|

|

25 June 2024 Bitcoin finally drops into major support zone |

| LMAX Digital performance |

|

LMAX Digital volumes kicked off the new week on a strong note. Total notional volume for Monday came in at $772 million, 118% above 30-day average volume. Bitcoin volume printed $404 million on Monday, 132% above 30-day average volume. Ether volume came in at $292 million, 114% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,951 and average position size for ether at $4,372. Market volatility is showing signs of wanting to turn back up after declining since March. We’re looking at average daily ranges in bitcoin and ether of $2,006 and $133 respectively. |

| Latest industry news |

|

There is nothing surprising about bitcoin’s recent price decline. We’ve come through a period of spectacular outperformance and it’s only natural to see price corrections after aggressive moves. Q2 2024 has been about a market that has already digested a flurry of positive headlines around ETFs, the halving event, and wider adoption, and a market that is taking a breather ahead of the next big wave of positive catalysts. Indeed, we believe as the ETH ETFs go live, there will be another nice injection of liquidity into crypto assets, which should invite additional support to bitcoin. We also believe we should expect more signs of adoption from major players in the traditional financial markets. The acceptance of crypto in 2024 will shed further light on the many advantages the asset class and underlying technology have to offer, including access to liquid markets on a 24 hour a day, 7 day a week basis. As far as recent weakness goes, one story getting attention in recent weeks is the story around the Mt. Gox repayments. In a letter to creditors, the rehabilitation trustee outlined preparations for distribution and payment of bitcoin from the beginning of July. Mt. Gox has approximately $8.6 billion worth of bitcoin to distribute between now and the end of October, and we believe the market has been pricing the event in throughout this second quarter of 2024. We suspect this also should mean that with the event being priced in, there should be little additional downside from this risk when the distributions actually get going. |

| LMAX Digital metrics | ||||

|

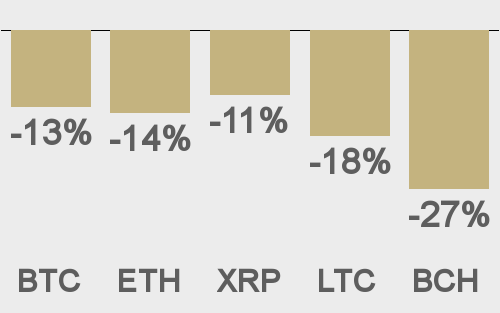

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

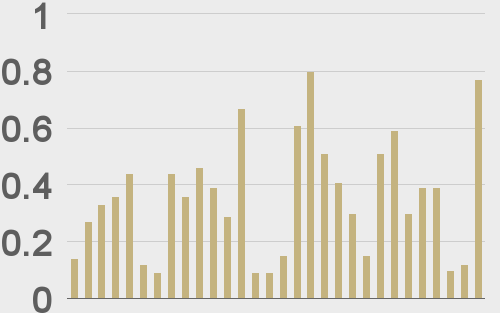

Total volumes last 30 days ($bn) |

||||

|

||||

|

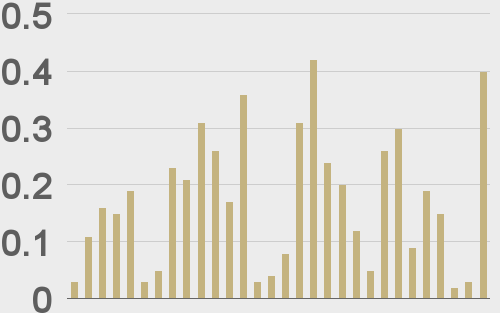

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

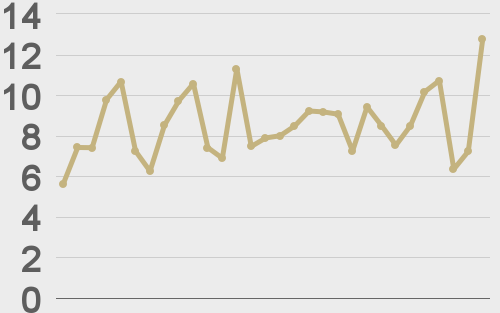

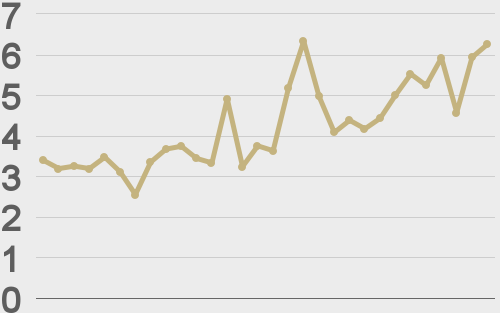

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||