|

|

14 April 2025 Bitcoin outpacing equities in shifting global landscape |

| LMAX Digital performance |

|

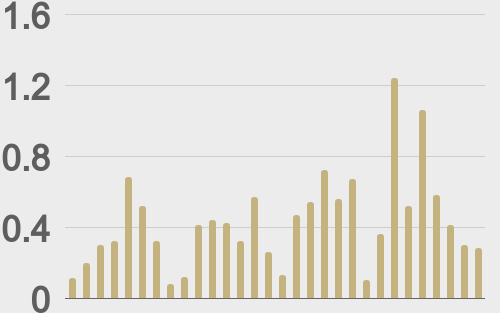

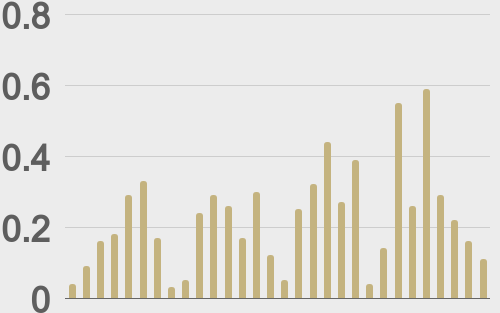

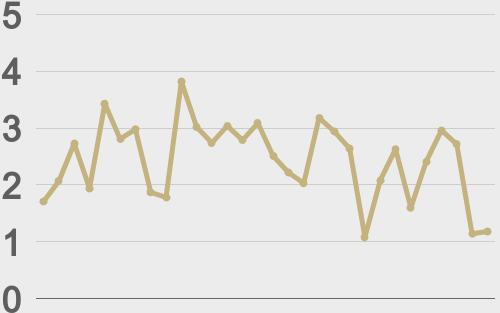

Total notional volume from last Monday through Friday came in at $3.8 billion, 28% higher than the week earlier. Breaking it down per coin, bitcoin volume came in at $1.9 billion, 31% higher than the previous week. Ether volume came in at $612 million, 54% higher than the week earlier. Total notional volume over the past 30 days comes in at $13 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,130 and average position size for ether at $2,374. Volatility has calmed down in recent days. We’re looking at average daily ranges in bitcoin and ether of $3,981 and $134 respectively. |

| Latest industry news |

|

Financial markets have shifted from tariff-driven volatility to a broader recovery in risk assets, including cryptocurrencies. With trade tensions subsiding, investor optimism has lifted equities and crypto, fostering a supportive backdrop for bitcoin and other digital assets. China’s move to limit retaliatory tariffs and avoid aggressive steps, such as targeting agricultural exports, signals a commitment to easing trade frictions. Meanwhile, President Trump’s more conciliatory tone toward President Xi hints at potential progress toward a June summit, further stabilizing sentiment. Bitcoin has shown resilience, outperforming U.S. equities during the trade war’s turbulence over the past 30 days. Performance data reflects bitcoin’s 3.47% rise against the U.S. dollar, compared to a 4.21% drop in the S&P 500, highlighting its value as a diversifying asset in uncertain times. Emerging skepticism toward the U.S. dollar’s outlook is also fueling bitcoin’s appeal. Pension funds in Europe, Canada, and China are scaling back U.S. exposure, while the U.S. Senate’s budget resolution—authorizing $5.3 trillion in tax cuts and a $5 trillion debt ceiling hike with minimal spending restraint—undermines the dollar’s structural stability. Technically speaking, bitcoin has done a formidable job bouncing out from a critical previous resistance turned support zone, setting the stage for the next major upside extension towards a retest and eventual break of the record high from earlier this year. |

| LMAX Digital metrics | ||||

|

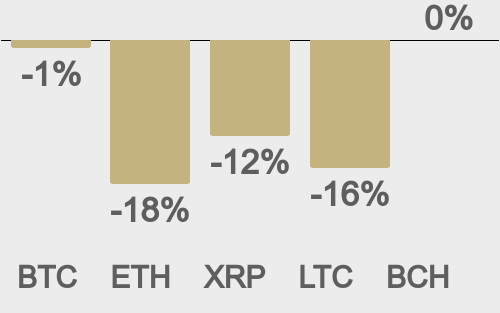

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@CoinDesk |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||