|

|

27 November 2023 Bitcoin confined to bullish channel |

| LMAX Digital performance |

|

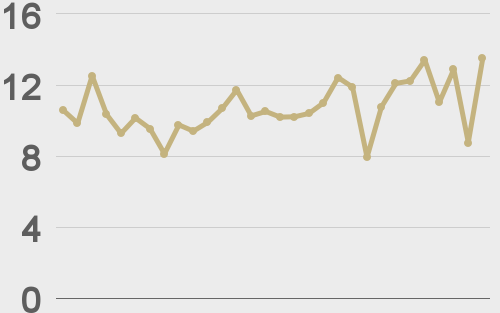

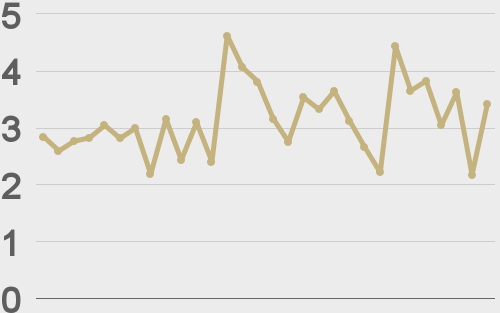

Total notional volume at LMAX Digital continues to trend higher in 2023. Total notional volume from last Monday through Friday came in at $3.3 billion, 14% higher than the week earlier. Breaking it down per coin, bitcoin volume came in at $2.3 billion in the previous week, 26% higher than the week earlier. Ether volume came in at $793 million, 4% higher than the week earlier. Total notional volume over the past 30 days comes in at $12.4 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,181 and average position size for ether at $3,341. Volatility has cooled off in recent sessions after stalling out ahead of yearly high levels. We’re looking at average daily ranges in bitcoin and ether of $1,142 and $75 respectively. |

| Latest industry news |

|

Market conditions are expected to get back to fuller form as the US returns from holiday break. As things stand, crypto assets remain exceptionally well supported into dips and continue to trend higher. If we look at the bitcoin technicals, the price has been confined to a bullish channel over the past several days, which suggests any setbacks should find demand ahead of $36k in favor of the next upside extension to fresh yearly highs and through $40k. Deal flow into the digital asset space did drop off in the previous week, though this was to be expected given the shortened holiday week. The most notable deal was Ethereum Layer 2 Blast, with its $20 million funding round led by Paradigm and Standard Crypto. A recent JP Morgan report has fueled more optimism after highlighting a significant number of Grayscale Bitcoin Trust shares have been bought in the secondary market this year in anticipation the trust’s conversion to an ETF will be approved by the SEC. Year-to-date, crypto asset performance is shining, with bitcoin up over 125% and ether up over 71%. Looking ahead, we think it will be interesting to keep an eye on the price of gold, which has just jumped up back above $2k and to its highest level since May. Upside pressure here could very well translate to more demand for bitcoin. |

| LMAX Digital metrics | ||||

|

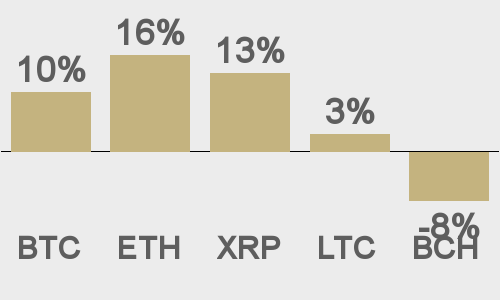

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

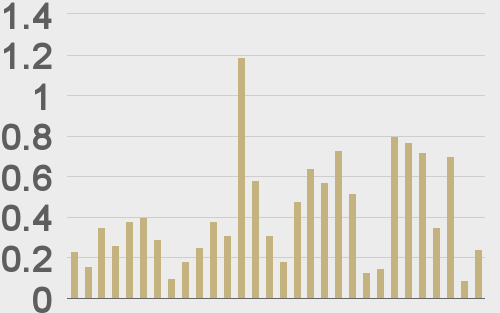

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

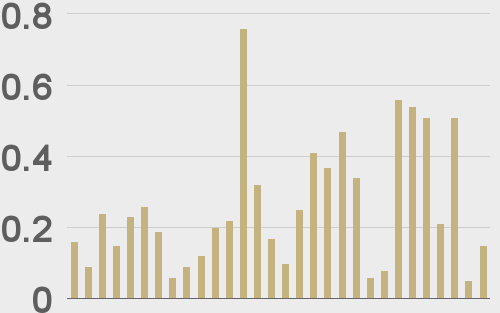

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||