|

|

7 November 2023 Bitcoin’s two hats |

| LMAX Digital performance |

|

LMAX Digital volumes were mixed to start the week. Total notional volume for Monday came in at $245 million, 18% below 30-day average volume. Bitcoin volume printed $124 million on Monday, 37% below 30-day average volume. Ether volume came in at $79 million, 12% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,975 and average position size for ether at $2,743. Volatility has settled down in recent sessions after breaking out to the topside from multi-month lows. We’re looking at average daily ranges in bitcoin and ether of $1,043 and $58 respectively. |

| Latest industry news |

|

We haven’t seen much activity in bitcoin over the past several sessions, with the crypto asset deferring to a period of tight consolidation. But given the fact that bitcoin has been correlating more as a store of value asset of late, the fact that the market has been so well supported amidst a wave of risk on flow has been very encouraging. The compelling thing about bitcoin right now is that it does have the potential to wear two caps and find demand in both risk on and risk off backdrops. In risk on markets, there could just as easily be bitcoin demand with the US Dollar selling off and yield differentials moving out of the US Dollar’s favor. There is also the argument to be made for bitcoin demand in risk on given the fact that there are market participants who view bitcoin as a maturing, emerging market asset. Yet lately, most of the demand has come from risk off flow, which we saw plenty of when stocks were getting hit hard on higher for longer Fed policy expectations leading into last week’s FOMC and on escalating geopolitical risk. The move higher in the price of bitcoin during that period, coincided with a rally in the price of gold, reflecting a demand for bitcoin as a store of value asset given its attractive properties including its ultra scarcity. Another positive for bitcoin right now is a recent report that shows the number of blockchain addresses holding at least $1,000 worth of bitcoin increasing to a record high of 8 million. And yet one more positive is the latest data that shows a sixth consecutive week of positive flows into digital asset investment products. Last week, we saw $261 million of inflows, bringing the total over the past six weeks to $767 million, surpassing the entirety of inflows for all of last year. |

| LMAX Digital metrics | ||||

|

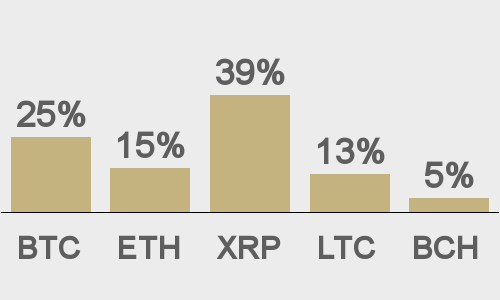

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

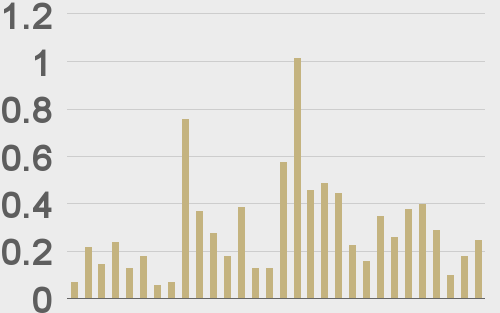

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

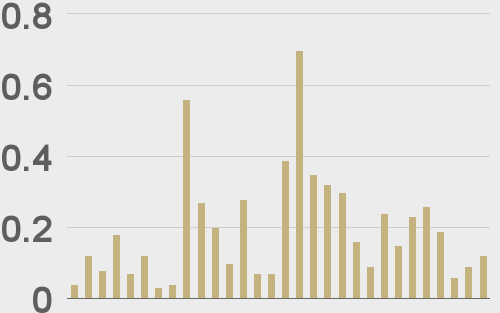

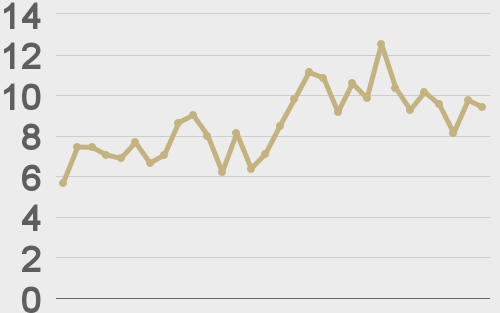

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

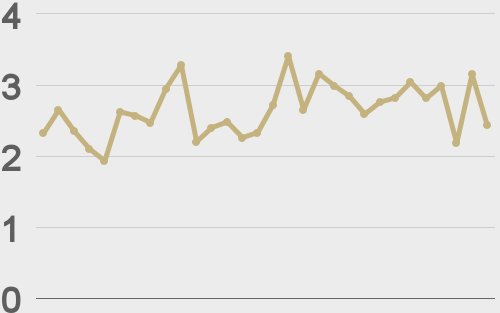

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||