|

|

4 December 2023 Buy the rumor, buy the fact |

| LMAX Digital performance |

|

Total notional volume at LMAX Digital cooled off in the previous week as the price of bitcoin entered a cautious phase on approach to $40k. Total notional volume from last Monday through Friday came in at $2.3 billion, 31% lower than the week earlier. Breaking it down per coin, bitcoin volume came in at $1.8 billion in the previous week, 24% lower than the week earlier. Ether volume came in at $392 million, 51% lower than the week earlier. Total notional volume over the past 30 days comes in at $13.4 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,893 and average position size for ether at $3,373. Volatility has been trending higher in recent months and looks like it could soon push to a fresh yearly high. We’re looking at average daily ranges in bitcoin and ether of $1,112 and $73 respectively. |

| Latest industry news |

|

Bitcoin has extended its run of 2023 highs, with the latest push opening a wave of bullish price action across the entire crypto space. Ether, which had been capped below its 2023 high despite fresh yearly highs in bitcoin for many days, has now finally pushed through to post its own fresh 2023 high. All of this comes at a time when the market is gearing up for what it expects will be a very big 2024, as institutional and mainstream adoption ramp up. At the center of this is the expectation the SEC will finally go ahead and approve bitcoin spot ETF applications in January. When this happens, a lot of traditional players will have an easy time gaining exposure to bitcoin, which should in turn drive the price much higher. These players have already been impressed with bitcoin’s strong outperformance in 2023, +150% year-to-date. What’s been even more attractive is how uncorrelated bitcoin has been to traditional assets, making it a compelling option for portfolio diversification. There has been some speculation that when the SEC finally goes ahead and approves the bitcoin spot ETFs there will be a ‘sell the fact’ reaction. And yet, we believe this is one of those rare times that will translate to ‘buy the rumor, buy the fact.’ It’s worth reminding that the first ever commodity ETF was a gold ETF. Much like the purpose of the bitcoin ETFs, the gold ETF offered a simple way for investors to take on exposure to gold. There was plenty of gold buying in the leadup to the event. And once the ETF was launched, gold did not sell off. Gold then went on to an 8 year rally with no single down year between 2005 and 2012. With that said, we expect a similar result when the bitcoin spot ETFs are approved. Supply and demand economics dictate this should be the case as well, given the exceptionally limited supply of bitcoin. Technically speaking, this latest push through $40k opens the door for a possible acceleration towards the next major resistance zone between $48k and $53k. |

| LMAX Digital metrics | ||||

|

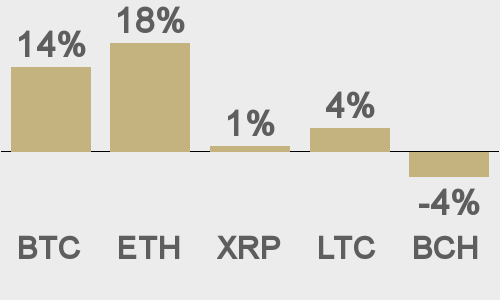

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

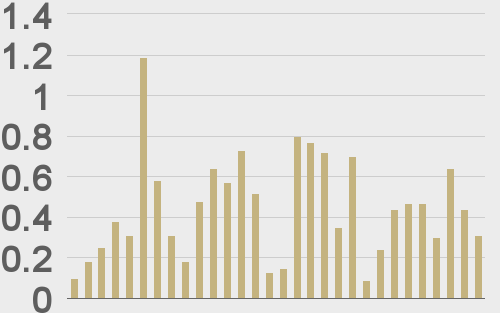

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

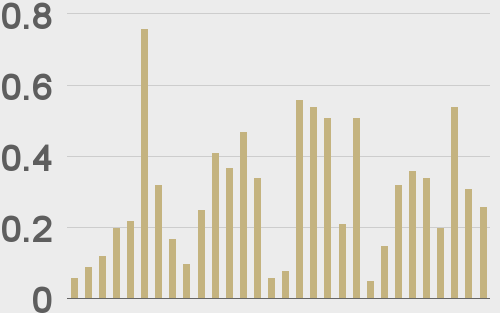

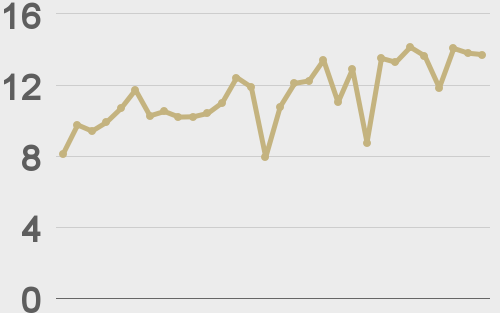

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

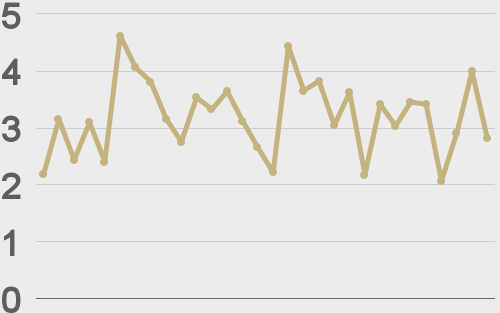

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@KaikoData |

||||

|

@CoinDesk |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||