|

|

18 October 2021 Bitcoin technicals push into overbought |

| LMAX Digital performance |

|

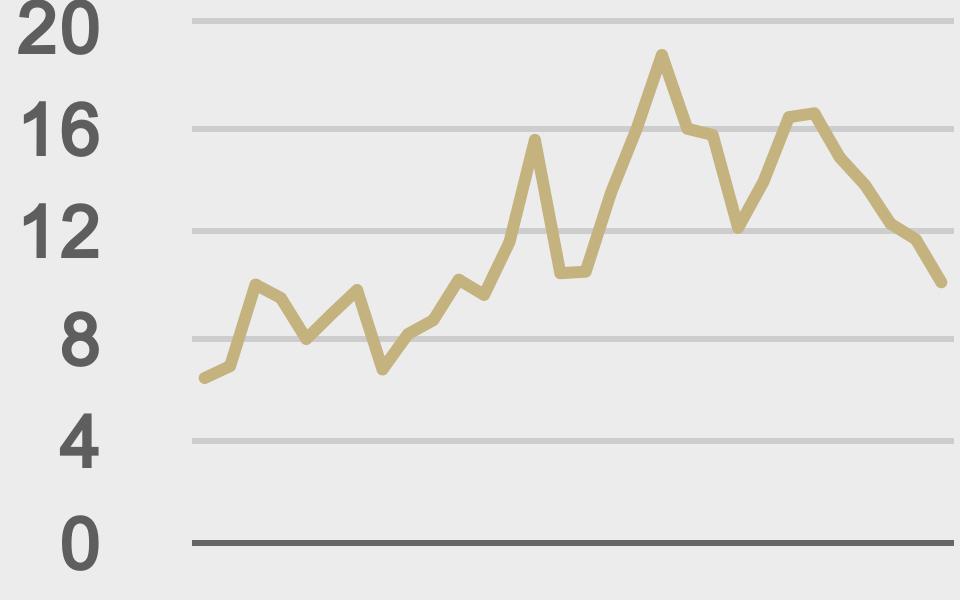

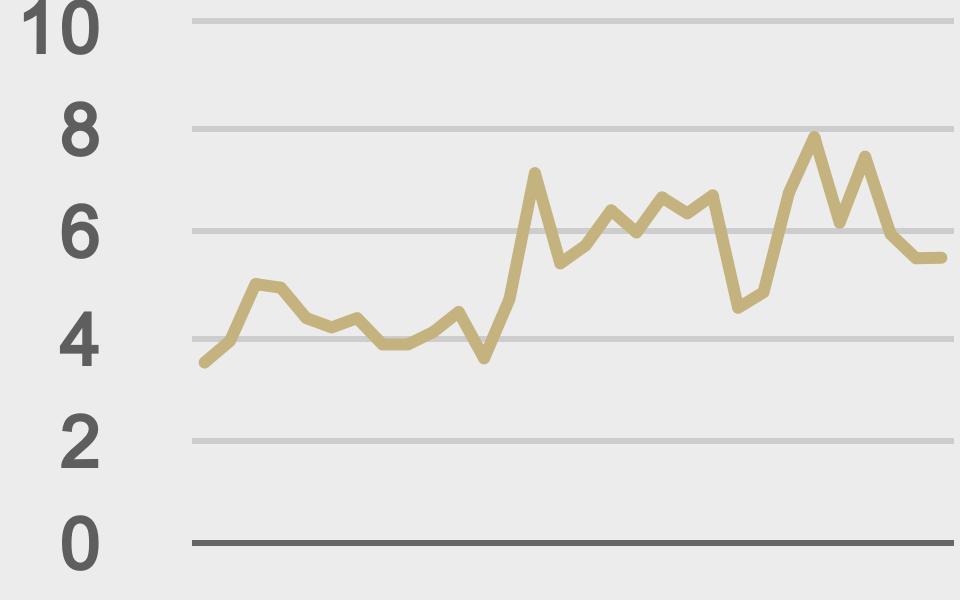

Total notional volume at LMAX Digital was off just a little last week, down 3% as compared with the week earlier. But overall, volume remains exceptionally healthy and the week closed out very strong. Friday volume was actually the highest single day volume in 11 days. Total notional volume this past Friday was 40% above the 30-day average, bitcoin volume was 54% above the 30-day average, and ether volume was 13% above the 30-day average. Weekend volume was also more impressive. This past weekend’s total notional volume came in at $1.5 billion, versus $1.3 billion the previous weekend. This represented a 16% increase in volume weekend over weekend. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,675 and average position size for ether at $5,284. Volatility has been slowly picking up since finding a bottom in July. We’re now looking at average daily ranges in bitcoin and ether of $2,785 and $207 respectively. |

| Latest industry news |

|

We continue to see plenty of support for bitcoin early in Q4 2021. Options volume and open interest metrics have been surging, reflective of intense demand from medium and longer-term players looking to get in ahead of the next big run through $100,000. Fundamentally, talk around an ETF in the US, and recent supportive comments from Russia’s Putin have been behind a lot of this latest push to the topside. Putin spoke of cryptocurrencies broadly and said they had a right to exist and could be used as a means of payment. Of course, the current backdrop of rising inflation that is looking more and more like something that is anything but transitory in nature, reminds investors just how attractive bitcoin can be as a hedge against this risk. Technically speaking, the recent break back above $60,000 in the price of bitcoin now puts the focus squarely on a retest of the record high from earlier this year at $64,900. |

| LMAX Digital metrics | ||||

|

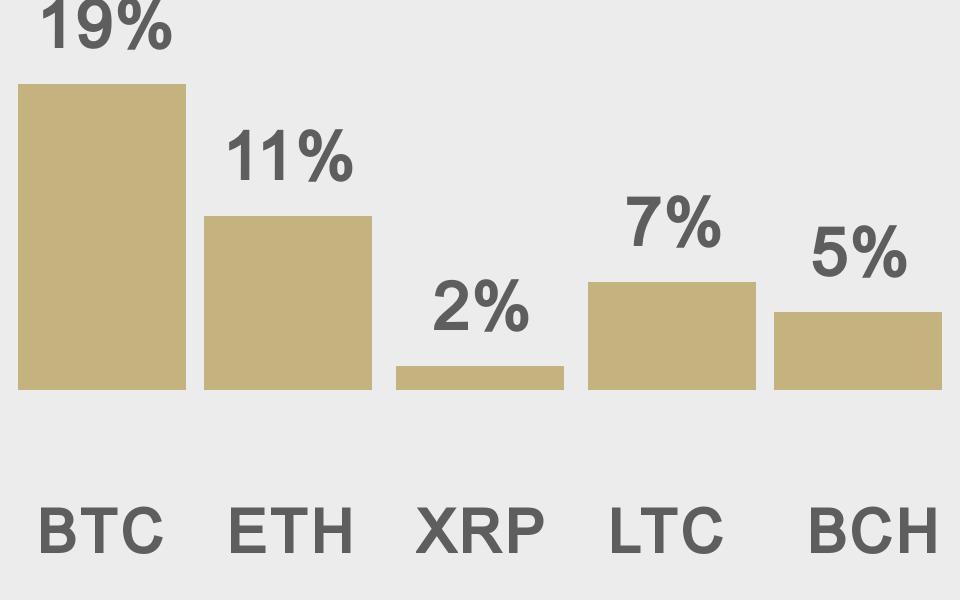

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

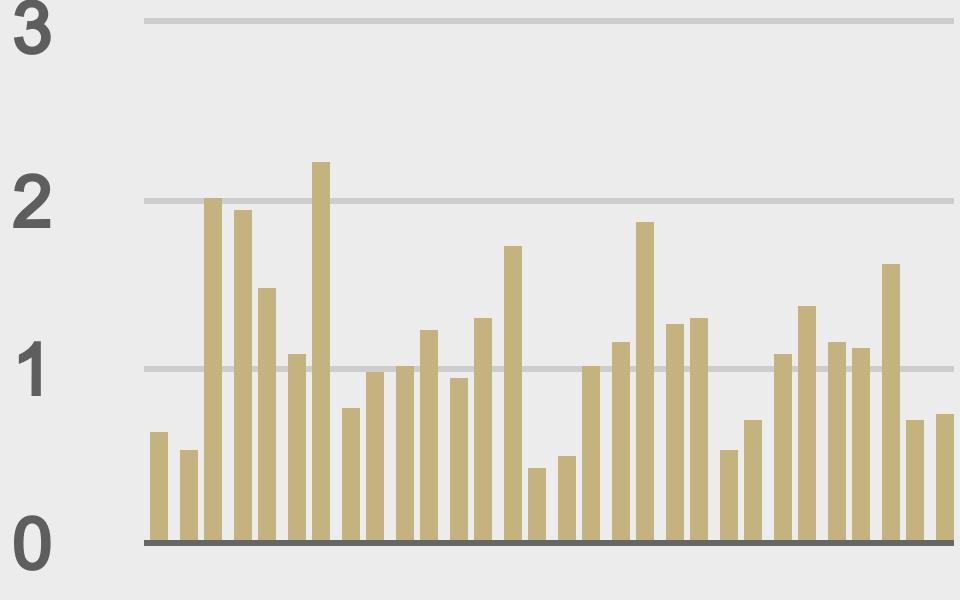

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

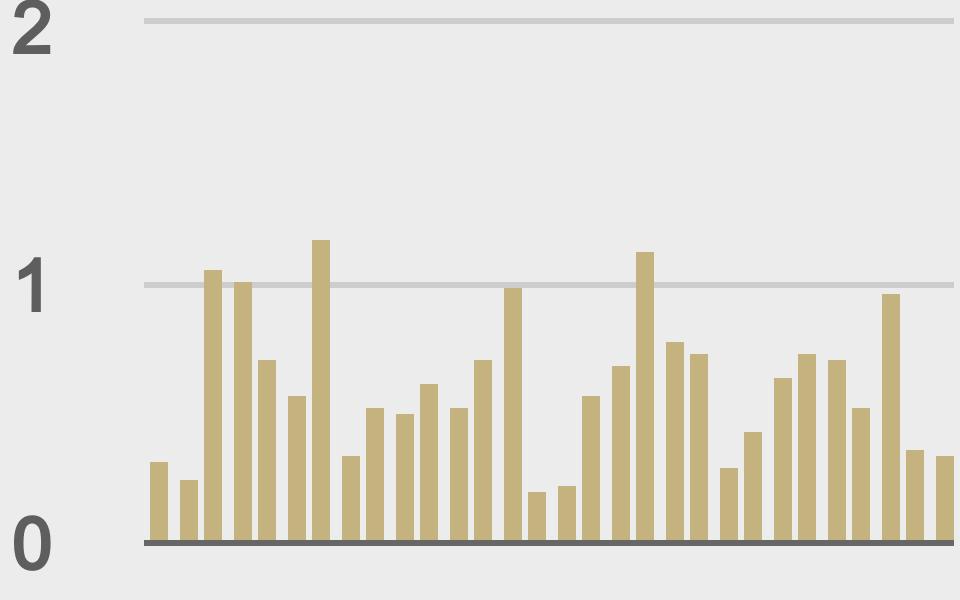

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@glassnode |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||