|

|

23 April 2025 Bitcoin stands tall, ETH making moves |

| LMAX Digital performance |

|

LMAX Digital volumes built on momentum from Monday’s solid performance. Total notional volume for Tuesday came in at $593 million, 32% above 30-day average volume. Bitcoin volume printed $377 million on Tuesday, 60% above 30-day average volume. Ether volume came in at $96 million, 21% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,090 and average position size for ether at $2,094. Volatility has calmed down for bitcoin and ETH in recent days, tracking at the lower bounds of multi-day ranges. We’re looking at average daily ranges in bitcoin and ether of $3,328 and $113 respectively. |

| Latest industry news |

|

Bitcoin continues to exhibit remarkable resilience, navigating a turbulent macroeconomic environment with poise. Bitcoin has managed to maintain its upward trajectory despite all of the stress in global markets around U.S.-China trade tensions and persistent inflation concerns. This resilience underscores bitcoin’s growing perception as a unique asset, increasingly untethered from equity markets and positioned as a hedge against macroeconomic risks such as U.S. Dollar volatility and stagflation. This shift is likely to draw fresh capital from investors seeking non-correlated assets, further enhancing bitcoin’s long-term appeal. The return of robust ETF inflows in recent days has also invited added confidence. Meanwhile, the Trump administration’s crypto-friendly stance, including signals of lighter regulation, further fuels positive sentiment, despite short-term volatility driven by tariff-related fears. Of course, progress in trade talks with India and a softened U.S. stance toward China, including Trump’s dismissal of tariff hikes and threats to oust Federal Reserve Chair Powell, signals a welcome shift to a de-escalation phase in Trump’s trade strategy. This has invited some relief for risk assets, which has also helped to inspire a return of investment in the broader crypto market. Indeed, the core focus is on the price of bitcoin. But the world’s second largest currency is back on the move after struggling mightily this year. ETH has managed to clear important resistance at $1,700, which could now signal a bottom for the crypto asset and open the start to a much bigger recovery. |

| LMAX Digital metrics | ||||

|

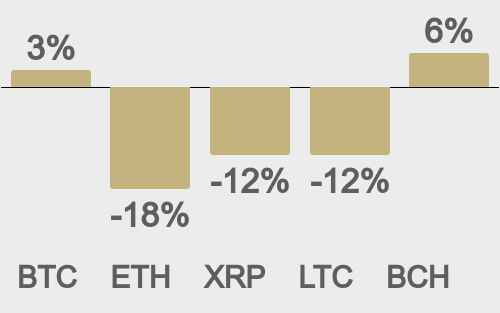

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

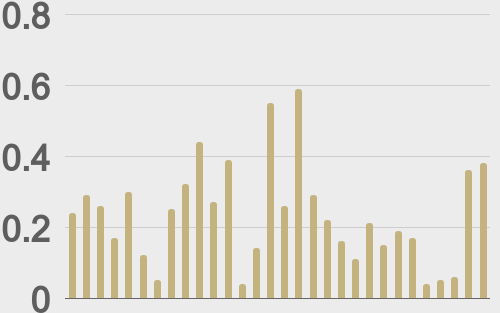

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

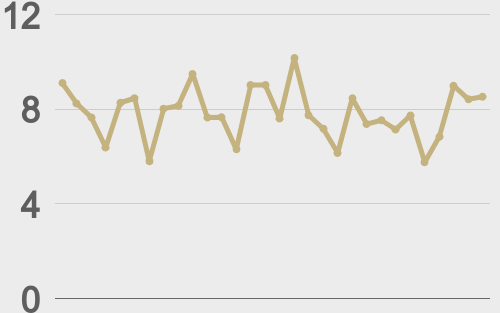

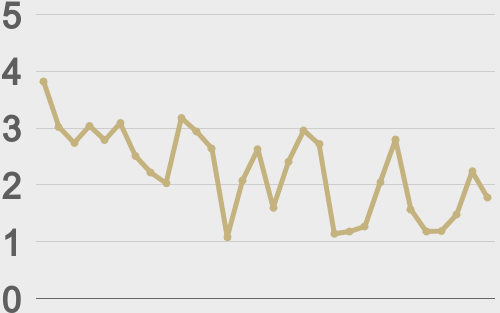

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||