|

|

9 March 2022 Bright signs….but still not out of the woods |

| LMAX Digital performance |

|

LMAX Digital volume took a little dip on Tuesday, falling victim to what has been a period of directionless sideways trade. Total notional volume for Tuesday came in at $760 million, 8% below 30-day average volume. Bitcoin volume printed $456 million on Tuesday, 3% below 30-day average volume. Ether volume came in at $241 million, 16% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,474 and average position size for ether at 6,409. Volatility has been trending lower in 2022. We’re now looking at average daily ranges in bitcoin and ether of $2,430 and $199 respectively. |

| Latest industry news |

|

This week’s price action has been significant in many ways, and not all that significant in many other ways. So let’s break it down and go through exactly what it is that we mean here. When we say ‘significant,’ we highlight what has been a very clear disconnect between price action in stocks and price action in cryptocurrencies. While stocks have extended declines in recent sessions, crypto has been holding up and heading higher. We argue that some of this has to do with the fact that medium and longer-term players are finally stepping in to take advantage of a dip in the market over the past few months, looking to take on added exposure at more attractive levels. But there is something else going on as well. That something is this latest news out of the White House relating to cryptocurrencies. President Biden’s executive order on crypto looks to be a lot friendlier to the space than many were fearing. Treasury Secretary Yellen has taken it even further, saying the executive order will address illicit finance but support innovation. And so, a lot of the drive higher that we’re seeing in crypto into Wednesday is on the back of this headline. While we certainly see this as crypto supportive, it’s also something the market is reacting to today that might be quickly forgotten tomorrow. And so, it’s important to not read too much into the latest run higher. The other reason we’re only cautiously optimistic at the moment is that overall, despite the latest encouraging bounce and break from correlations with traditional risk assets, we haven’t really gone anywhere as far as price goes, with both bitcoin and ether still confined to choppy bearish consolidations. The bottom line here is that things have indeed been more encouraging of late, but we’re not out of the woods just yet. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

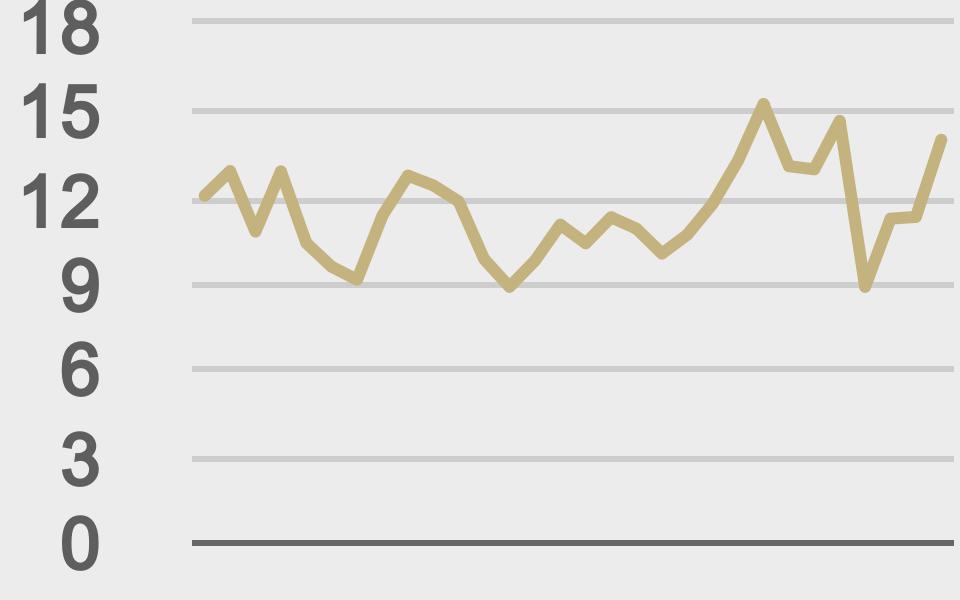

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@KaikoData |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||