|

|

23 February 2023 Bitcoin stalling out into critical resistance |

| LMAX Digital performance |

|

LMAX Digital volumes followed up an impressive Tuesday performance with an even more impressive Wednesday showing. Total notional volume for Wednesday came in at $532 million, 41% above 30-day average volume. Bitcoin volume printed $316 million on Wednesday, 61% above 30-day average volume. Ether volume printed $119 million, 9% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $5,377 and average position size for ether at 3,033. Volatility has turned up from multi-month lows. We’re looking at average daily ranges in bitcoin and ether of $912 and $72 respectively. |

| Latest industry news |

|

Some of the downside pressure we had been seeing in the space this week was attributed to Coinbase reporting a $2.6 billion annual loss. But at a closer glance, the fact that the company’s results weren’t all that much of a shock considering what was already anticipated to be a big hit from setbacks in Q4, was ultimately taken by many to be a net positive. Moreover, we’ve talked a lot about the move towards institutional adoption. The fact that JP Morgan, widely considered to be more resistant to moves in the space, has been seemingly slowly increasing coverage of the asset class, should also be taken as a net positive. Ultimately, we think the setbacks we’ve been seeing are more about global macro forces right now. The repricing of Fed expectations has hit the market harder in recent days, and the reality that rates could be heading even higher is not a development that comes off as investor friendly. Because crypto is still considered by many to be an emerging asset class, there are still going to be correlations (for now) with risk off flow. Moreover, after seeing a bitcoin run of 40% in January, it’s also not surprising to see the market entering a corrective phase, especially after also stalling out into critical resistance in the form of the August 2022 high just over $25,200. |

| LMAX Digital metrics | ||||

|

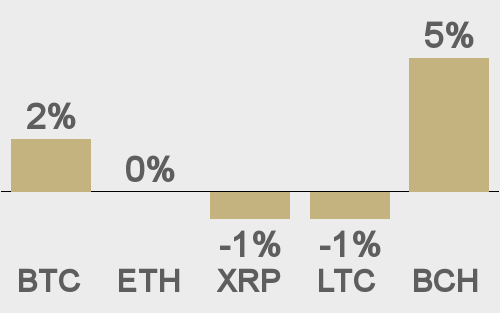

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

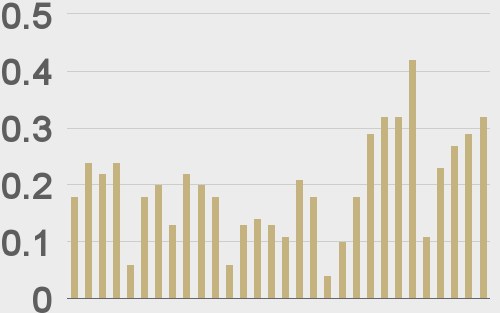

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

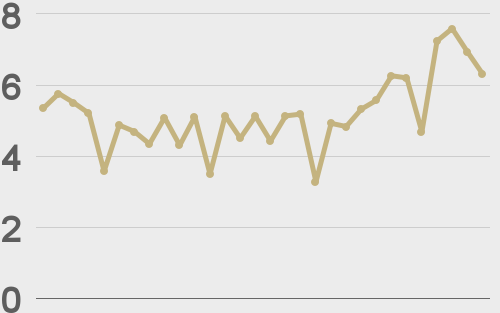

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

CoinDesk |

||||

|

lindyhan |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||