|

|

2 November 2023 Bitcoin network more secure than ever |

| LMAX Digital performance |

|

LMAX Digital volumes picked back up nicely on Wednesday following a Tuesday hiccup. Total notional volume for Wednesday came in at $375 million, 28% above 30-day average volume. Bitcoin volume printed $229 million on Wednesday, 18% above 30-day average volume. Ether volume came in at $92 million, 31% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,747 and average position size for ether at $2,725. Volatility has settled down in recent sessions after breaking to the topside, out from multi-week lows. We’re looking at average daily ranges in bitcoin and ether of $1,092 and $57 respectively. |

| Latest industry news |

|

Bitcoin has rallied to yet another yearly high today, continuing to show a desire to extend towards the next measured move extension objective in the $40,000 area. There are a couple of interesting things going on that further reflect the degree of bullishness in the market right now. The first comes from the options market, where put options on bitcoin are trading at a discount relative to historical standards. We suspect this discount won’t last much longer as it also translates to a cheaper price to hedge against downside risk. Nevertheless, the metric does reflect a market sentiment that is less concerned about downside risk at the moment, which is the key takeaway. The second thing going on is that bitcoin’s hashrate has traded up to a fresh record high. The hashrate is a reference for the computational power used by miners to validate and process transactions on the blockchain. A higher hashrate means a more secure bitcoin network, which ultimately means a more attractive asset. Moving on, there hasn’t been much of a reaction to the latest Fed decision, which on the whole, was taken to be more dovish leaning. As per our Wednesday report, we highlighted Fed event risk wasn’t likely to be a major factor given the fact that bitcoin has found a way to be bid up both on its store of value merit in times of risk off, and on its emerging market properties in times of risk on. In essence, whatever message was going to come from the Fed, was going to be a message that would give traders a reason to be wanting to increase exposure to bitcoin. |

| LMAX Digital metrics | ||||

|

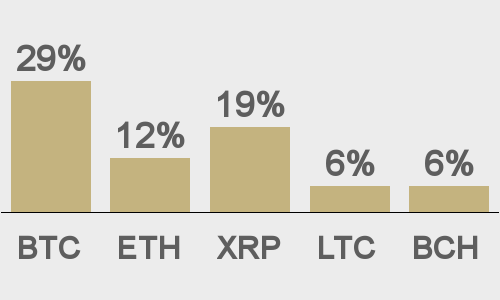

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

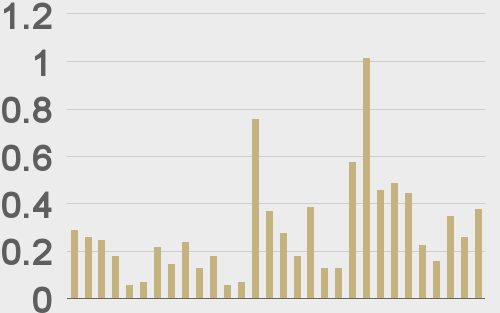

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

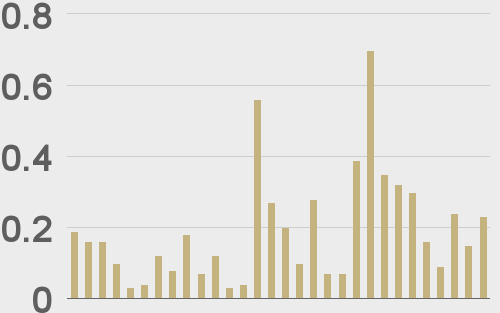

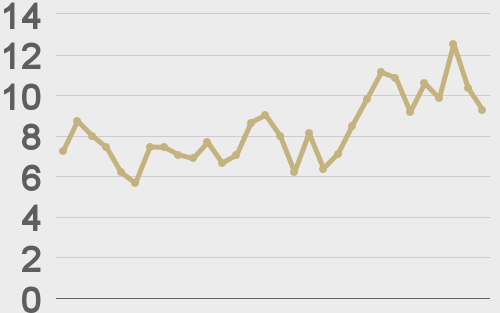

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

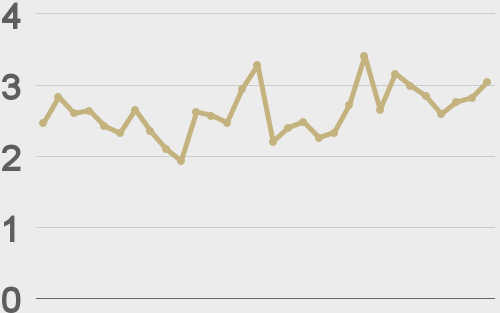

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||