|

|

12 January 2023 Bitcoin rally arrives at important resistance |

| LMAX Digital performance |

|

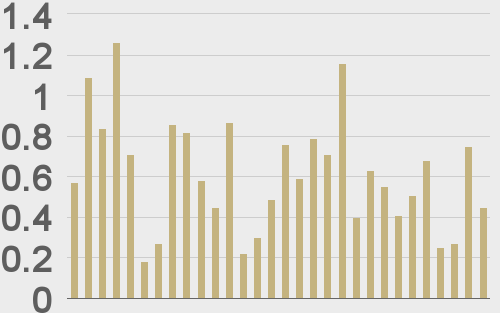

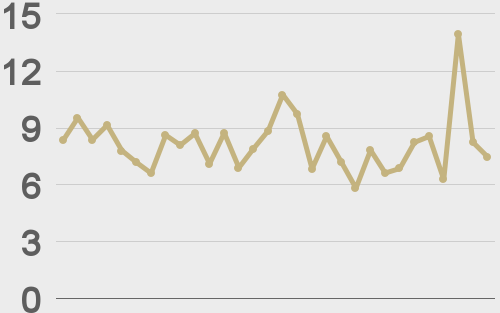

LMAX Digital volumes continue to trend higher into the latter half of the week. Total notional volume for Wednesday came in at $243 million, 23% above 30-day average volume. Bitcoin volume printed $134 million on Wednesday, 14% above 30-day average volume. Ether volume came in at $46 million, 4% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $4,547 and average position size for ether at 1,893. Volatility is still suppressed at multi-month lows, though we are seeing some signs of life. We’re looking at average daily ranges in bitcoin and ether of $336 and $39 respectively. |

| Latest industry news |

|

In today’s technical overview, we highlight the fact that the bitcoin rally has arrived at a critical juncture. Up until this point, the rally has been impressive. But now, bitcoin will need to make one more push to officially transition into uptrend mode on the daily chart. We isolate $18,500 as the level to watch, with a daily close above to encourage fresh bullish momentum. All of this comes at a time when we are likely to find out if we will indeed get that push. Today’s US CPI data has been the headline event of the week and how this data comes out will determine, at least in the short-term, if we are about to see a trend shift. If the CPI read comes out below or even as expected, we see this opening the door for another push higher into uptrend mode. A softer or as expected result will force yield differentials out of the US Dollar’s favor, thereby propping bitcoin. If however the CPI read comes in above forecast, lookout for bitcoin to stall out at this critical resistance zone and turn back to the downside. As far as crypto specific news updates go, bankrupt crypto exchange Voyager Digital has received initial approval on its proposal to sell $1 billion in assets to Binance US. |

| LMAX Digital metrics | ||||

|

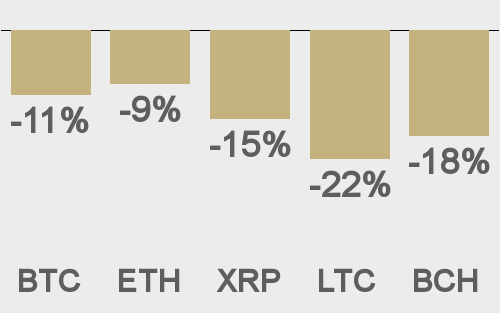

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||