|

|

19 July 2023 Bitcoin holding within well defined consolidation |

| LMAX Digital performance |

|

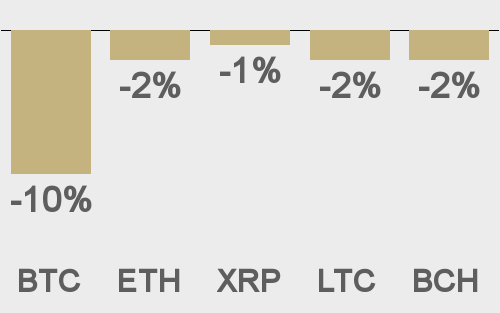

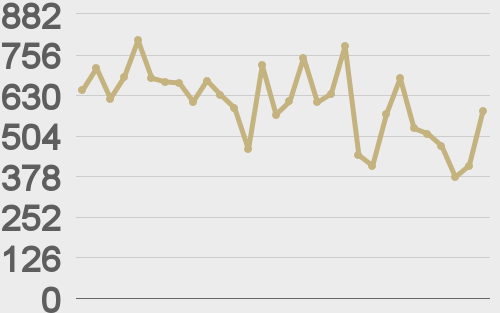

LMAX Digital volumes were rather light on Tuesday, though this could easily be reconciled by the fact that the market remains confined to a tight consolidation. Total notional volume for Tuesday came in at $290 million, 24% below 30-day average volume. Bitcoin volume printed $181 million on Tuesday, 18% below 30-day average volume. Ether volume came in at $65 million, 35% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,121 and average position size for ether at 2,877. Volatility has been trending lower in July after an impressive run up in June. We’re looking at average daily ranges in bitcoin and ether of $815 and $58 respectively. |

| Latest industry news |

|

We continue to highlight a well defined consolidation in the price of bitcoin which has yet to break despite recent downside pressure. And while this consolidation holds up into support, we retain a short-term constructive outlook. Should consolidation support break with a daily close back below $29,420, it would negate the short-term constructive outlook and open the door for a deeper correction back down towards the $25,000 area. Fundamentally, the combination of hope for an approval of a bitcoin ETF and ongoing yearly highs in US equities have helped to keep the price of bitcoin and other crypto assets well supported in recent days. The SEC has initiated its review of BlackRock’s updated application for a bitcoin ETF, and if approved, we believe it will indeed serve as a catalyst for a bullish break of consolidation, with the move seen opening the door for a push to fresh yearly highs. At the same time, while softer inflation reads out of the US have inspired a risk on reaction, we do worry that US equities have run a little too far and fast, which could expose crypto assets to vulnerability should we see a sharp turnaround in stocks and global sentiment. Ideally, there is a place for bitcoin to rally in a world where stocks are declining, given its value proposition as a store of value asset. But we’re not sure we’re there just yet in terms of the world recognizing this value over still considering bitcoin to be a emerging, maturing, and thereby risk correlated asset. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||