|

|

6 February 2024 Bitcoin holding up well all things considered |

| LMAX Digital performance |

|

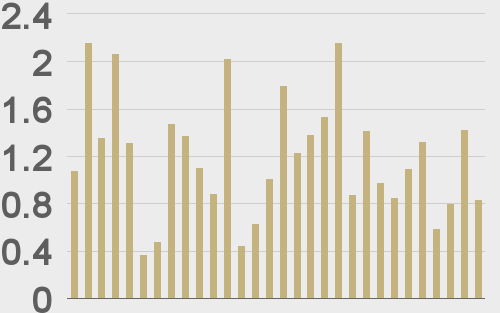

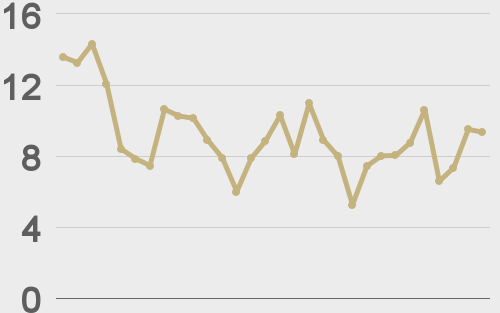

LMAX Digital volumes were quite soft on Monday as the market continued to consolidate in tight ranges. Total notional volume for Monday came in at $279 million, 51% below 30-day average volume. Bitcoin volume printed $172 million on Monday, 57% below 30-day average volume. Ether volume came in at $73 million, 33% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,625 and average position size for ether at $3,410. Volatility has come down by about 40% since peaking at multi-month highs in January. We’re looking at average daily ranges in bitcoin and ether of $1,360 and $81 respectively. |

| Latest industry news |

|

Bitcoin hasn’t been moving much of late, though the ability for the market to hold up well above $40k could be viewed as a positive, especially in the face of recent developments that could argue for a lower price. We’ve already highlighted resilience in the bitcoin price amidst a wave of broad based US Dollar demand in the aftermath of a less dovish Fed decision and strong US jobs report. On the crypto front, there have been other headlines bitcoin has done a good job contending with. One such headline comes from bankrupt crypto lender Genesis. The company filed a motion this past Friday asking a US judge to approve the sale of over $1.6 billion bitcoin and other crypto assets. The fact that the market is now aware of this and bitcoin remains supportive is arguably quite constructive. Another potentially market weighing headline comes from renewed critique of stable coin Tether. The stable coin has come under pressure on a routine basis over the years on account of its less than transparent operations. JP Morgan is the latest to come out expressing concern over USDT dominance and the negative impact it could have on the crypto ecosystem. But overall, we think the driving force that will continue to support bitcoin and crypto assets in 2024, is the move to mainstream adoption on the back of the SEC bitcoin ETF approvals. This upside from this breakthrough should more than offset any negative drivers. |

| LMAX Digital metrics | ||||

|

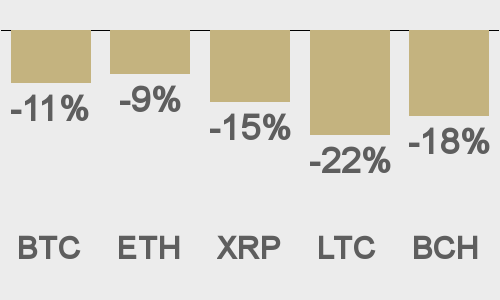

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

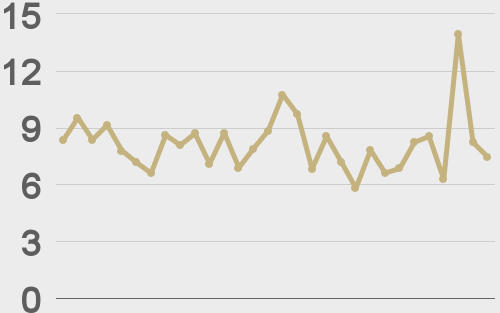

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||