|

|

5 July 2023 Bitcoin trying to hold up above $30k |

| LMAX Digital performance |

|

LMAX Digital volumes cooled off on Tuesday as expected in light of the US market closure. Total notional volume for Tuesday came in at $264 million, 29% below 30-day average volume. Bitcoin volume printed $164 million on Tuesday, 24% below 30-day average volume. Ether volume came in at $62 million, 43% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $6,987 and average position size for ether at 2,664. Volatility has been trending lower in recent days after an impressive run up in June. We’re looking at average daily ranges in bitcoin and ether of $920 and $62 respectively. |

| Latest industry news |

|

Bitcoin continues to hold up above $30k and just off recently established fresh 2023 highs. The market has been feeling a lot better in recent weeks, mostly on the back of a flurry of interest from larger institutional players in the traditional financial markets. These names include the likes of BlackRock, Fidelity Citadel, Invesco, VanEck, 21Shares and WisdomTree. On Monday, BlackRock refiled paperwork with US regulators to add new details to its proposal to indicate Coinbase Global Inc. would provide market surveillance in support of the proposed ETF. Other big names have since refiled as well. These moves come on the heels of a response from the SEC following the initial applications that the filings were deemed to be insufficient, lacking necessary information. We’re hopeful that this is ultimately nothing more than some more red tape before an approval for a bitcoin ETF ultimately comes through. The implication is tremendously bullish for the space as it will open the flood gates for a deluge of institutional money that has been looking to get involved in crypto and patiently waiting on the side for the necessary clarity to proceed. It feels like we are getting closer to that point and we believe this flood of money will have a major positive impact on price in the extreme limited supply asset that is bitcoin. This should also benefit the rest of the crypto market as well despite ongoing regulatory uncertainty around crypto assets that are not bitcoin. On this front, we are hopeful that the newer draft legislation proposal that is decidedly more crypto friendly will gain enough traction and momentum to invite further interest from larger players. As far as overall price action goes, we expect activity will start to pick back up into the latter half of the week as the US market returns from the July 4th holiday break. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

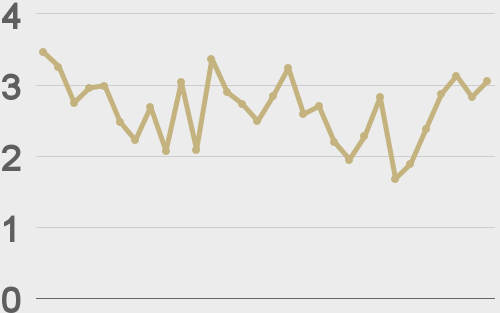

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@CoinDesk |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||