|

|

22 April 2025 Bitcoin decouples from slumping stocks |

| LMAX Digital performance |

|

LMAX Digital volumes got off to a solid start this week. Total notional volume for Monday came in at $575 million, 33% above 30-day average volume. Bitcoin volume printed $360 million, 60% above 30-day average volume. Ether volume came in at $102 million, 33% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,025 and average position size for ether at $2,105. Volatility has calmed down for bitcoin and ETH in recent days, tracking at the lower bounds of multi-day ranges. We’re looking at average daily ranges in bitcoin and ether of $3,094 and $103 respectively. |

| Latest industry news |

|

Bitcoin continues to demonstrate resilience, holding steady despite a volatile macro landscape. Crypto market participants will be pleased to see a notable decoupling from equities, breaking a historical correlation with indices like the S&P 500. Over the past week, while U.S. equities have faced consistent downward pressure from trade uncertainties and inflation fears, bitcoin has held firm, climbing toward $90,000. This divergence suggests bitcoin is increasingly viewed as a distinct asset class, less tethered to traditional markets and more aligned with its role as a hedge against macroeconomic risks like US Dollar volatility and stagflation. This shift should attract new capital seeking non-correlated assets, which will further amplify bitcoin’s overall appeal. As per our Monday update, corporate adoption continues to fuel optimism as well. This has been highlighted by initiatives at Strategy, with well over $40 billion in bitcoin holdings, and Japan’s Metaplanet, now at about $400 million in bitcoin holdings. These moves underscore bitcoin’s growing role as a treasury asset. On the macro front, U.S.-China trade tensions, persist. Yet, hopes for softer tariff policies have supported bitcoin’s recent strength. Moreover, the Trump administration’s crypto-friendly moves have also bolstered sentiment. |

| LMAX Digital metrics | ||||

|

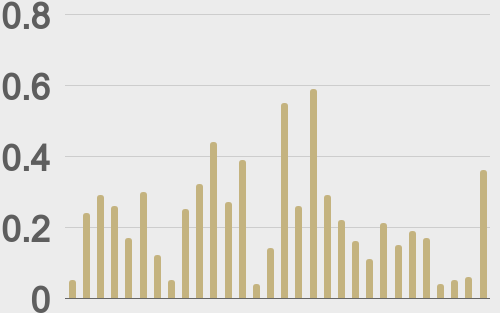

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

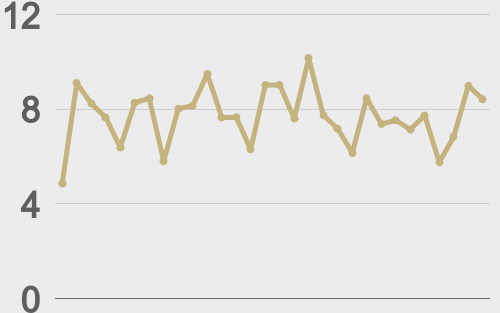

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||