighter to start the week. Total notional volume for Monday came in at $352 million, 6% below 30-day average volume. Bitcoin volume printed $184 million on Monday, 15% below 30-day average volume. Ether volume came in at $70 million, 29% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,082 and average position size for ether at 2,875. Volatility has been trending lower in July after an impressive run up in June. We’re looking at average daily ranges in bitcoin and ether of $859 and $62 respectively. |

| Latest industry news |

|

We continue to hear about option expiries in the price of bitcoin at $30,000, which have been hanging around for much of this month. As per our technical insights, the market remains confined to a consolidation while above the June 30 low at $29,420. There has however been a wave of downside pressure within the consolidation resulting in a move back towards consolidation support. We believe this has been brought on by tension around the SEC and the latest comments from SEC Chair Gensler in reaction to the Ripple decision. On Monday, the SEC Chair was out expressing his disappointment with the court ruling that there was no violation of securities law with respect to retail investors. The ruling was seen as a victory for the space, though Gensler’s comments have raised some fear there will be an appeal to reverse the decision. Gensler also declined to answer a question about what more would be needed for the SEC to approve a bitcoin ETF, something the market is very much hoping will finally get the green light. If not, we suspect we could indeed see a wave of sell-stops triggered. As far as today goes, we recommend keeping an eye on that consolidation support at $29,420. Should the market hold up above the level on a daily close basis, we will consider the consolidation intact. If however we close below the level, it could open the door to a period of weakness back down towards $25,000. Correlations with risk on flow have not been relevant in recent sessions, with crypto under pressure despite higher US equities. But we do worry that this correlation could be more relevant in risk off flow, where a turnaround in US equities could be something that weighs on crypto. Again, for the time being the best barometer is that $29,420 support in bitcoin. We’ll keep an eye on the level for an indication of where things stand. |

| LMAX Digital metrics | ||||

|

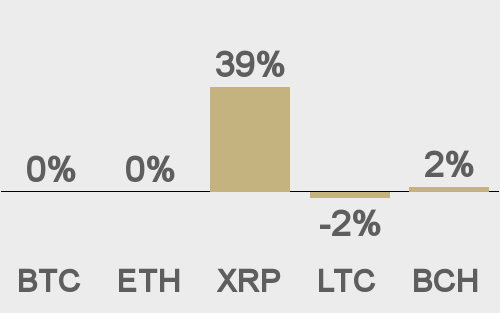

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

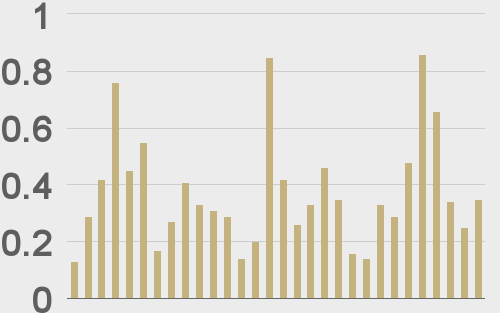

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

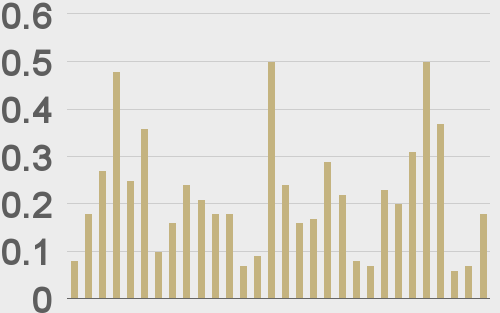

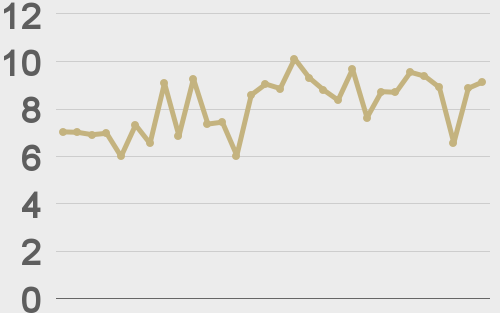

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

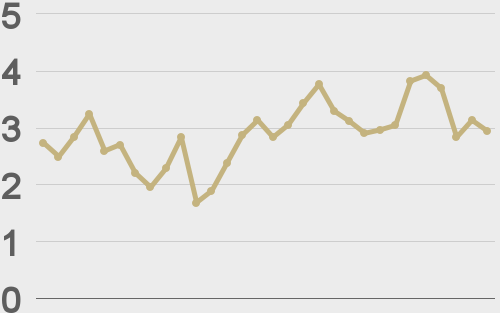

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@markets |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||