|

|

26 July 2022 Bitcoin has its eye on the Fed decision |

| LMAX Digital performance |

|

LMAX Digital volumes got off to a decent start this week. Total notional volume for Monday came in at $363 million, just 4% below 30-day average volume. Bitcoin volume printed $197 million on Monday, 21% below 30-day average volume. Ether volume came in at $127 million, 33% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $6,191 and average position size for ether at 2,280. Volatility has been showing signs of picking up off yearly lows. We’re looking at average daily ranges in bitcoin and ether of $1,240 and $124 respectively. |

| Latest industry news |

|

There hasn’t been a whole lot in the way of activity this week, and the price action we’re seeing is more reflective of consolidation ahead of event risk than anything else. We have seen some mild selling of US equities in recent sessions, which has also been factoring into some of the pullback in crypto that we’ve been seeing. But it really does feel like it’s all about positioning ahead of tomorrow’s FOMC decision. As things stand, if the Fed delivers a rate hike of 75 basis points or less, it should be supportive of crypto assets. Technically speaking, if the recent broader recovery in crypto is going to hold up, we will need to see bitcoin hold above $20,000 into this dip. Back above $24,300 will help to strengthen the outlook. |

| LMAX Digital metrics | ||||

|

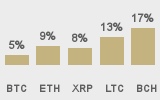

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

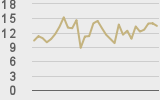

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||