|

|

11 September 2023 Broad US Dollar weakness a positive for crypto |

| LMAX Digital performance |

|

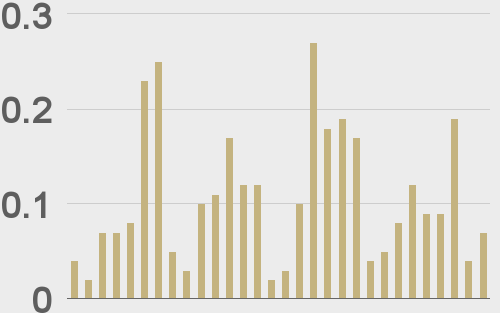

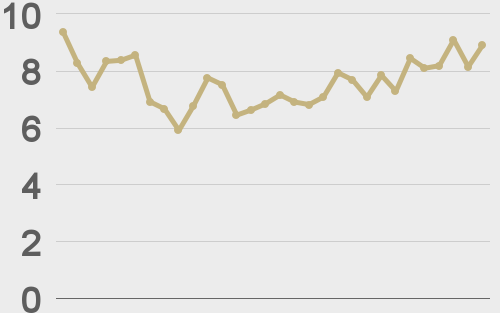

Total notional volume at LMAX Digital cooled off in the previous week. Total notional volume from last Monday through Friday came in at $903 million, 35% lower than the week earlier. Breaking it down per coin, Bitcoin volume came in at $569 million in the previous week, 37% lower than the week earlier. Ether volume came in at $235 million, 31% lower than the week earlier. Total notional volume over the past 30 days comes in at $5.3 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,529 and average position size for ether at $2,399. Volatility is moderately higher after recovering from cycle lows in August. We’re looking at average daily ranges in bitcoin and ether of $635 and $41 respectively. |

| Latest industry news |

|

The crypto market remains confined to exceptionally tight trade, unwilling to make any fresh directional commitments. The market is less inclined to be wanting to push higher right now as it waits for the SEC to go ahead and finally approve a bitcoin ETF. All signs point to ETFs getting approved, though the SEC continues to be difficult, now moving into a phase of delaying to the point of what could be perceived as unreasonable rejection. Giants in the traditional financial markets space like BlackRock and Fidelity aren’t in the business of applying for these types of applications without proper due diligence and ultimately, it feels like it’s only a matter of time before the SEC finally relents. Still, whatever the outcome, there has been plenty of support built up for bitcoin into the $25,000 area. As per our technical insights, the outlook for bitcoin remains constructive overall while the market holds above $25,000. Ultimately, we see any setbacks below $25,000 as short-lived, with the psychological barrier at $20,000 expected to be an even firmer and more formidable line of defense. As far as today goes, we have seen a round of broad based US Dollar selling, along with a concurrent uptick in risk sentiment. This could open the door for some upside in crypto assets. |

| LMAX Digital metrics | ||||

|

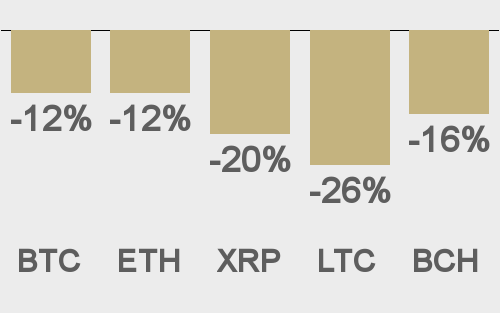

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

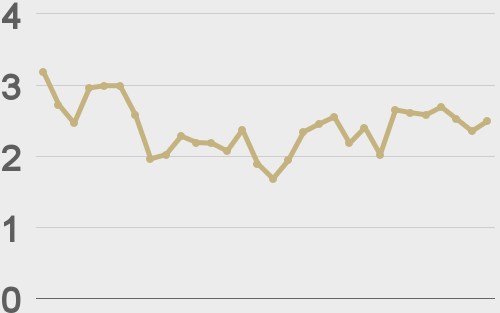

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||