|

|

6 November 2023 Bitcoin correlations making more sense |

| LMAX Digital performance |

|

Total notional volume at LMAX Digital cooled off in the previous week, though this was to be expected following an explosive week. Total notional volume from last Monday through Friday came in at $1.7 billion, 44% lower than the week earlier. Breaking it down per coin, bitcoin volume came in at $1.1 billion in the previous week, 48% lower than the week earlier. Ether volume came in at $370 million, 44% lower than the week earlier. Total notional volume over the past 30 days comes in at $8.8 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,947 and average position size for ether at $2,753. Volatility has settled down in recent sessions after surging in October. We’re looking at average daily ranges in bitcoin and ether of $1,032 and $57 respectively. |

| Latest industry news |

|

We’ve highlighted bitcoin’s closer correlation to gold of late. There have been many out there who have been more comfortable trying to correlate bitcoin with risk assets, though this is not an accurate relationship. We concede there could be demand for bitcoin in periods of risk on, with the crypto asset benefiting from those who still view it as a maturing, emerging asset. But overall, there has been a lot less of this of late, particularly as we move towards more acceptance and adoption. And indeed, what we’ve seen in recent sessions is more consolidation similar to that of gold, following some impressive moves to the topside in reaction to ongoing inflation worry and the emergence of geopolitical stress. The correlation with gold is ultimately more accurate when considering bitcoin’s properties, which make it much more in line with a store of value asset than a risk asset. As far as industry specific updates go, the crypto market has been pleased with the latest earnings results from Coinbase, which showed reduced losses in the third quarter despite a downturn in trading volume. Technically speaking, bitcoin setbacks are expected to be exceptionally well supported on dips towards $30,000, with the next upside extension underway and targeting a measured move extension target in the $40,000 area. |

| LMAX Digital metrics | ||||

|

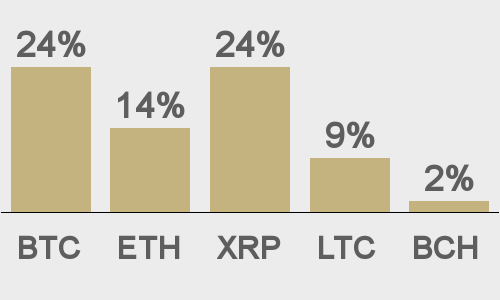

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

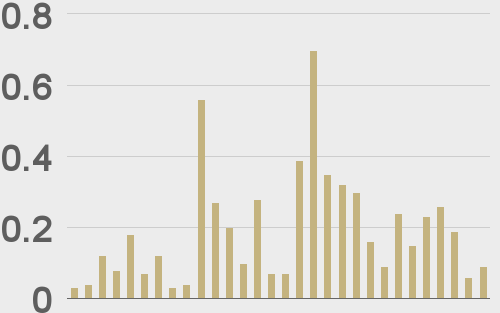

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

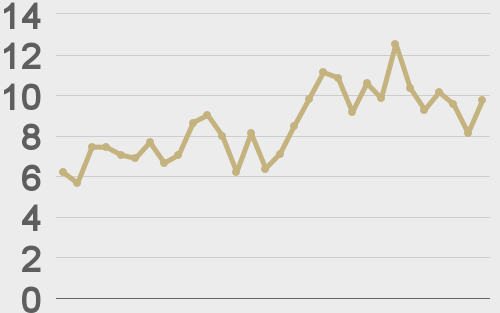

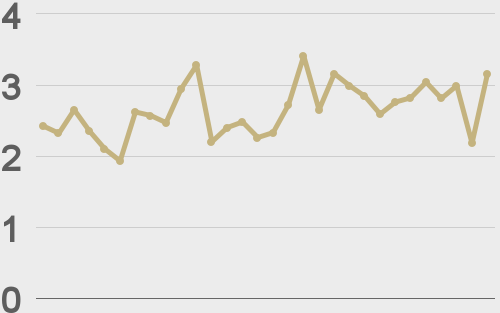

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||