|

|

24 April 2025 Bitcoin more about currencies than stocks |

| LMAX Digital performance |

|

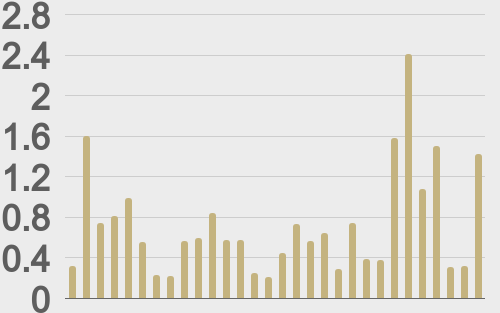

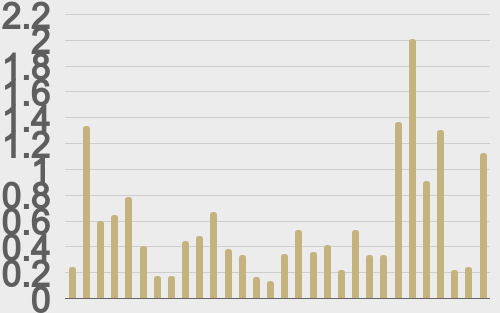

LMAX Digital volumes were impressive on Wednesday. Total notional volume for Wednesday came in at $857 million, 84% above 30-day average volume. Bitcoin volume printed $503 million on Wednesday, 106% above 30-day average volume. Ether volume came in at $171 million, 109% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,144 and average position size for ether at $2,002. Volatility is tracking at the lower end of multi-day ranges. We’re looking at average daily ranges in bitcoin and ether of $3,289 and $109 respectively. |

| Latest industry news |

|

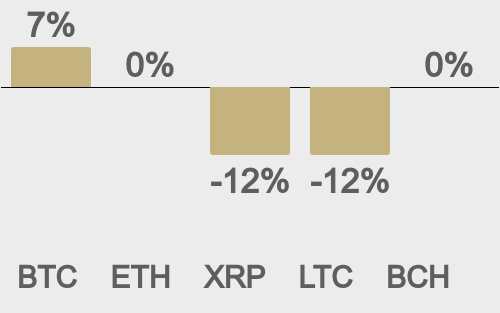

Bitcoin has recently shown a stronger correlation with currency market movements than with US equities. While stocks have faced challenges, bitcoin has surged alongside other currencies, rallying against the US dollar. Over the past 30 days, bitcoin’s performance (+7.11%) trails only gold (+9.77%), outpacing all major currencies, while the S&P 500 has declined by over 7%. Growing concerns about the US dollar’s outlook, driven by potential policy shifts under the new US administration, are fueling a shift away from dollar exposure. Bitcoin remains an attractive alternative to the US dollar, bolstered by its store-of-value properties and increasing mainstream adoption. On Wednesday, bitcoin surpassed Google to rank among the top five global assets, and it seems poised to overtake Google and Nvidia to secure a top-three position. What makes bitcoin particularly compelling is its perception as a maturing yet still-emerging market. This duality positions it to rally during risk-off periods as a store of value and during risk-on periods as a technology representing the future of money. Looking ahead, markets will closely monitor US administration policies and Federal Reserve actions. Despite signs of the President softening his trade stance, uncertainty persists about the US economy’s trajectory. Pressure is mounting on the Fed to cut rates more aggressively, which could trigger broader US dollar outflows. Traditional financial markets are increasingly wary of US equities, with fears of deeper setbacks driven by unpredictable policies, inflation concerns, geopolitical risks, and limited monetary policy options. However, we believe bitcoin and cryptocurrencies are well-positioned to outperform, even if stocks continue to decline. The transformative potential of bitcoin and blockchain technology is simply too compelling to overlook. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

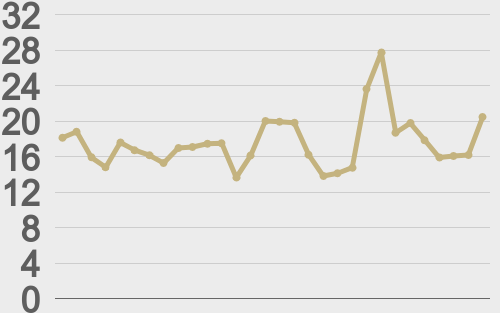

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

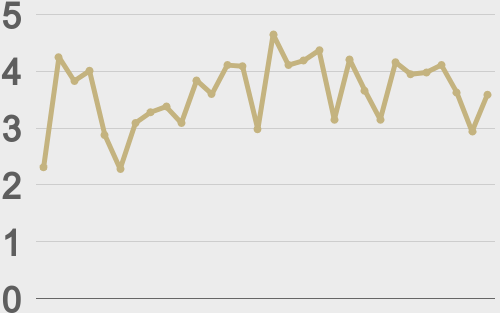

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BitcoinMagazine |

||||

|

@CoinDesk |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||