|

|

2 January 2024 Bitcoin to highest level since April 2022 |

| LMAX Digital performance |

|

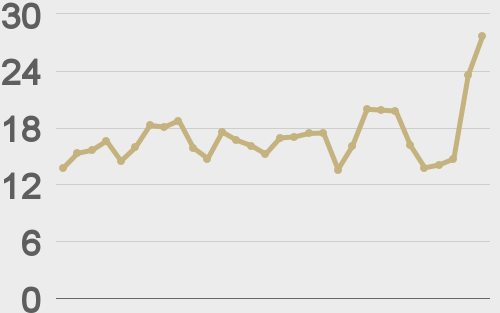

LMAX Digital volumes were light on Monday, though this was completely understandable considering the New Year’s holiday. Total notional volume for Monday came in at $373 million, 40% below 30-day average volume. Bitcoin volume printed $334 million on Monday, 30% below 30-day average volume. Ether volume came in at $30 million, 66% below 30-day average volume. Average position size over the past 30 days has been trending up. We’re seeing average bitcoin position size at $16,579 and average position size for ether at $3,625. Volatility has been correcting just off multi-month high levels set in December. We’re looking at average daily ranges in bitcoin and ether of $1,486 and $93 respectively. |

| Latest industry news |

|

There are a number of potential catalysts for the latest surge in the price of bitcoin to its highest level since April of 2022. And as per todays technical insights, the push through $45k opens the next measured move target extension at $50k. As far as the catalysts go, there’s been plenty of chatter over the holiday long weekend around the SEC approving the bitcoin spot ETF applications this week. The excitement around this fact has invited impressive soundbites from many reputable names in the traditional markets space, including Goldman Sachs’ head of digital assets, Matthew McDermott. McDermott highlights what we’ve been highlighting over the past year, which is the fact that bitcoin ETFs will inspire mass adoption that spreads to big ticket players like pension funds, insurers and sovereign wealth funds. The other catalyst for this latest wave of demand comes by way of the revelation JP Morgan will be buying bitcoin on behalf of the BlackRock ETF as an authorized participant once approved. What makes this news so bullish is the fact that it throws cold water on the idea that JP Morgan is anti-bitcoin following CEO Jamie Dimon’s recent testimony in which he urged the government to shut bitcoin down. Ultimately, as we get going in 2024, the outlook for bitcoin and crypto assets is much brighter than it was at the start of 2023. Market particpants are waking up to this fact and understand it will most likely be a case of ‘if you can’t beat ’em, join ’em.’ |

| LMAX Digital metrics | ||||

|

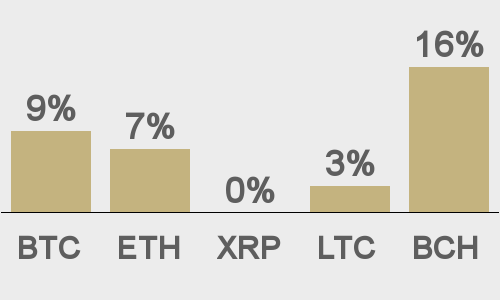

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

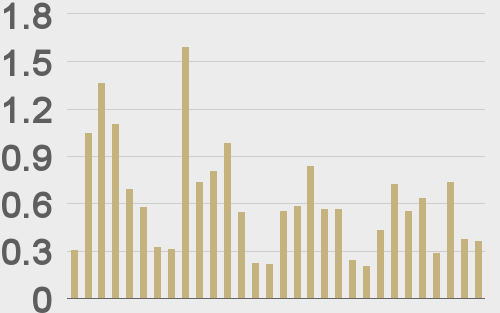

Total volumes last 30 days ($bn) |

||||

|

||||

|

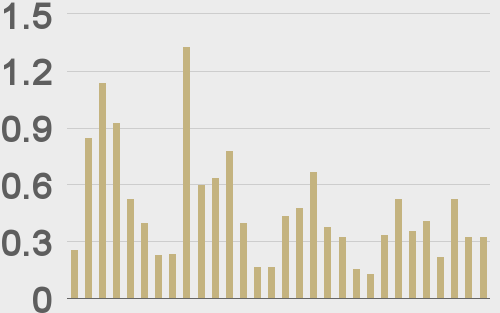

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

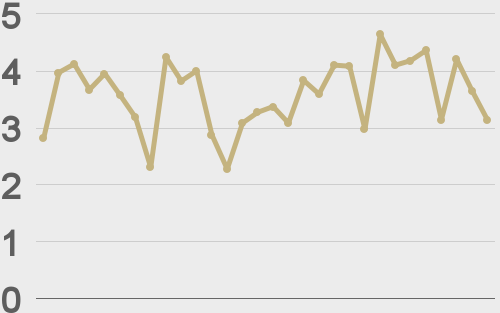

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@Tgroth8 |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||