|

|

19 October 2021 Bitcoin volume at highest levels since early September |

| LMAX Digital performance |

|

We’re coming off another day of healthy volume at LMAX Digital. Total notional volume for Monday was $1.82 billion, its highest since earlier this month, 50% above 30-day average volume. Bitcoin volume was more impressive, coming in at $1.19 billion on Monday, the highest bitcoin volume since September 7th. This represented Monday volume 81% above 30-day average volume. And while ether volume wasn’t nearly as impressive, it wasn’t anything to laugh at, coming in at $465 million, 33% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size jumping up to $13,912 and average position size for ether shooting up to $5,947. Volatility has been slowly picking up since finding a bottom in July. We’re now looking at average daily ranges in bitcoin and ether of $2,795 and $209 respectively. |

| Latest industry news |

|

There continues to be a whole lot of buzz around the first bitcoin-linked ETF in the US. The market had been anticipating an ETF from ProShares for quite some time and that debut is expected to come today. This serves as another giant step for the crypto space and will likely invite a flood of additional ETF offerings in the weeks ahead. Things have become decidedly less cold from the US regulatory side, especially after hearing Fed Quarles talk about how the regulators are not wanting to suffocate innovation. Of course, there continues to be a lot of caution and crypto hasn’t been accepted with open arms just yet. Nevertheless, progress is being made and the market has responded accordingly. October has been the best performing month for bitcoin over the past 6 years and this month has been no different, with the asset already up some 40%. At this stage, we suspect we should soon see a retest of the record high, with market participants clearly locked in on the barrier. Still, technically speaking, we have highlighted overextension in the market right now, which does warn against any expectations for meaningful gains beyond the record high, before some form of corrective price action to allow for these stretched studies to unwind. |

| LMAX Digital metrics | ||||

|

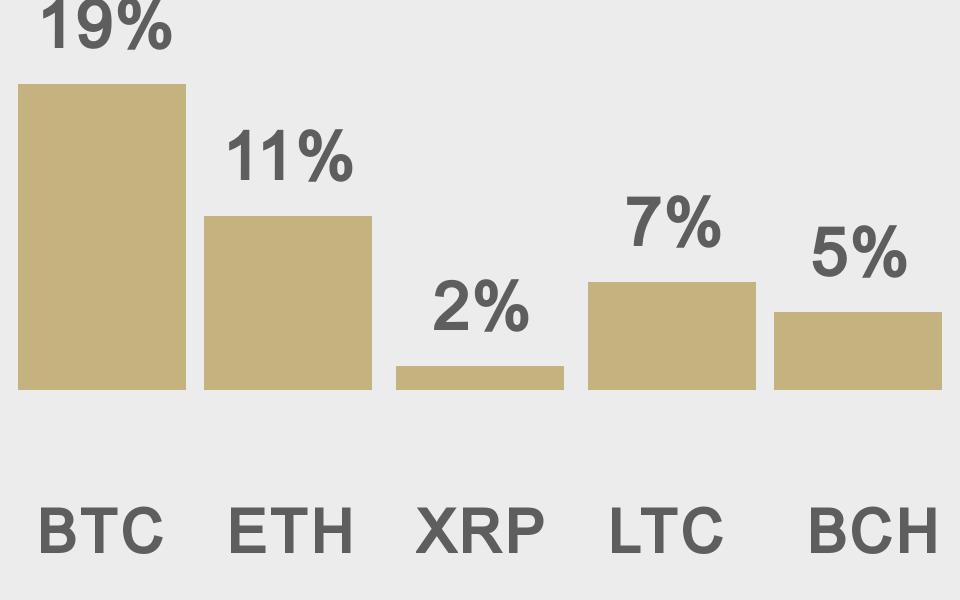

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

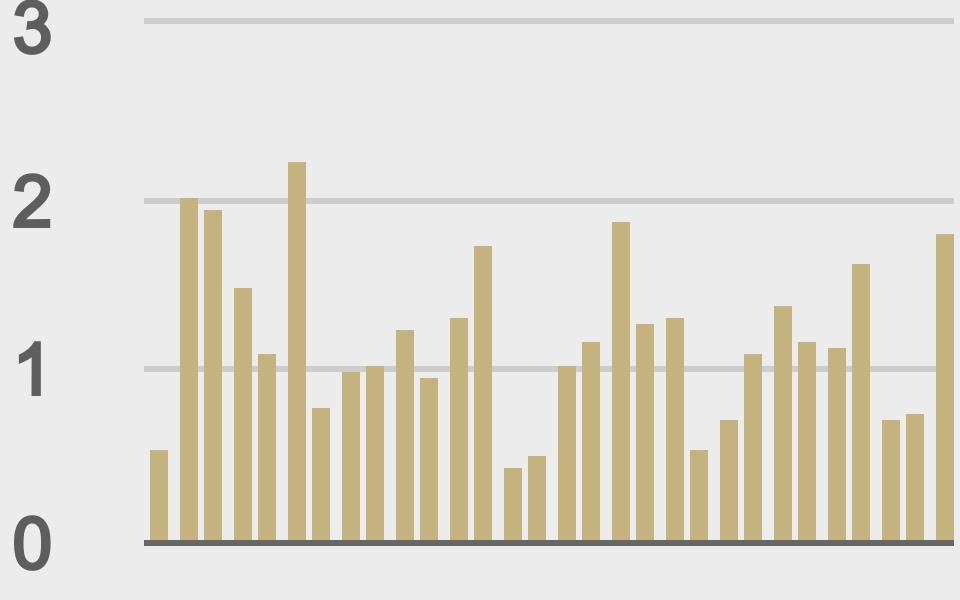

Total volumes last 30 days ($bn) |

||||

|

||||

|

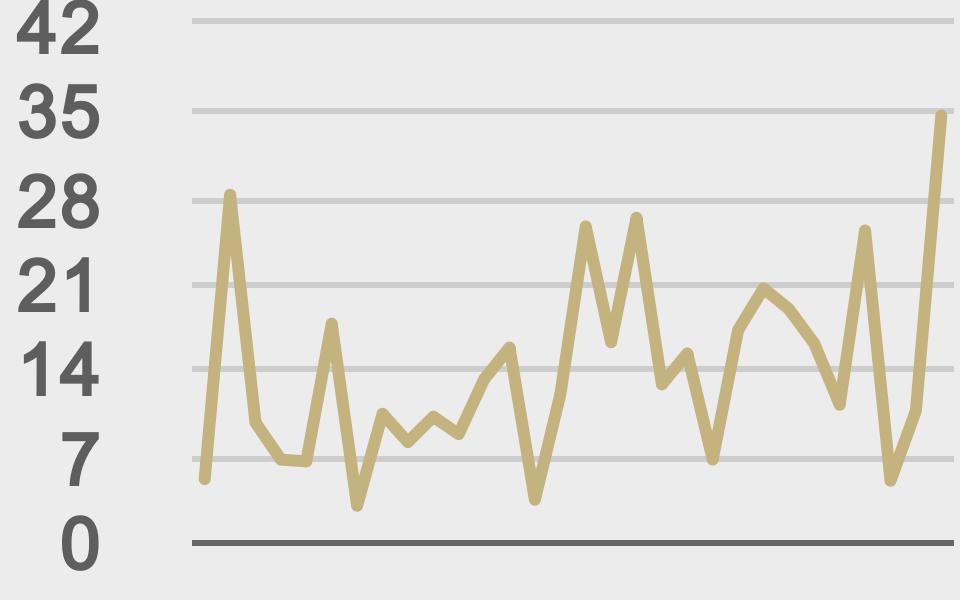

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

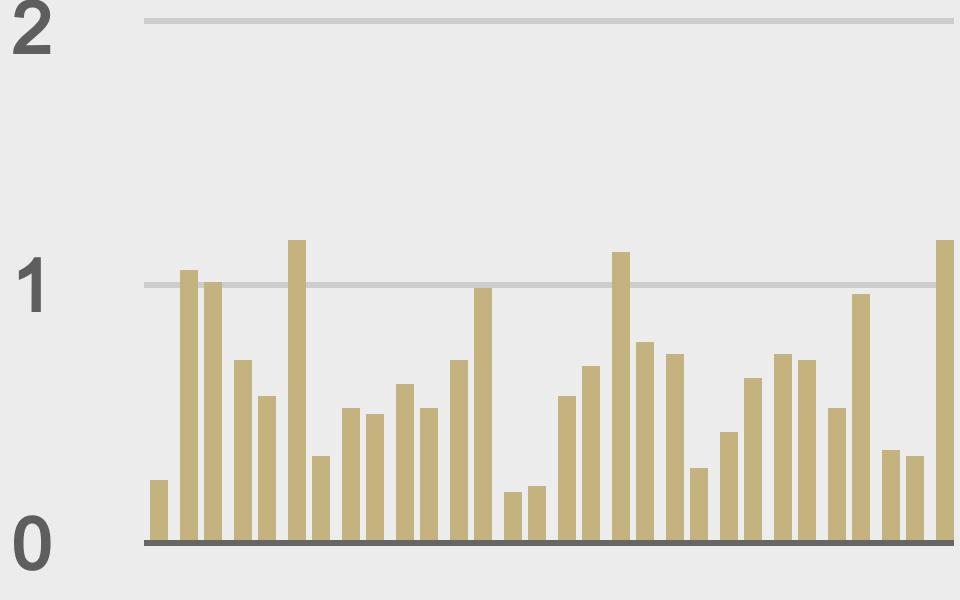

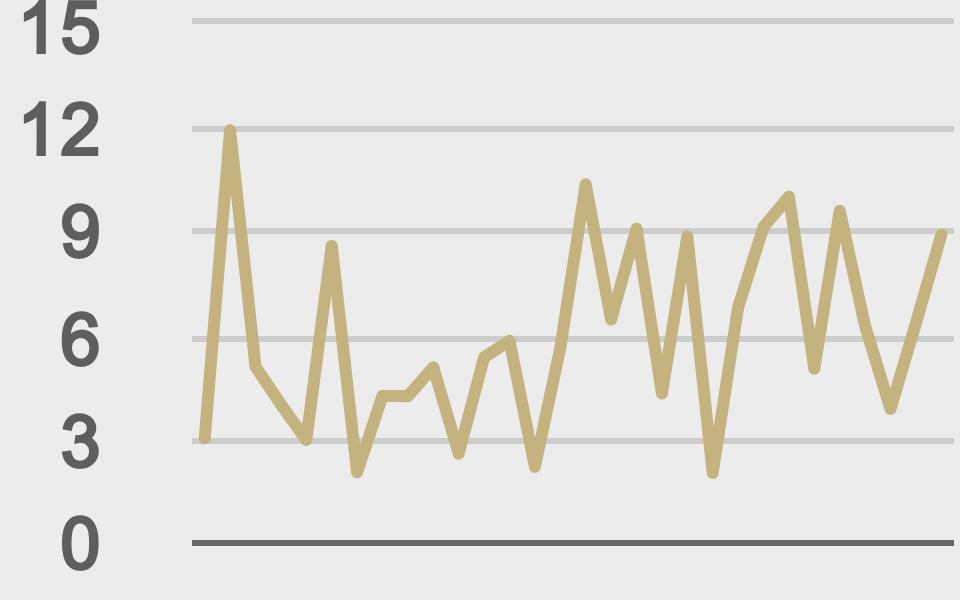

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@amytongwu |

||||

|

@justindanethanI can recognize that feeling. It’s the “we’re close to the all-time high” feeling. |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||