|

|

29 May 2023 Bitcoin breaks higher in thin trading session |

| LMAX Digital performance |

|

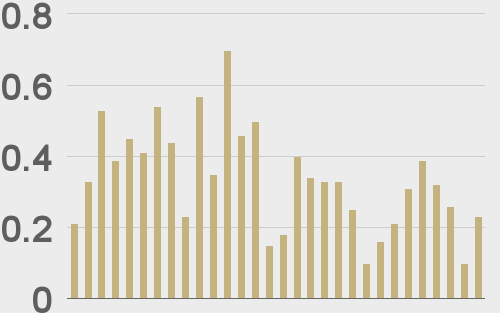

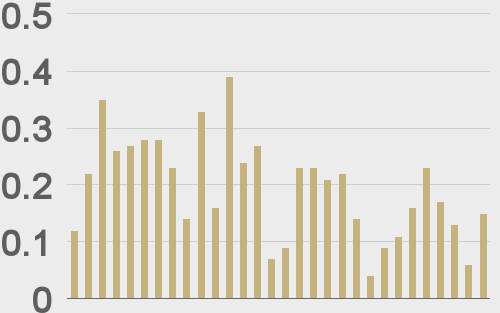

Total notional volume at LMAX Digital cooled off in the previous week, though there was exception with respect to Ether. Total notional volume from last Monday through Friday came in at $1.5 billion, 11% lower than the week earlier. Breaking it down per coin, Bitcoin volume came in at $803 million in the previous week, 22% lower than the week earlier. Ether volume however impressed, coming in at $471 million, 25% higher than the week earlier. Total notional volume over the past 30 days comes in at $10.2 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,464 and average position size for ether at $2,759. Volatility has come back down after recently trading up to yearly high levels. We’re looking at average daily ranges in bitcoin and ether of $843 and $58 respectively. |

| Latest industry news |

|

The crypto market has seen a healthy pullback in volatility in recent weeks after volatility had run up to a yearly high. This pullback has unsurprisingly coincided with a bout of consolidation. But as the new week gets going, we are seeing signs of a potential break of the bigger picture consolidation being broken after bitcoin took out some short-term consolidation resistance. What this does is open the door to the possibility the market could be getting ready for that next major bullish breakout beyond the yearly high. Fundamentally, the catalyst for the latest jump seems to be coming from the news of a US debt deal being reached. This means market optimism is once again translating to higher crypto prices. But at this stage, we wouldn’t want to make to much of the latest upside break, especially with the move coming in a long weekend holiday in the US. Trading conditions are quite a bit thinner than normal on this Monday and the latest moves certainly need to be taken with a grain of salt. Having said that, the price action is constructive and could be warning of the start to a bigger move. We think the market will be getting back to focusing on monetary policy updates and regulatory headlines from the crypto front, which could produce the type of catalyst needed to open a more meaningful and sustainable rally. |

| LMAX Digital metrics | ||||

|

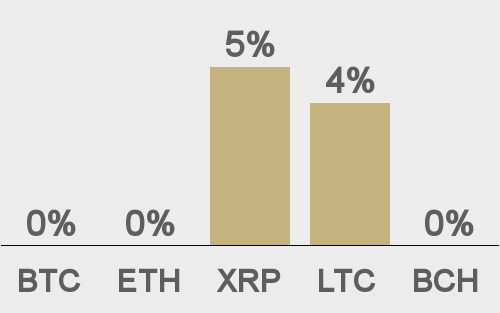

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

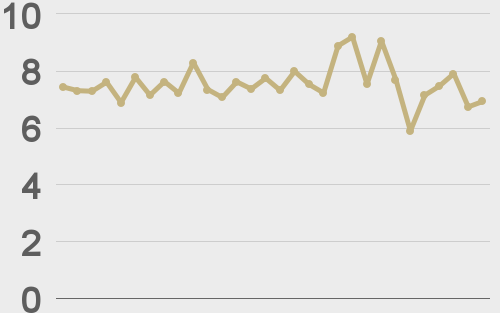

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

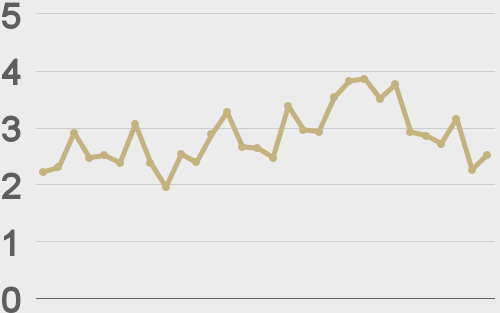

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@CoinDesk |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||