|

| 4 June 2025 Bitcoin holds firm above $100k despite market jitters |

| LMAX Digital performance |

|

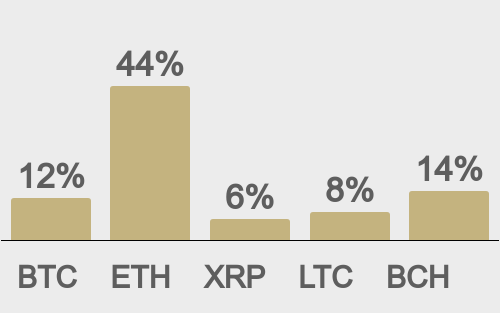

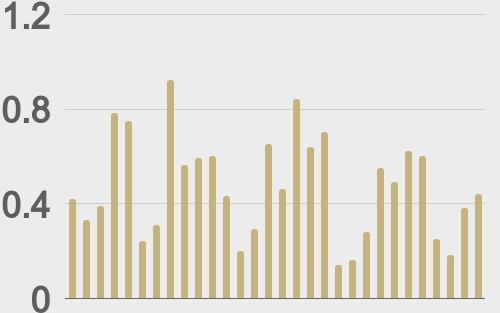

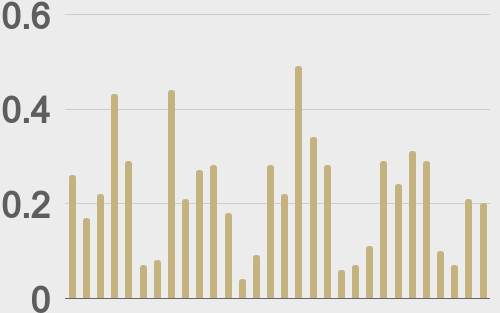

LMAX Digital volumes improved from Monday levels but were still a little below average. Total notional volume for Tuesday came in at $441 million, 7% above 30-day average volume. Bitcoin volume printed $198 million, 10% below 30-day average volume. Ether volume came in at $124 million, 6% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $10,541 and average position size for ether at $3,254. Bitcoin volatility continues to be rather subdued, just off recent yearly low levels, while ETH volatility is consolidating after trending up from its yearly low in May. We’re looking at average daily ranges in bitcoin and ether of $2,628 and $127 respectively. |

| Latest industry news |

|

Bitcoin continues to show its resilience, holding well above the psychological $100,000 level. Growing institutional demand, evidenced by a notable pickup in corporate bitcoin treasuries, is helping to reinforce bitcoin’s appeal as a strategic reserve asset. Meanwhile, ETH has been the standout outperformer, driven by sustained institutional interest and positive sentiment around potential network upgrades. We have however seen some headwinds from broader market dynamics, with US listed spot Bitcoin ETFs recording a third day of net outflows, while options on BlackRock’s iShares Bitcoin Trust (IBIT) show a bias toward puts, signaling downside fears. At the same time, these outflows and cautious sentiment have been offset by bitcoin’s on-chain whale accumulation. In traditional markets, the OECD’s downward revision of global growth forecasts has been getting some attention. These macroeconomic pressures, combined with escalating U.S.-China trade tensions and looming tariff hikes, contribute to market uncertainty, which take away from some of the upside in crypto right now. Overall, as markets navigate these crosscurrents, bitcoin and ETH are likely to remain range-bound, with investors closely monitoring upcoming US economic data, for further clues on Federal Reserve policy and global trade impacts. |

| LMAX Digital metrics | ||||

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

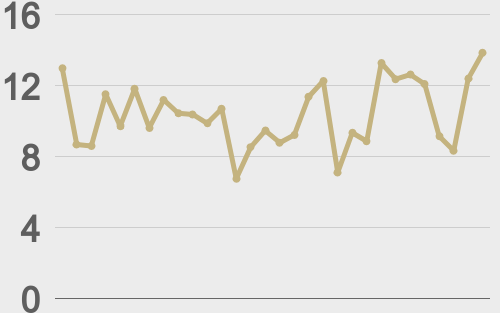

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

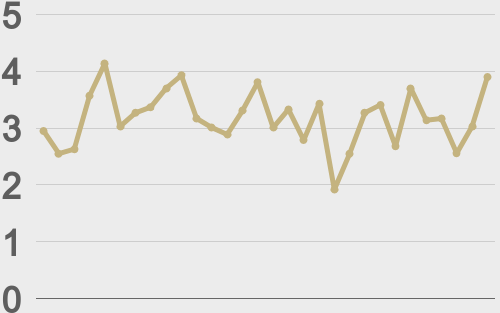

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||