|

|

30 May 2022 Bullish price action in thin trade |

| LMAX Digital performance |

|

Total notional volume at LMAX Digital continued to cool off last week after some impressive volumes earlier in the month. Total notional volume from Monday through Friday came in at $2.6 billion, 17% lower than the week earlier. Breaking it down per coin, Bitcoin volume came in at $1.5 billion in the previous week, off 24% from a week earlier. Ether volume managed to turn up a bit, coming in at $730 million, up 2% from the week earlier. Total notional volume over the past 30 days comes in at $20.8 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,615 and average position size for ether at $4,055. Volatility has been showing signs of wanting to pick back up after a period of extreme low volatility for much of 2022. We’re now looking at average daily ranges in bitcoin and ether of $1,666 and $145 respectively. |

| Latest industry news |

|

We’re seeing a welcome recovery in crypto assets over the past couple of sessions. But the price action is to be taken with a grain of salt given the weekend trade and long weekend holiday in the US. Crypto traders are relieved nonetheless, especially after stocks had already been in recovery mode last week, while crypto continued to struggle. It’s difficult to reconcile the relative underperformance that we saw last week. Perhaps this comes on the heels of the fallout from Luna and all of the negative attention the event generated. But we wouldn’t read too much into it and would even argue that crypto markets held up well overall considering, which should be a testament (not a negative) to the emerging asset class. Trading conditions are expected to be lighter this week given the already mentioned US holiday closure and a holiday closure in the UK on Thursday and Friday. It will be important to continue to keep an eye on all things macro, with market sentiment towards Fed expectations and US economic data playing a part. Later this week, we get the monthly employment report out of the US. As things stand, if the report produces data that has the market growing more concerned about inflationary pressures, as reflected through the hourly earnings print, we could see renewed downside pressure on stocks, which could translate to renewed downside pressure on crypto. Technically speaking, as per our insights in today’s report, the bullish price action should only be viewed as short-term constructive at this stage. While the push back to the topside does take the immediate pressure off the downside, we are still very much confined to a downtrend on the daily charts, with scope for a lower top and bearish continuation. We would need to see bitcoin back above $40,000 to suggest a more significant recovery is in play. |

| LMAX Digital metrics | ||||

|

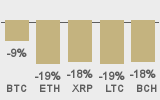

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

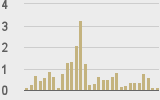

Total volumes last 30 days ($bn) |

||||

|

||||

|

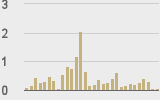

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

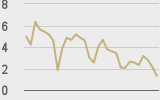

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||