|

|

26 September 2024 Bitcoin recovers after misleading headline |

| LMAX Digital performance |

|

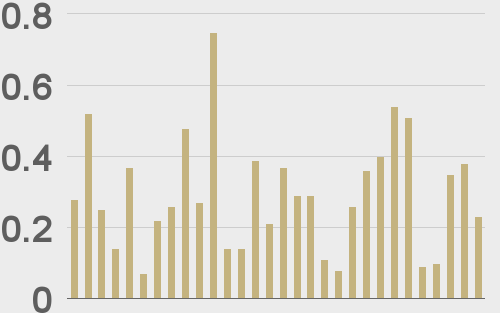

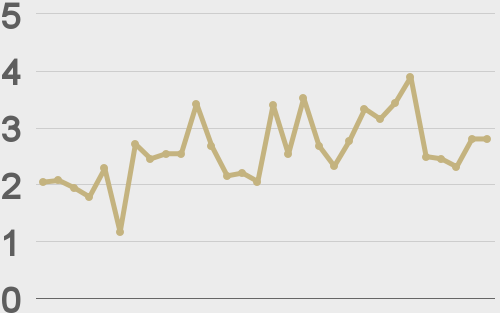

LMAX Digital volumes cooled off on Wednesday after solid showings on Monday and Tuesday. Total notional volume for Wednesday came in at $227 million, 23% below 30-day average volume. Bitcoin volume printed $131 million on Wednesday, 26% below 30-day average volume. Ether volume came in at $50 million, 33% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $6,866 and average position size for ether at $2,587. Market volatility continues to trend lower since peaking in August, now tracking at multi-week lows. We’re looking at average daily ranges in bitcoin and ether of $2,079 and $114 respectively. |

| Latest industry news |

|

There was some confusion in Wednesday trade that opened a minor wave of downside pressure on bitcoin and other crypto assets by extension. That confusion came from a headline the SEC had determined crypto mining devices were to be classified as securities. In reality, the news was about a court ruling involving a cloud mining scam that made no mention of bitcoin or real mining devices. Crypto assets have since recovered. Though, for the moment, we’re confined to consolidation and waiting for the next big break. The big level to pay attention to is bitcoin resistance at $65,000. A break above this level will do a good job encouraging the prospect for a fresh wave of bullish momentum that opens a retest and break of the record high. There has been talk that the options market has been keeping prices capped, which could change on Friday when approximately $6 billion in bitcoin options expire. Overall, we continue to see plenty of positive signs as far as demand goes. Those signs include a renewed wave of inflows into both the bitcoin and ETH spot ETFs, along with continued stablecoin inflows. As far as the economic calendar goes, we get a batch of first-tier data out of the US later today including durable goods, GDP, initial jobless claims and pending home sales. The market will also be curious to see what comes of tomorrow’s US core PCE read as it relates to Fed policy expectations. But things are looking up as we come to the end of an always challenging September month and head towards a Q4 that has historically been a very bright spot for crypto assets. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@CoinDesk |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||