|

| 29 May 2025 Bitcoin holds firm, ETH on the move |

| LMAX Digital performance |

|

LMAX Digital volumes held up well on Wednesday. Total notional volume for Wednesday came in at $487 million, 10% above 30-day average volume. Bitcoin volume printed $241 million, 17% above 30-day average volume. Ether volume came in at $116 million, 7% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $10,107 and average position size for ether at $2,880. Bitcoin volatility continues to be rather subdued, just off recent yearly low levels, while ETH volatility has picked up since bottoming out earlier this month. We’re looking at average daily ranges in bitcoin and ether of $2,886 and $144 respectively. |

| Latest industry news |

|

Bitcoin remains robust in the latter half of the week, consolidating just below its recent peak while steadfastly holding above $100,000 for 20 consecutive days, underscoring persistent bullish momentum. Meanwhile ETH has taken the spotlight as it soars to its highest level since February, driven by vibrant DeFi activity, corporate interest, and institutional staking. CoinDesk notes the $300,000 BTC call option for June 27 as the leading wager, with $600 million in notional open interest and active strikes at $115,000, $125,000, and $150,000, reflecting strong market confidence. Institutional embrace, including Trump Media’s $2.5 billion bitcoin treasury allocation and supportive U.S. crypto legislation, provides solid support near $106,700. Global political tailwinds enhance crypto optimism, with U.S. Vice President J.D. Vance and Eric Trump addressing the Bitcoin Conference 2025 in Las Vegas, signaling robust bipartisan backing for digital assets. The U.S. Court of International Trade’s ruling deeming Trump’s tariffs illegal has alleviated stagflation concerns, bolstering equities and crypto by easing pressures on corporate margins and consumer prices, though the administration’s appeal and the approaching “Liberation Day” tariff deadline may introduce volatility. Overall, the outlook remains highly positive, particularly as ETH gains traction, showing signs of reversing its multi-month downtrend against bitcoin. This shift toward ETH outperformance highlights broadening interest across the crypto market, a trend we explore in our weekly chart overview. |

| LMAX Digital metrics | ||||

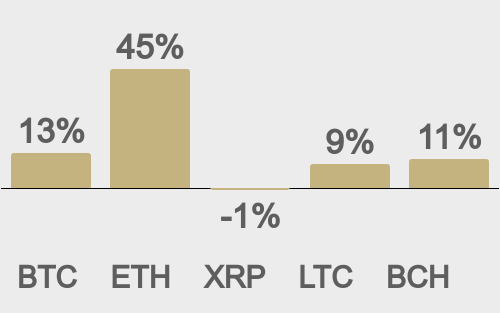

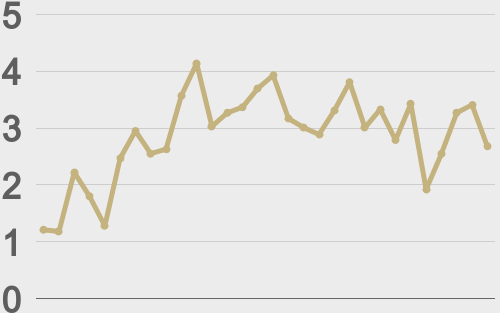

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

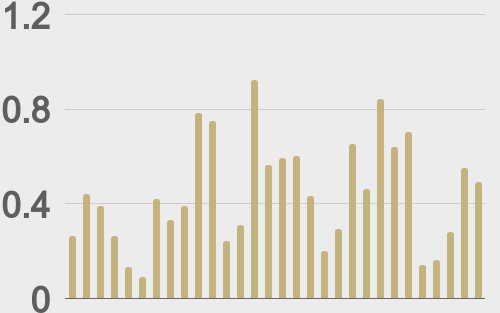

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

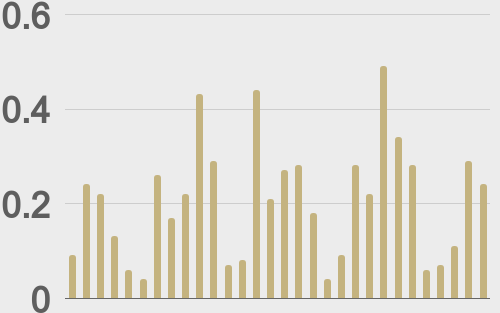

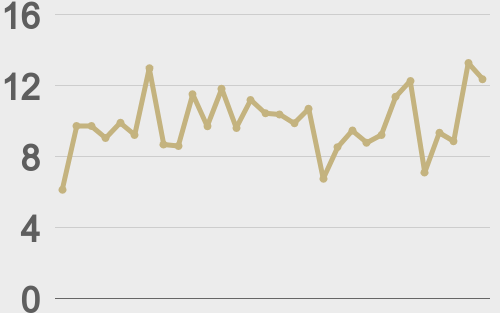

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||