|

| 10 July 2025 Bitcoin notches another record high |

| LMAX Digital performance |

|

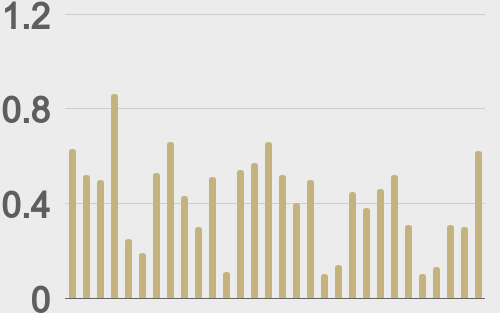

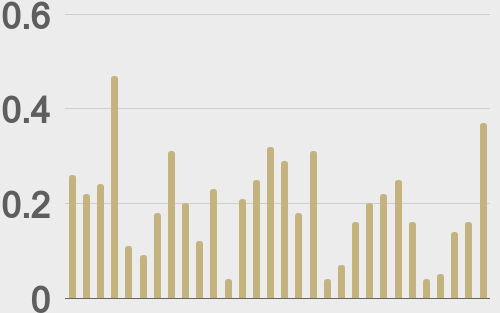

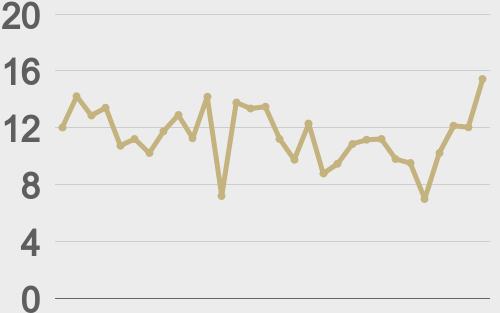

LMAX Digital volumes recovered nicely on Wednesday after a Tuesday dip. Total notional volume for Wednesday came in at $624 million, 49% above 30-day average volume. Bitcoin volume printed $368 million, 87% above 30-day average volume. Ether volume came in at $151 million, 45% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,900 and average position size for ether at $2,962. Bitcoin volatility is trading at the lowest level of the year, while ETH volatility has been contained since bottoming in May. We’re looking at average daily ranges in bitcoin and ether of $2,404 and $122 respectively. |

| Latest industry news |

|

Bitcoin managed to squeak out another record high on Wednesday, helped along by an ongoing healthy wave of demand from institutions and corporate treasuries. One of the largest crypto index fund managers in the US reported that corporate Bitcoin holdings surged by 60% in Q2, reaching a total of $91 billion. Corporates added 159,107 BTC last quarter alone, now worth approximately $17.7 billion—underscoring the persistent narrative of Bitcoin as a balance sheet asset and strategic reserve tool. This institutional activity continues to provide a floor for price action and reinforces bitcoin’s role as the market’s macro anchor. Meanwhile, ETH has taken the lead in price momentum, rallying off recent lows amid a pickup in derivatives activity and growing enthusiasm around its broader role in settlement and tokenization infrastructure. Traditional markets remain in a holding pattern ahead of next week’s US inflation data, with crypto markets tracking the global policy tone closely. Comments from US trade officials around commodity-linked tariffs—particularly on copper—have subtly reinforced Bitcoin’s use case as a strategic reserve asset in an increasingly protectionist world. For now, traders appear reluctant to chase breakouts until the macro fog clears, but underlying positioning remains skewed toward the upside. |

| LMAX Digital metrics | ||||

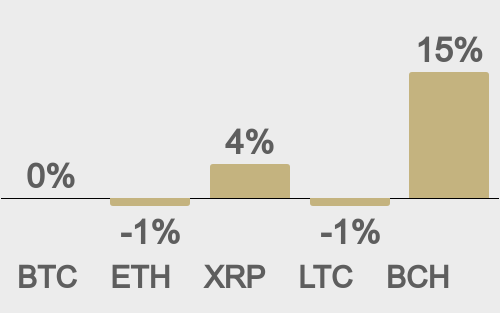

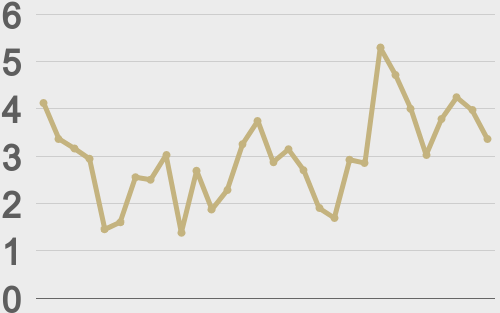

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||